Single Sheet DCF (Discounted Cash Flow) Excel Template

$0.00

Description

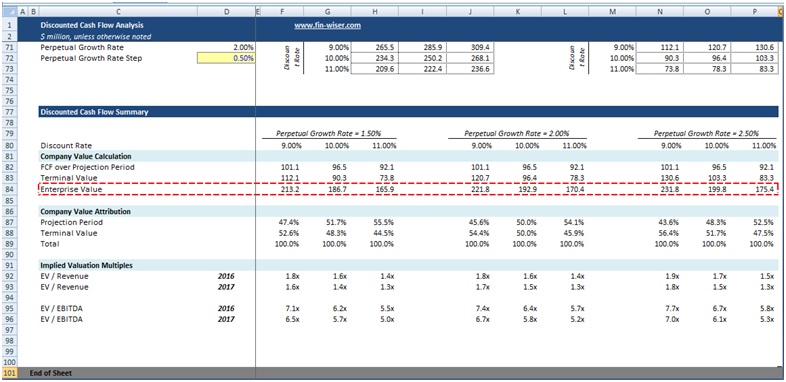

Fin-wiser Advisory has developed the single sheet Discounted Cash Flow (DCF) Template to help user to understand the dynamics of Discounted Cash Flow (DCF) valuation.

This template is designed to include one Actual period and ten forecast periods.

Users can input various assumptions around Revenue Growth Rate, EBITDA Margin, Capital Expenditure, Working Capital Requirement, and Depreciation & Amortization as a % of Revenue and other DCF components like Discount Rate, Terminal Growth Rate, and Tax Rate to understand their impact on Intrinsic Value.

Template Calculates:

- Free Cash Flow to Firms (FCFF) using the conventional equation starting from EBIT and adjusting for Taxes, Depreciation & Amortization, Capital Expenditure, and Change in Working Capital.

- Discount Rate for the calculation of the present value of FCFF

- Terminal Values based on perpetual growth rate

- Enterprise Value

- Implied Valuation Multiple like ‘Enterprise Value/Revenue’ and ‘Enterprise Value/EBITDA’

The user has the option to calculate discount rate and perpetual growth rate for three different steps to assess the impact of change in rate on terminal value.

The objective of this template is to appraise users with the discounted cash flow fundamentals and should not be used for valuation in real-world scenarios.

Yellow Color cells represent assumption cells and white color cells with black text represent calculation cells.