Online Car Rental – 3 Statement Financial Model with 5 years Monthly Projection

$120.00

Categories: Business Plan Models, Financial Model, online businesses & retail, Paid

Tags: : 5-year financial projections Accounts Payable Accounts Receivable Break-Even Budget Business Valuation car rental Cash Flow Analysis Cash Flow Projections Dashboard DCF Model Debt Schedule Discount Rate excel Financial Analysis Financial Debt Financial Feasibility financial model financial modeling Financial Projections Financial Ratios financial statements Income Statement Inventory Investment Multiple Investor Cash Flows Investors IRR (Internal Rate of Return) KPIs (Key Performance Indicators) NPV (Net Present Value) online car rental online Rental Private Equity Private Equity Waterfall Distribution Models Profitability Analysis Revenue Projections Scenario Analysis Startup Financial Models terminal value Three Statement Model | Three Financial Statements transport Uses and Sources of Funds valuation Venture Capital WACC (Weighted Average Cost of Capital)

Description

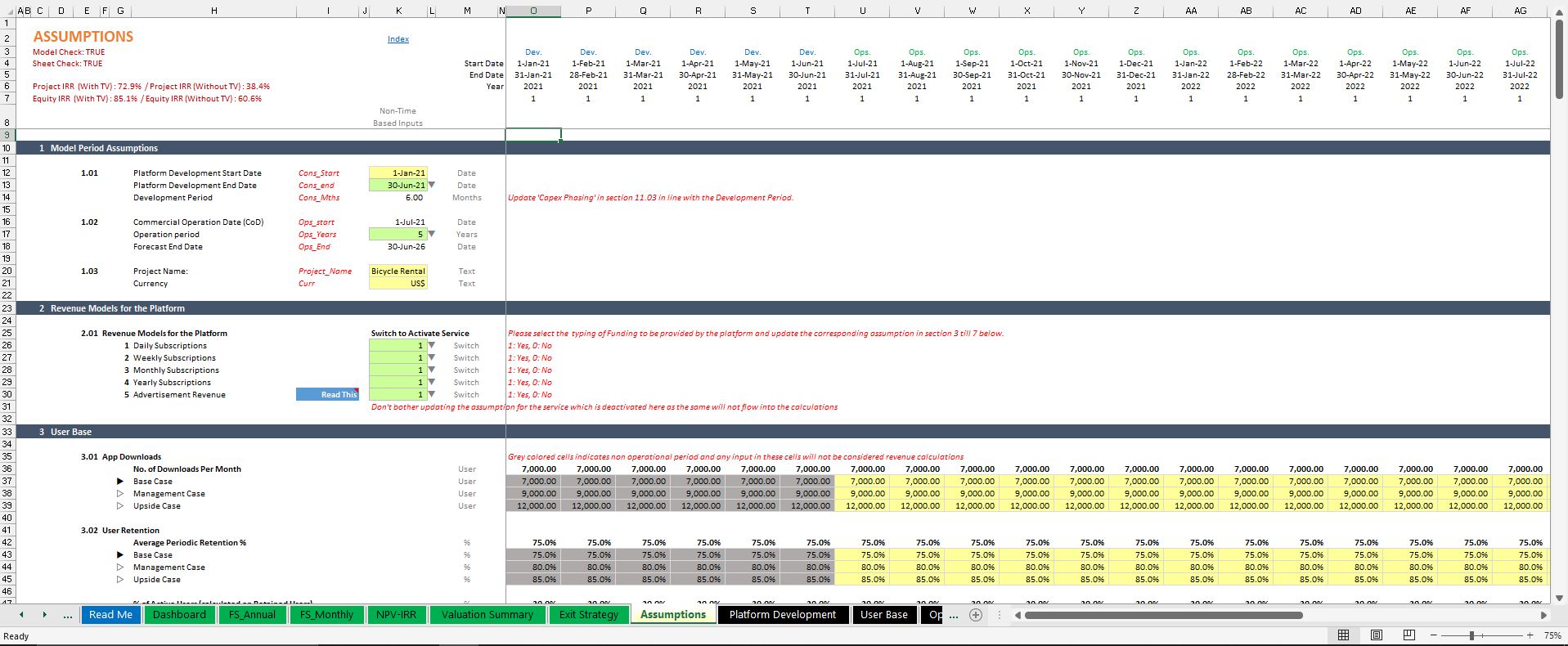

This Online Car Rental Business Plan Model is a perfect tool for a financial feasibility study on launching an online car rental platform. The model can be used by start-ups to create 5 years projections along with the development phase.

The business plan model can be used by a platform with a focus on any of the following revenue streams:

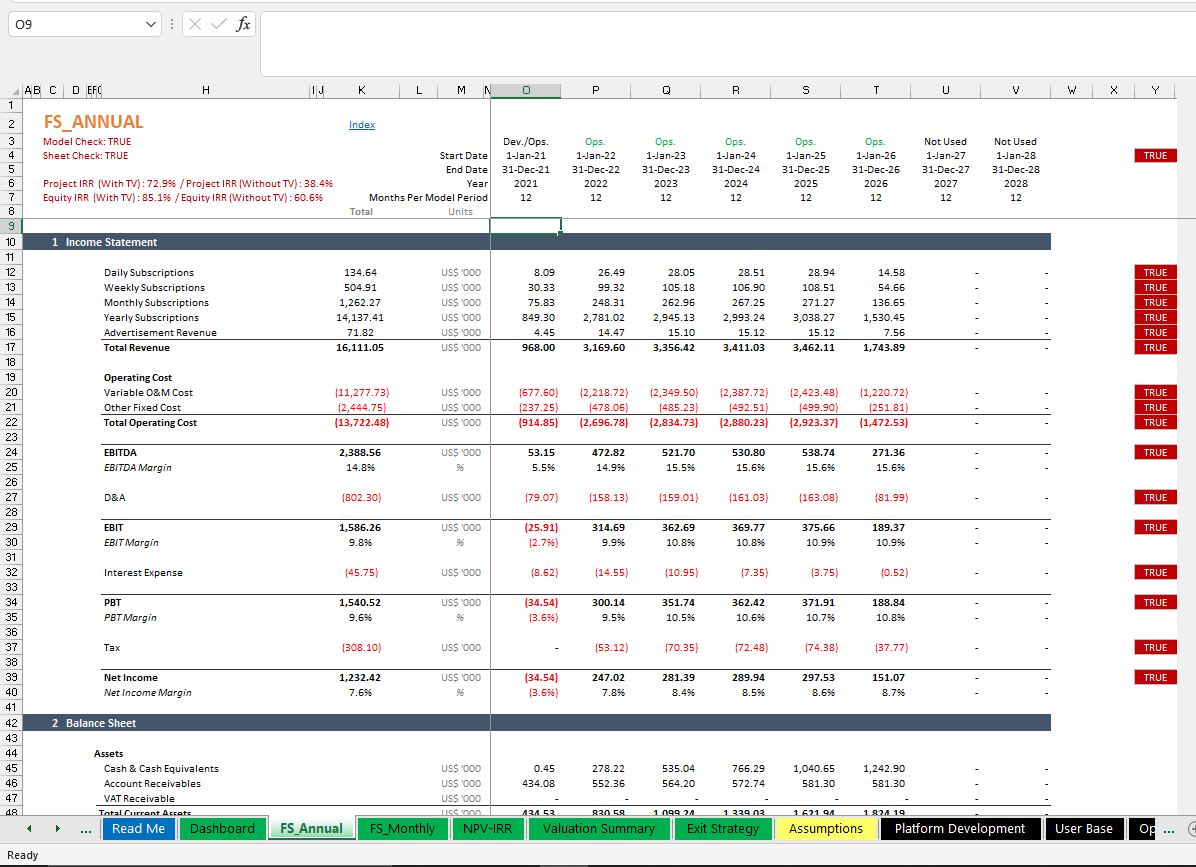

- Daily Subscription

- Weekly Subscription

- Monthly Subscription

- Annual Subscription

- Advertisements

Users can forecast revenue from any combination of the above options.

Also, you can incorporate 3 scenarios into the model which can be updated with a click of a button to understand the impact of the ever-evolving business environment on business returns.

The Model includes assumptions related to:

- Platform Development cost

- Revenue source includes Daily Subscription, Weekly Subscription, Monthly Subscription, Annual Subscription, and Ad revenue. You can keep revenue assumptions from all the mentioned sources or can pick and choose the option which is the Best Fit for the Business.

- Operating costs can be assumed separately for all 5 business divisions as a % of revenue and you can forecast Other

- Fixed Annual Costs (Up to 11 different cost heads)

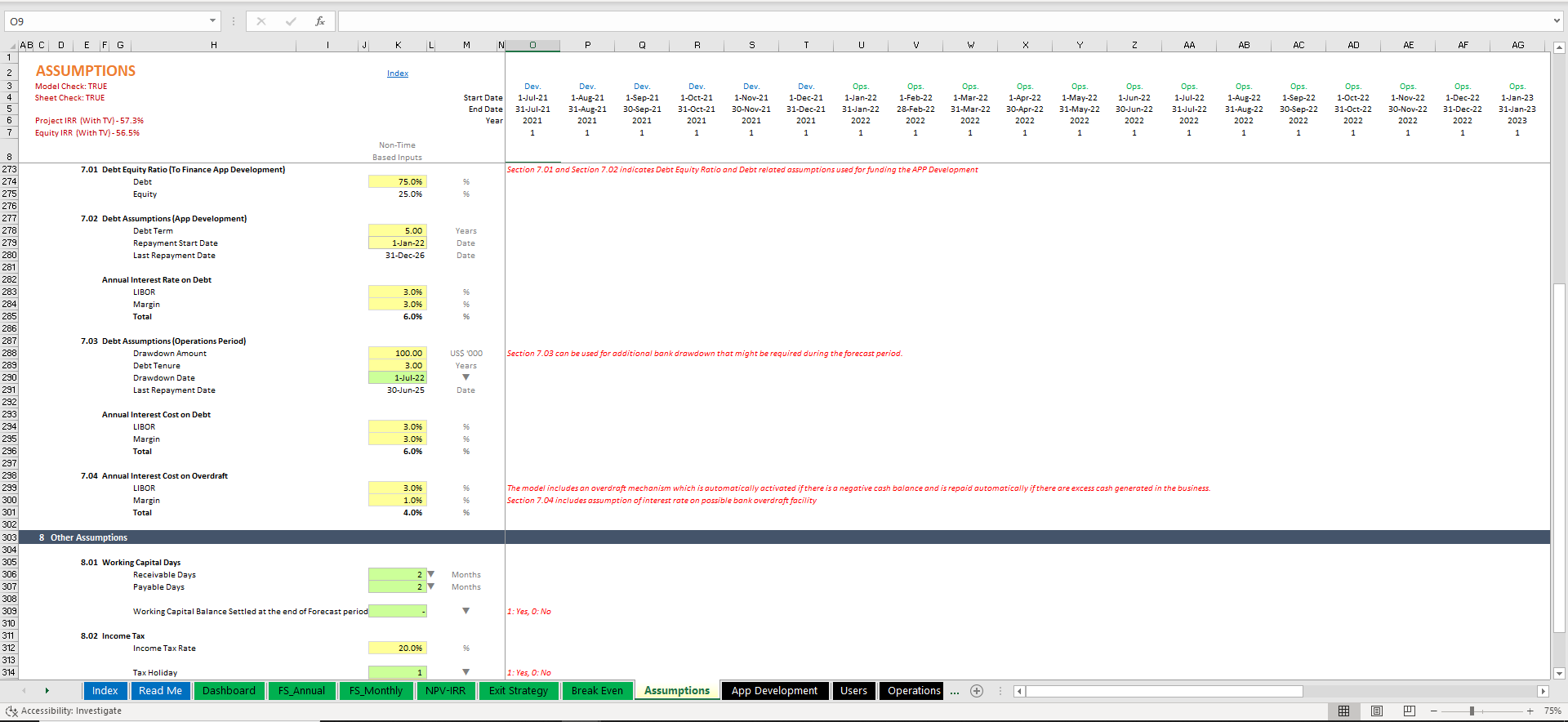

- Flexible Funding Profile – Cash equity, Bank Debt, and Bank overdraft

- Working Capital Assumptions related to accounts receivables and payables

- Straight Line Depreciation with the option to renew assets at the end of their useful economic life.

- Annuity and Even Principal Repayment options

- Inflation and Indexation

- VAT during the construction and operations phase

- Tax Assumptions including Tax holiday period

Model Output includes:

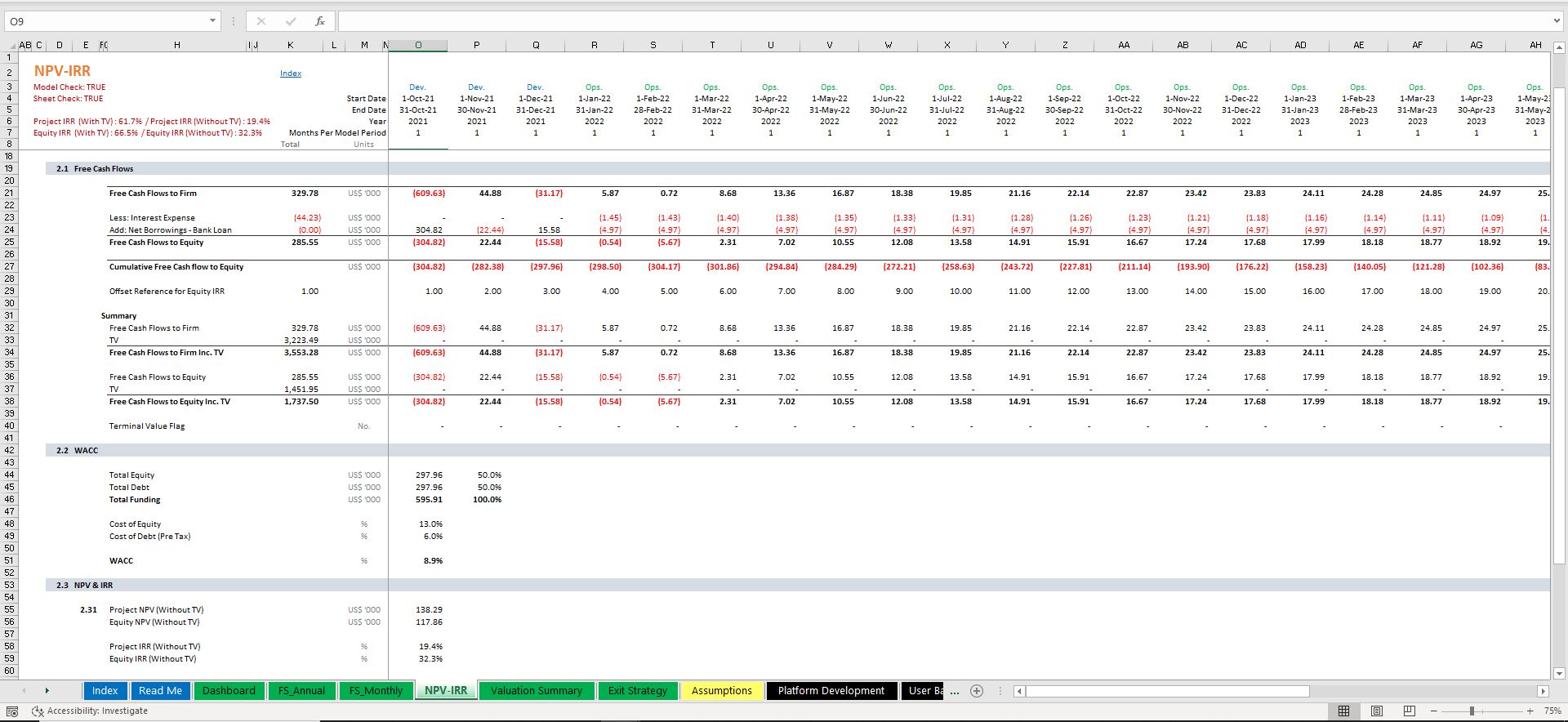

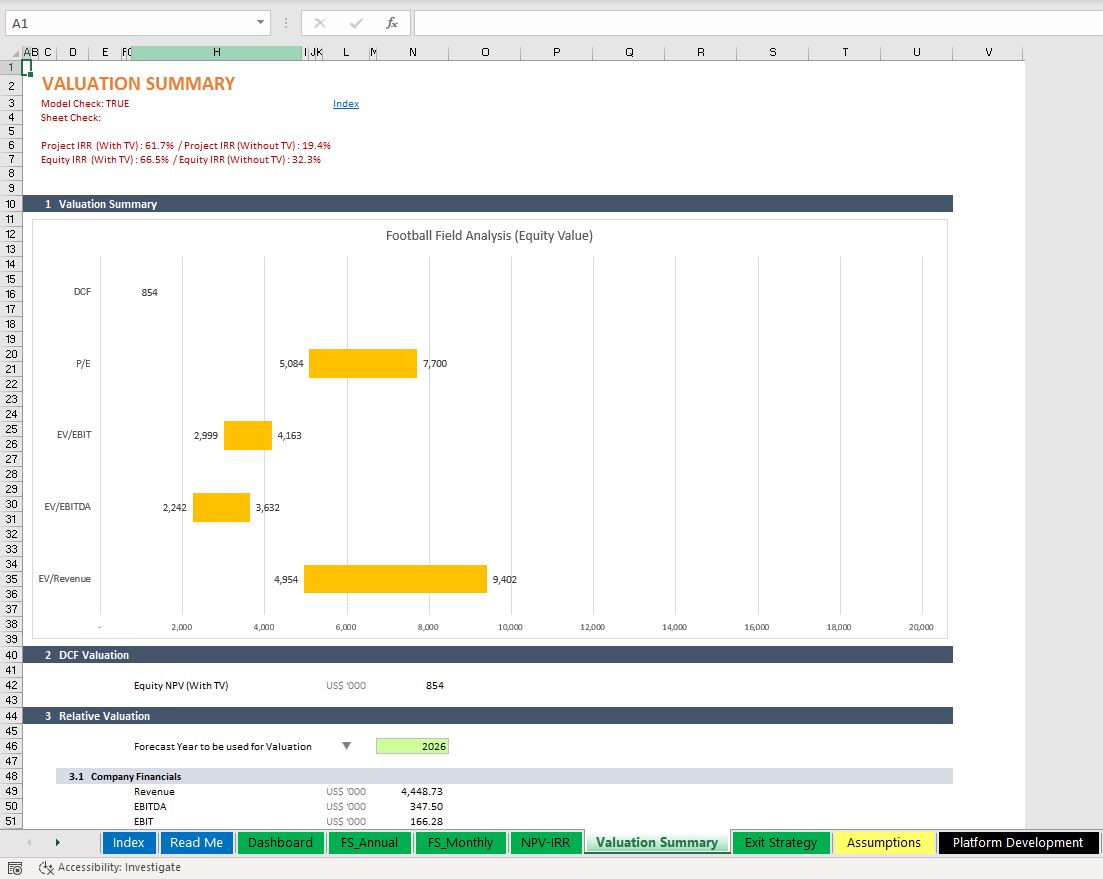

- Project IRR & NPV (via DCF Valuation)

- Equity IRR & NPV (via DCF Valuation)

- Relative valuation

- Football Field Analysis

- Equity Payback Period

- Cash Waterfall

- Debt Service Profile

- Integrated Financial Statements

- Fully Integrated Dashboard

Why Fin-wiser’s Financial Model Template:

- Our model is built on the monthly timeline which provides more detailed data for the Analysis

- The model is divided into two phases i.e. Development and Operations

- All revenue and cost assumptions can be input into 3 scenarios. This helps users to assess the impact of multiple business scenarios in one model. This can be operated simply with a click of a button.

- The debt repayment has been profiled with 2 scenarios i.e. Annuity payment and Even Principal Payment repayment. You can change the scenario with a click of a button and assess the impact on IRR.

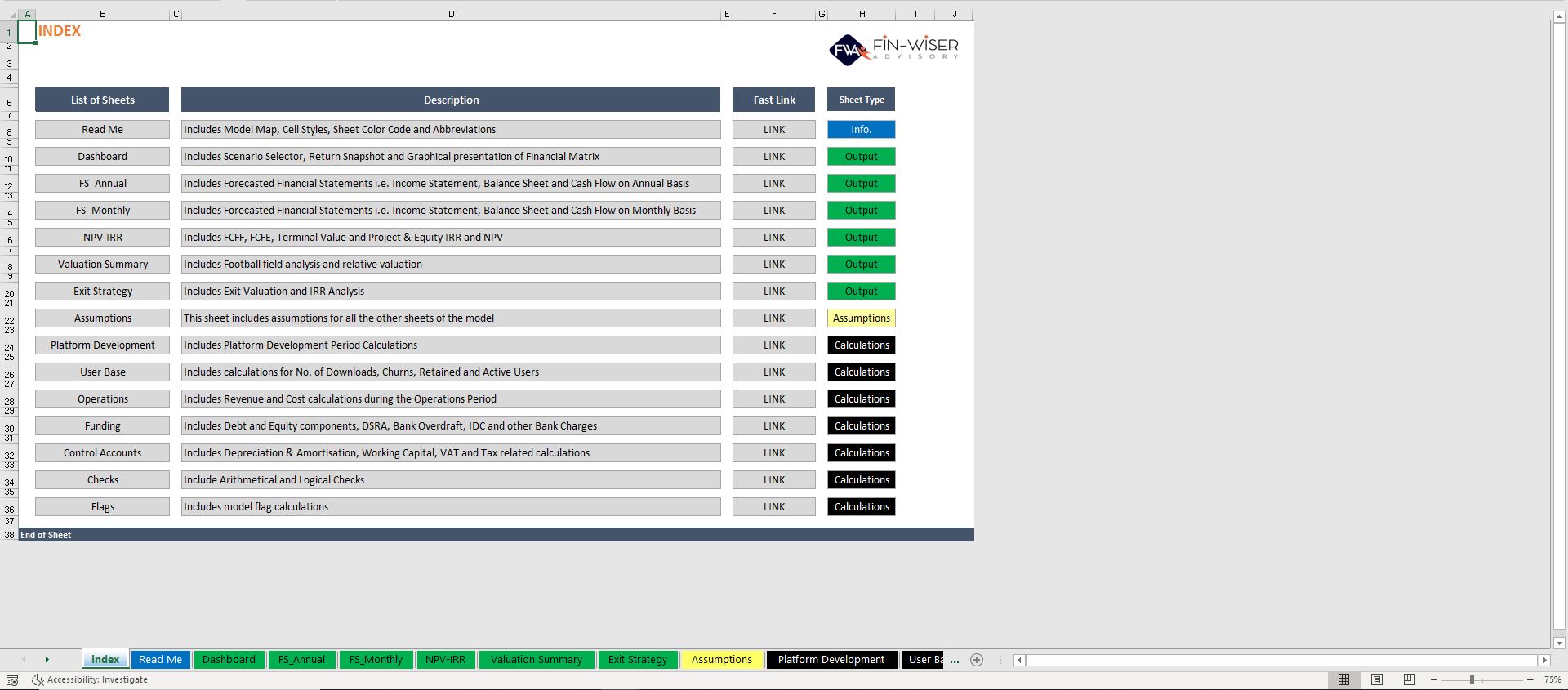

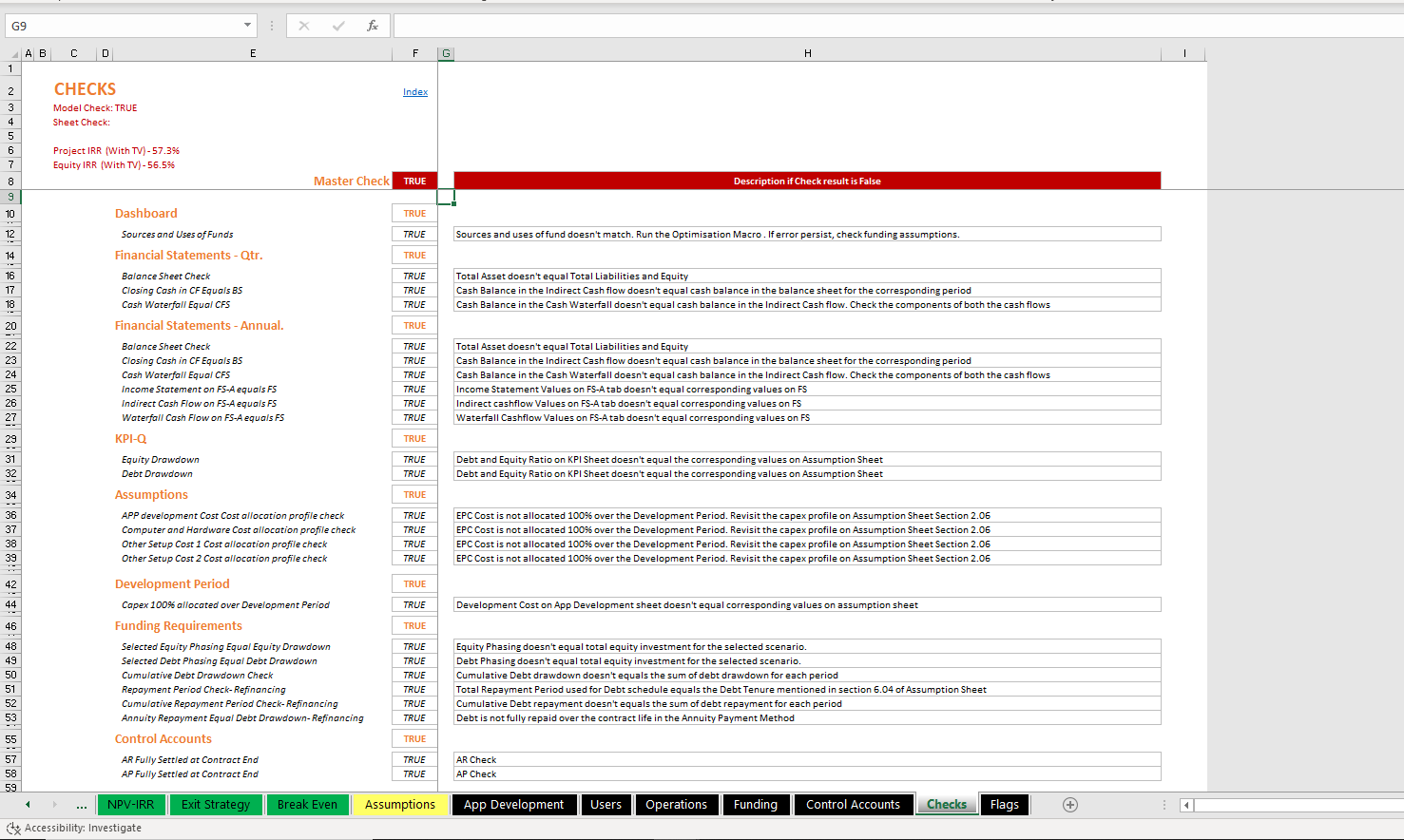

- The model is built with Financial Modeling Best Practices and has clearly defined input, calculations, output cells, and tabs to help even a rookie Excel user operate the model efficiently.

- Our Models are thoroughly reviewed, and Quality checked for Arithmetic and Logical flow

Technical Specifications:

- Model doesn’t use Macros (VBA) and hence the impact of change in any assumption can be directly seen on the return.

- The model is built using Microsoft Excel 2019 version for Windows. Please note, on certain Mac laptops or MS Excel prior to 2007, Excel with Macros can slow down your computer if your PC does not have enough processing power.

- We advise you not to delete or insert rows and columns into the model if you are not aware of the model structure as it can distort model functioning. If you need assistance with customizing the model template, the author is more than willing to help you. Simply contact us at pushkarkumar@fin-wiser.com and send your model template as well as specifications. We will then get back to you with a quotation for the customization service (billable hours & completion date).

- The model uses Cell Styles.