Business Plan Financial Model – Farm Land

$120.00

Description

Looking at the current global pandemic situation, a self-reliant business proposition would be to grow your own food produce. One might plan to invest commercially in the Agriculture sector or can decide to work in a small area. Whatever it is, a sound business plan would definitely be handy.

A robust business plan always helps in performing key business calculations and conducting projections to ensure feasibility. Keeping in mind the current economic factors, Fin-wiser Advisory has developed a robust Business Plan Model –Farm Land. It is a useful financial planning tool, whatever size and stage of development your business is.

The Model includes assumptions related to:

- Plant processing capacity, biomass received per month, calorific value, and storage capacity.

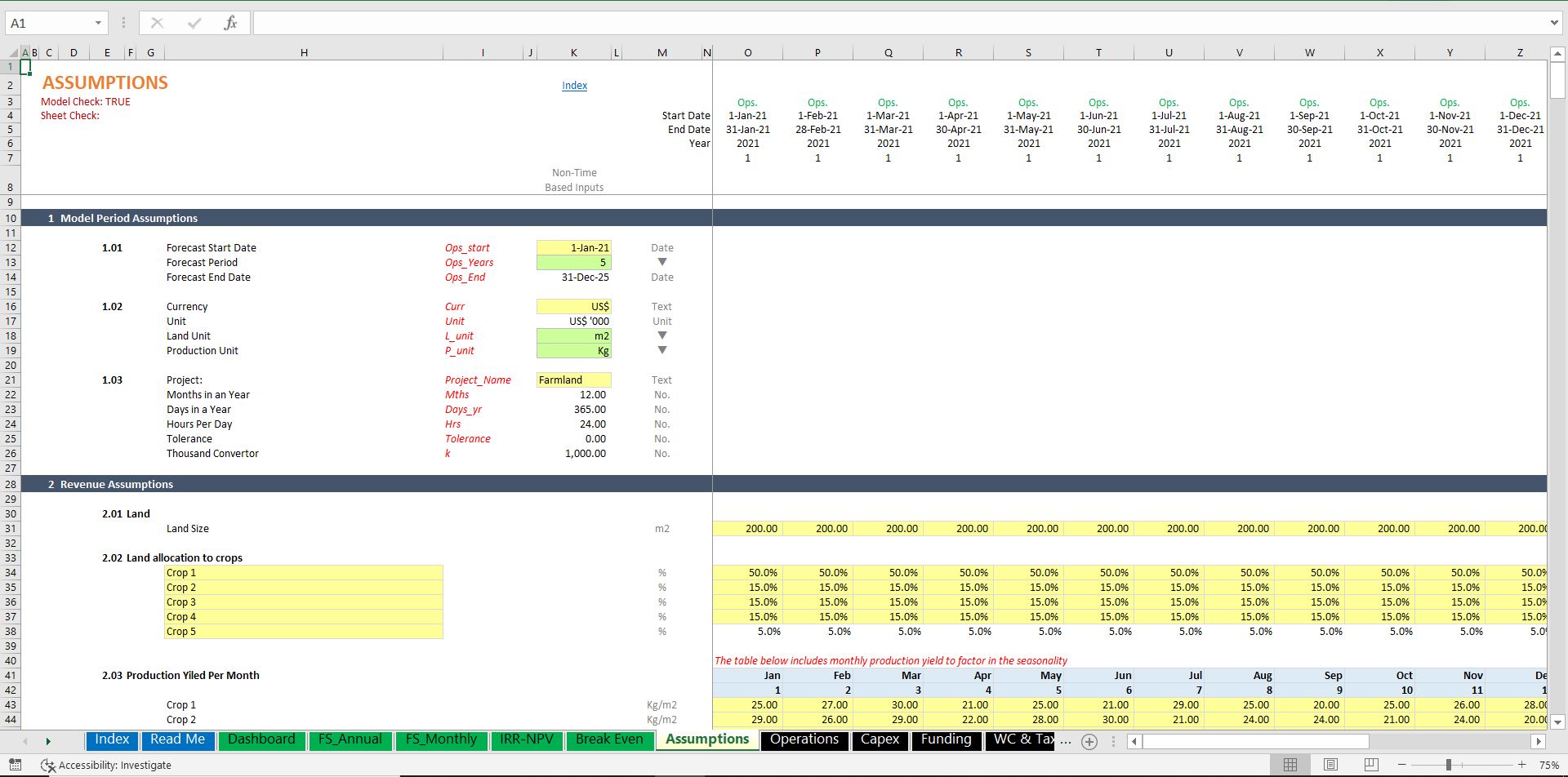

- Land size, utilization, and allocation across 5 crops.

- Crop Price for up to 5 crops and other sources of revenue

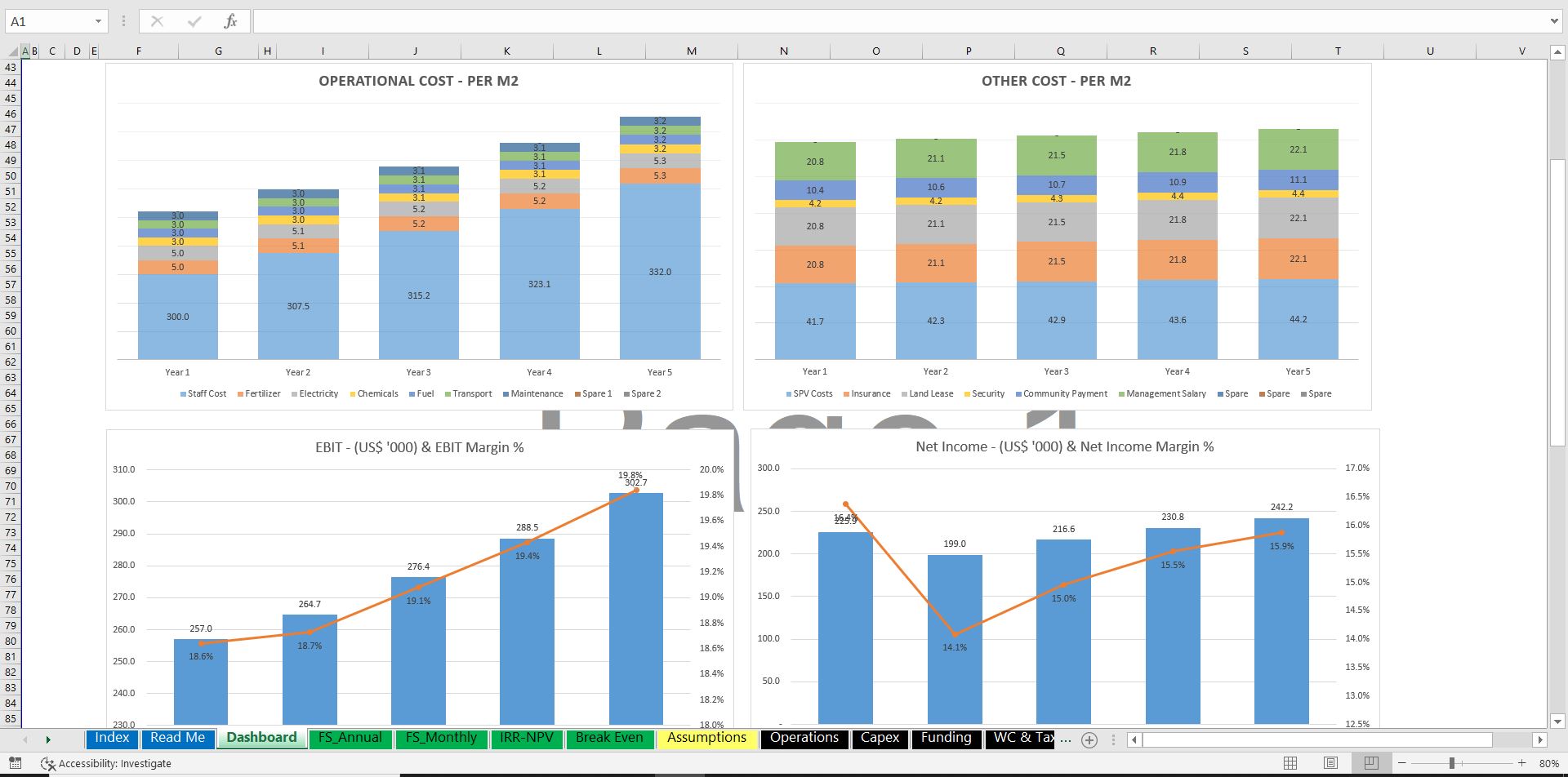

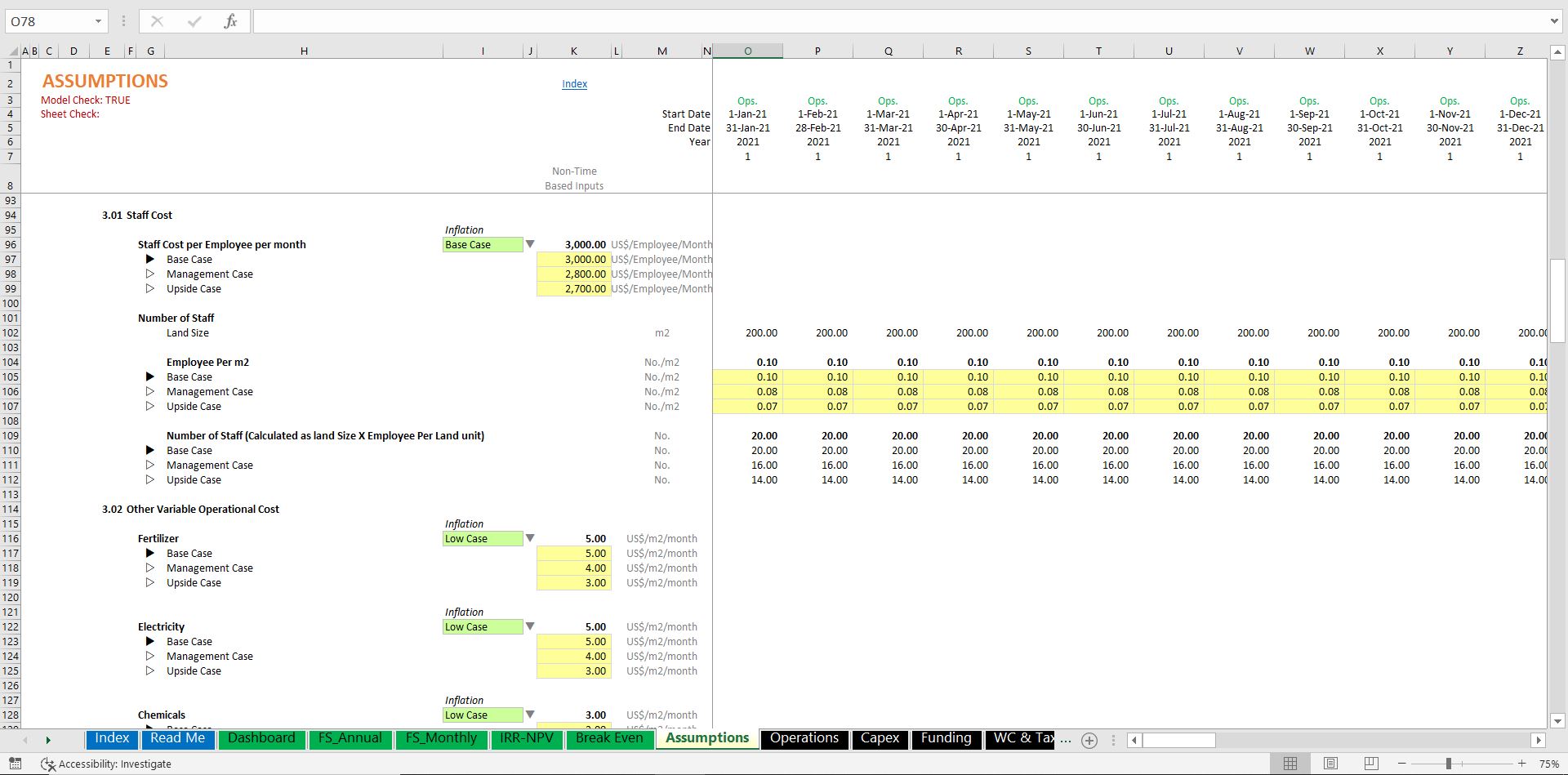

- Staff Cost, Variable O&M cost per land unit (divided into 8 subheads such as staff, electricity, consumables, transport, and fuel) and other fixed costs (SPV, insurance, land lease, community payment, management fee & more)

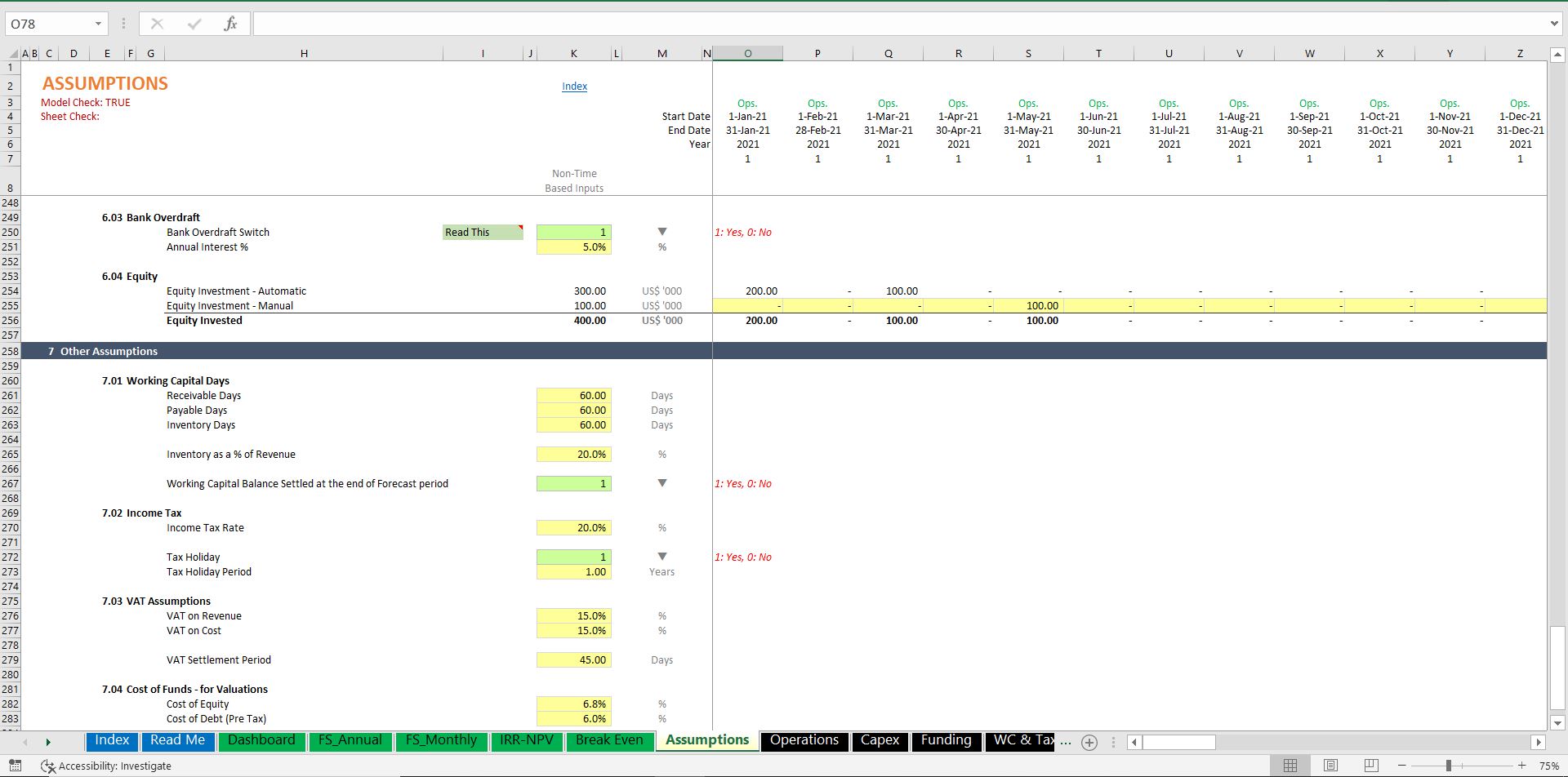

- Flexible Funding Profile – Cash equity, Bank Debt, and Bank overdraft

- Working Capital Assumptions related to accounts receivables, inventory, and payables

- Straight Line Depreciation

- Annuity, and Even Principal Repayment options

- Inflation and Indexation

- VAT during operations

Model Output includes:

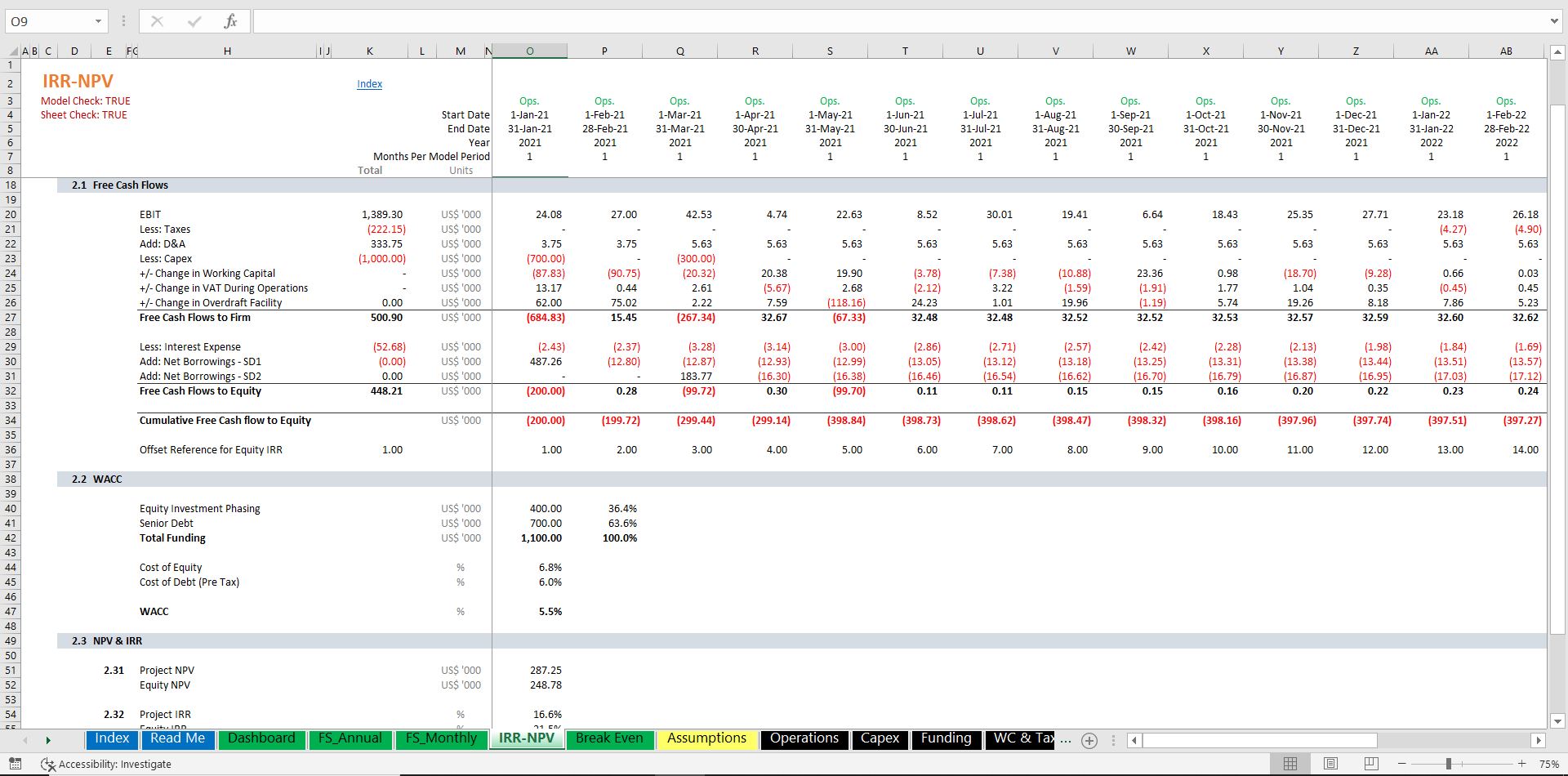

- Project IRR & NPV (via DCF Valuation)

- Equity IRR & NPV (via DCF Valuation)

- Equity Payback Period

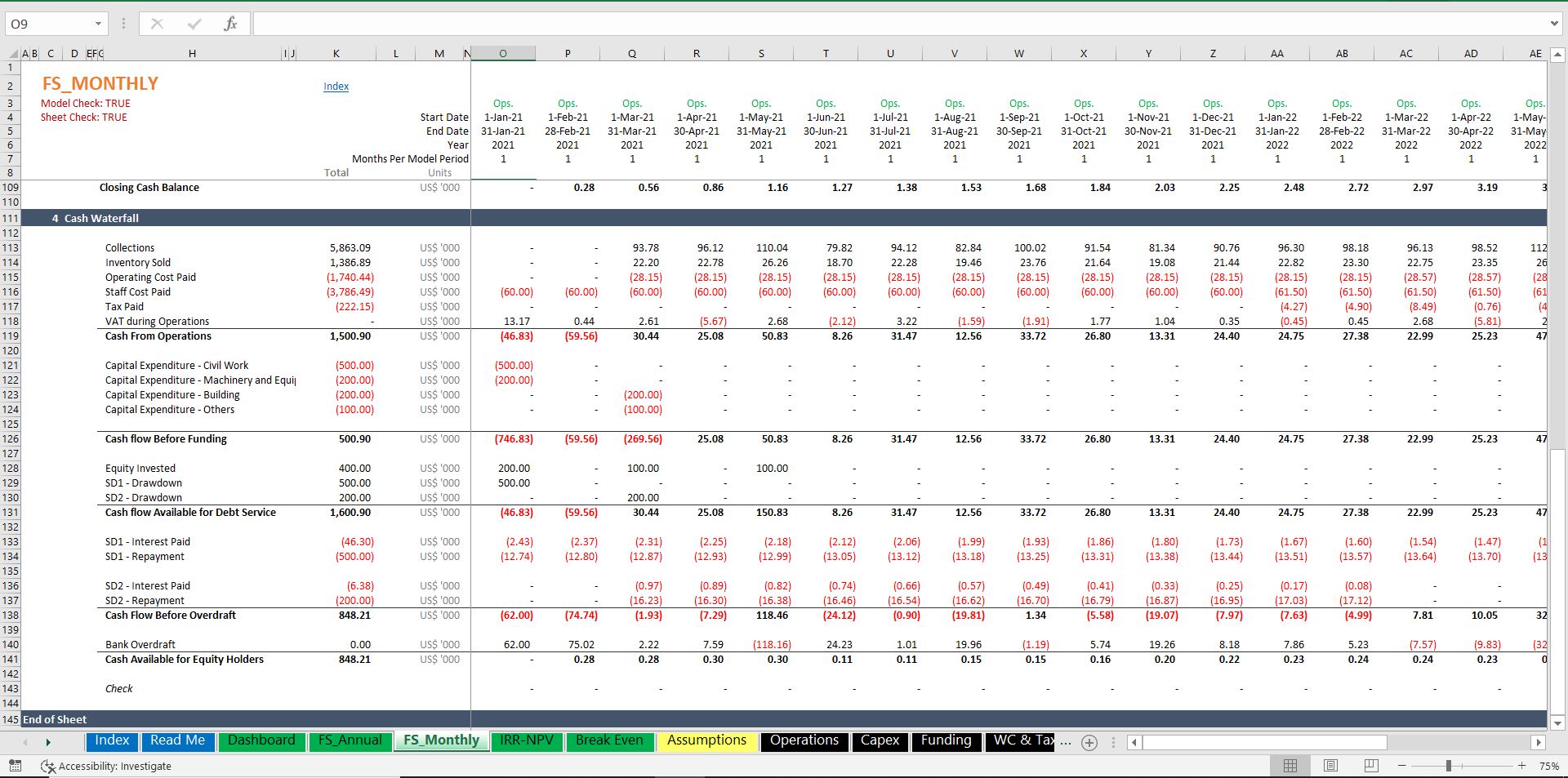

- Cash Waterfall

- Debt Service Profile

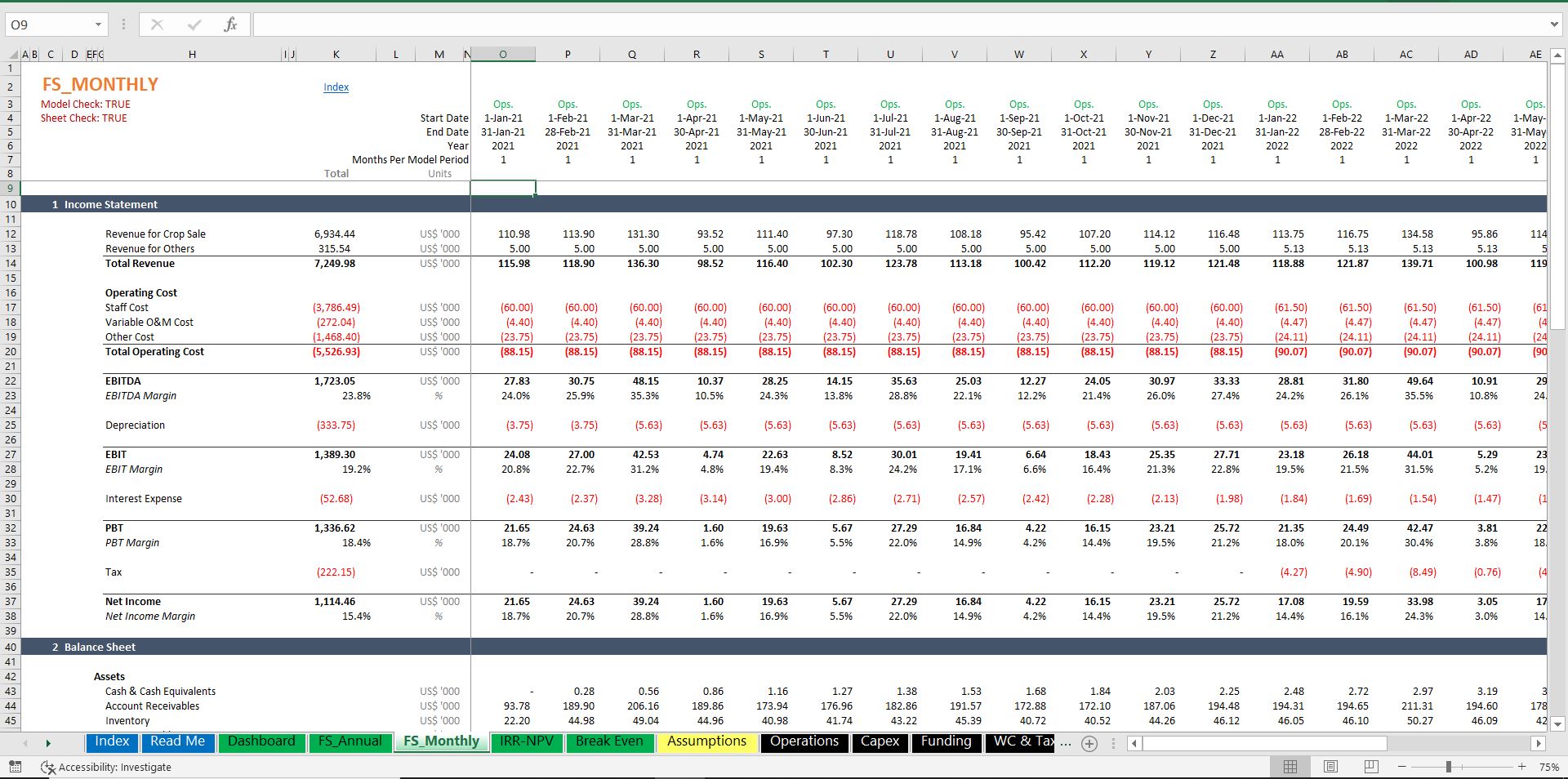

- Integrated Financial Statements

- Fully Integrated Dashboard

- Break Even Analysis

Why Fin-wiser’s Financial Model Template:

- Our model is built on the monthly timeline which provides more detailed data for the Analysis

- All revenue and cost assumptions can be input into 3 scenarios. This helps users to assess the impact of multiple business scenarios in one model. This can be operated simply with a click of a button.

- The debt repayment has been profiled with 2 scenarios i.e. Annuity payment and Even Principal Payment. You can change the scenario with a click of a button and assess the impact on IRR.

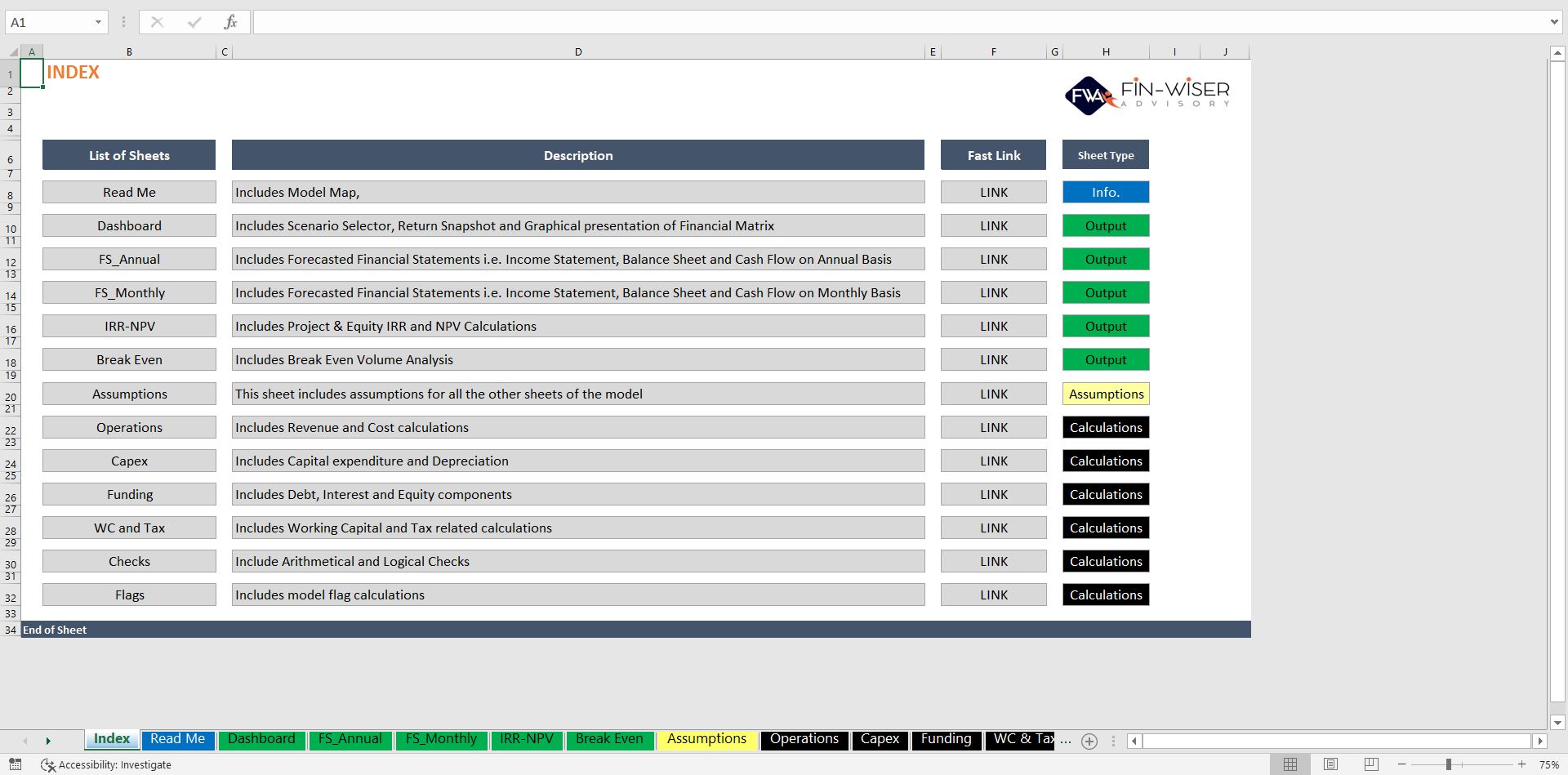

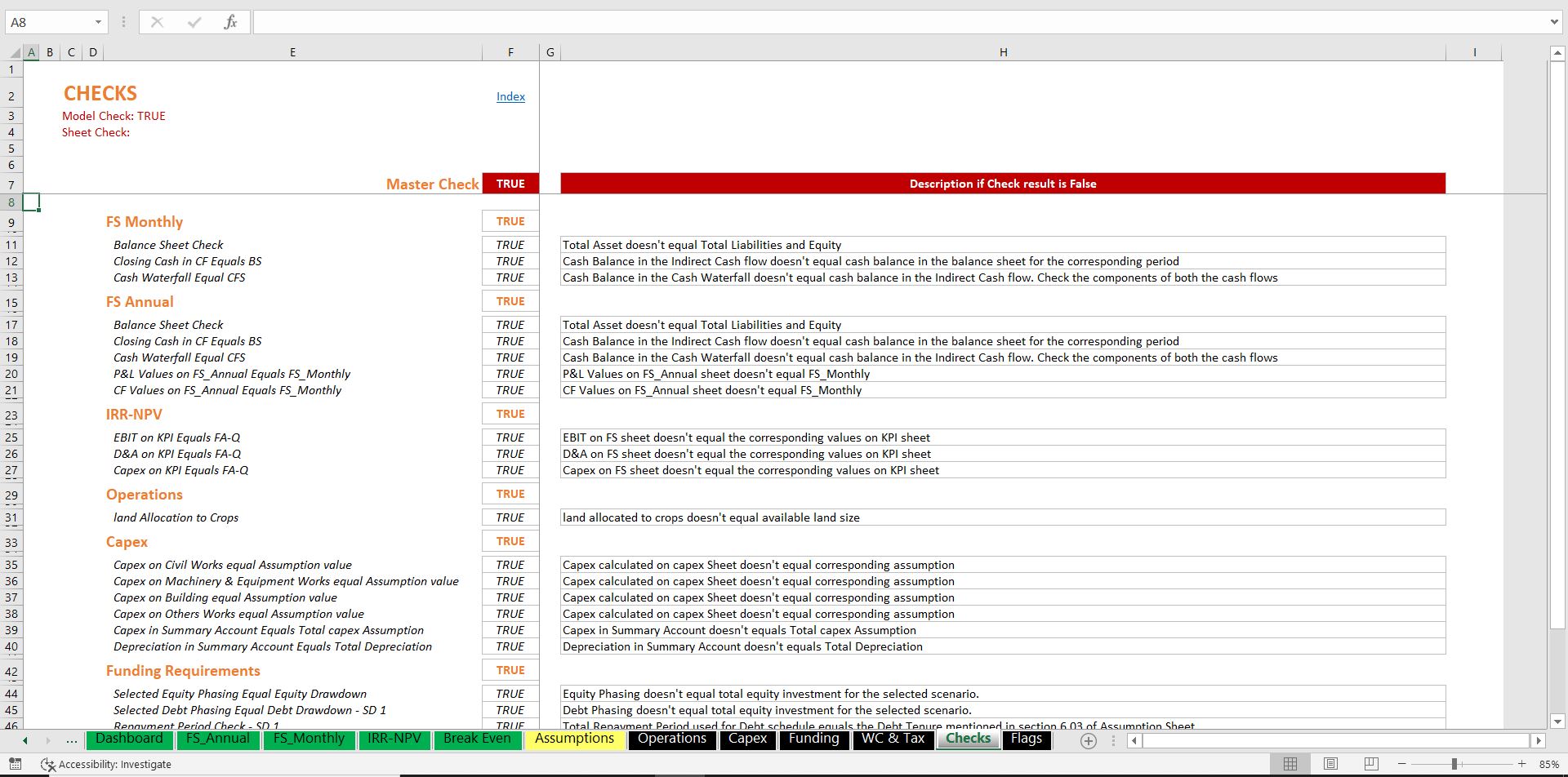

- The model is built with Financial Modeling Best Practices and has clearly defined input, calculations, output cells, and tabs to help even a rookie Excel user operate the model efficiently.

- Our Models are thoroughly reviewed, and Quality checked for Arithmetic and Logical flow

Technical Specifications:

- The model doesn’t use Macros (VBA) and any changes in inputs are directly captured on output in real time without any delay.

- The model is built using Microsoft Excel 2019 version for Windows. Please note, on certain Mac laptops or MS Excel prior to 2007, Excel with Macros can slow down your computer if your PC does not have enough processing power.

- We advise you not to delete or insert rows and columns into the model if you are not aware of the model structure as it can distort model functioning. If you need assistance with customizing the model template, the author is more than willing to help you. Simply contact us at pushkarkumar@fin-wiser.com and send your model template as well as specifications. We will then get back to you with a quotation for the customization service(billable hours & completion date).

- The model uses Cell Style