Biogas Plant (Waste to Energy) Financial Model with 3 Statements, Cash Waterfall, NPV, & IRR and Flexible Timeline

$149.00

Categories: Best Selling, Featured Products, Financial Model, Paid, Project Finance & PPP Models, Renewable Energy

Tags: biogas Cash Flow Analysis Cash Flow Projections cash waterfall debt debt funding Debt Schedule debt service coverage ratio Discount Rate dscr equity equity funding equity irr equity payback excel fcfe fcff Financial Debt Financial Feasibility financial model Financial Planning Financial Projections Financial Ratios financial statements Forecasting Investment Multiple Investor Cash Flows irr IRR (Internal Rate of Return) KPIs (Key Performance Indicators) npv NPV (Net Present Value) Profitability Analysis project finance renewable WACC (Weighted Average Cost of Capital)

Description

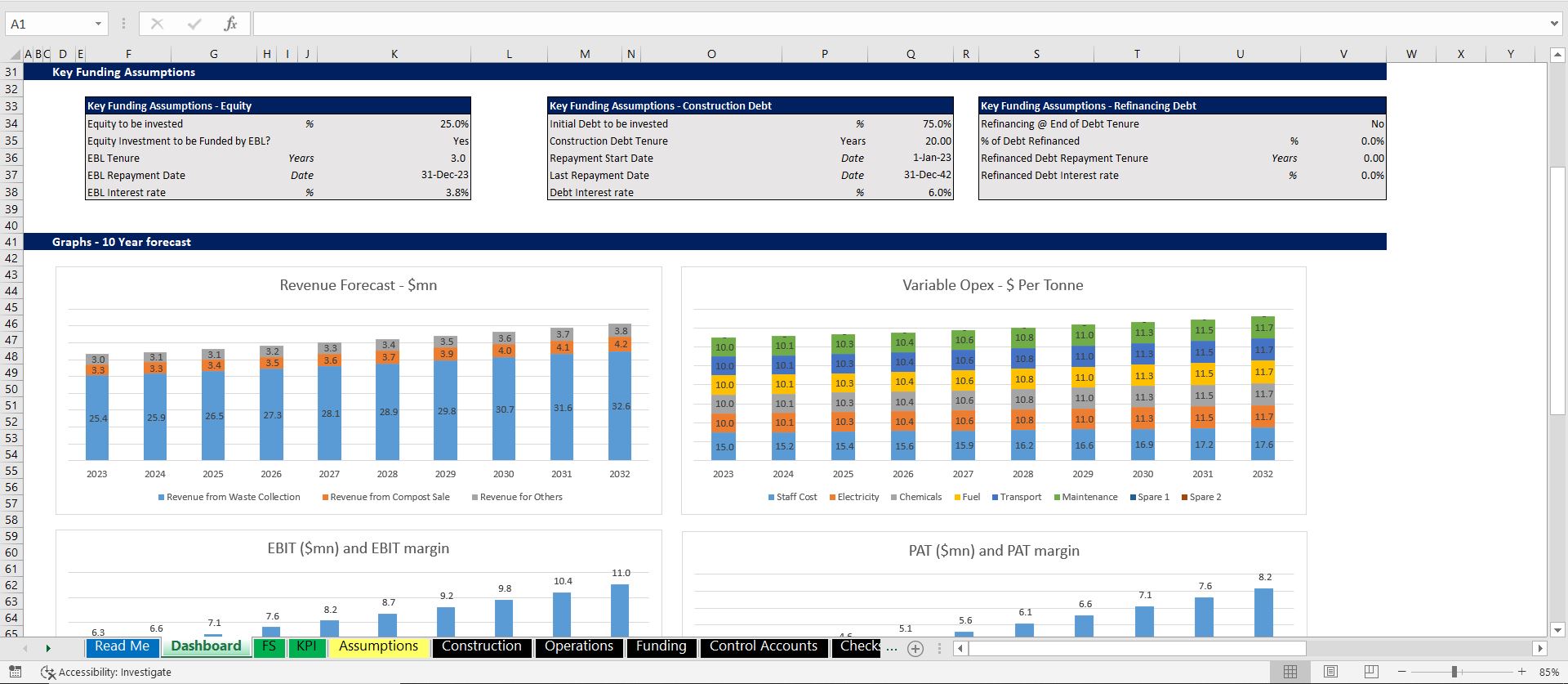

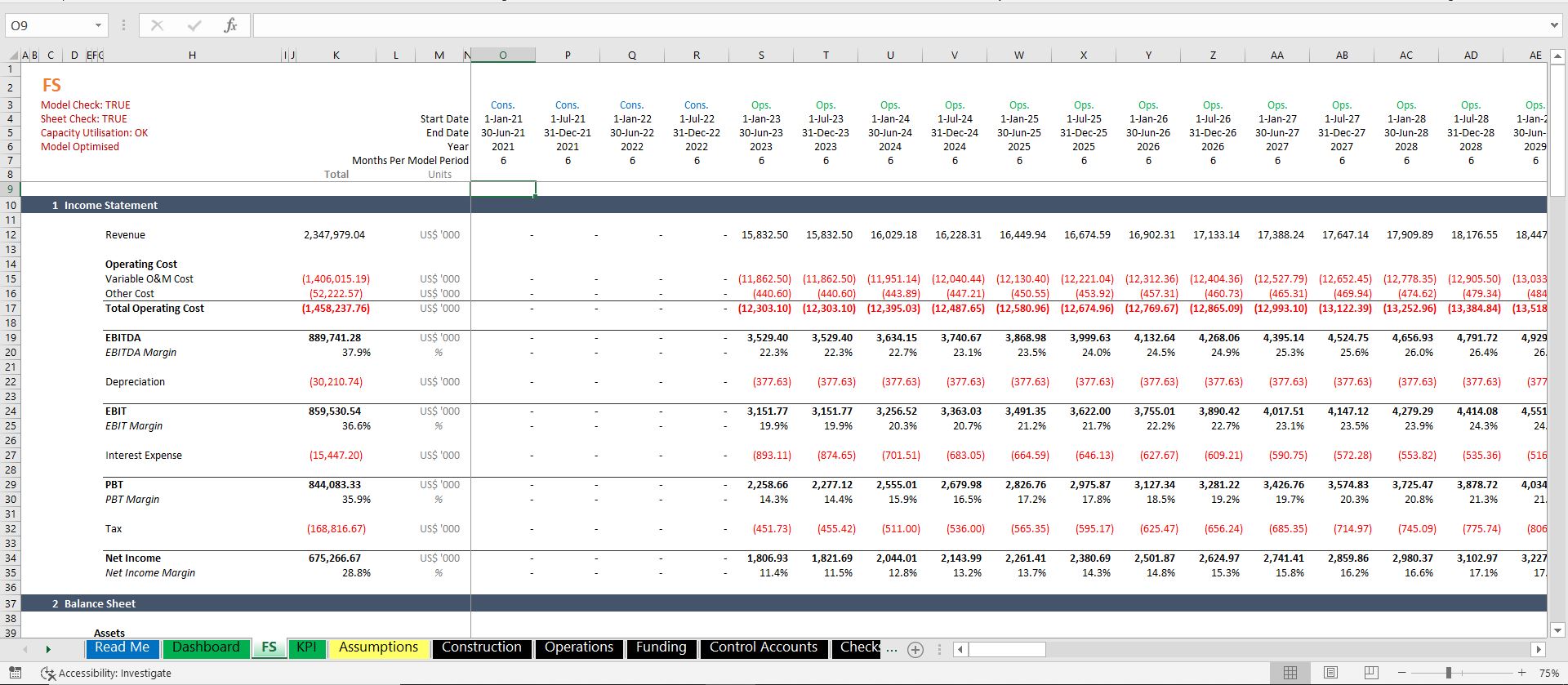

Fin-wiser’s Bio Gas Plant model helps users to assess the financial viability of a biogas plant (compost/waste to electricity), by capturing all the essential inputs related to construction, operation, and financing.

The Model includes assumptions related to:

- Development cost, Construction costs, and Developer’s Fee

- Plant processing capacity, biomass received per month, calorific value, and storage capacity.

- Electricity Tariff, Gate Fee, and other sources of revenue.

- Waste Treatment Cost, Variable O&M cost per tonne (divided into 8 sub heads such as staff, electricity, consumables, transport, and fuel), and other fixed costs (SPV, insurance, land lease, community payment, management fee & more)

- Flexible Funding Profile – Cash equity, Bridge Loan, Bank Debt, DSRA, and Bank overdraft

- Working Capital Assumptions related to accounts receivables and payables

- Straight Line and Accelerated Depreciation option

- Annuity, Sculpted Debt, and Even Principal Repayment options

- Inflation and Indexation

- VAT during the construction and operations phase

- Decommissioning cost and reserve, if required

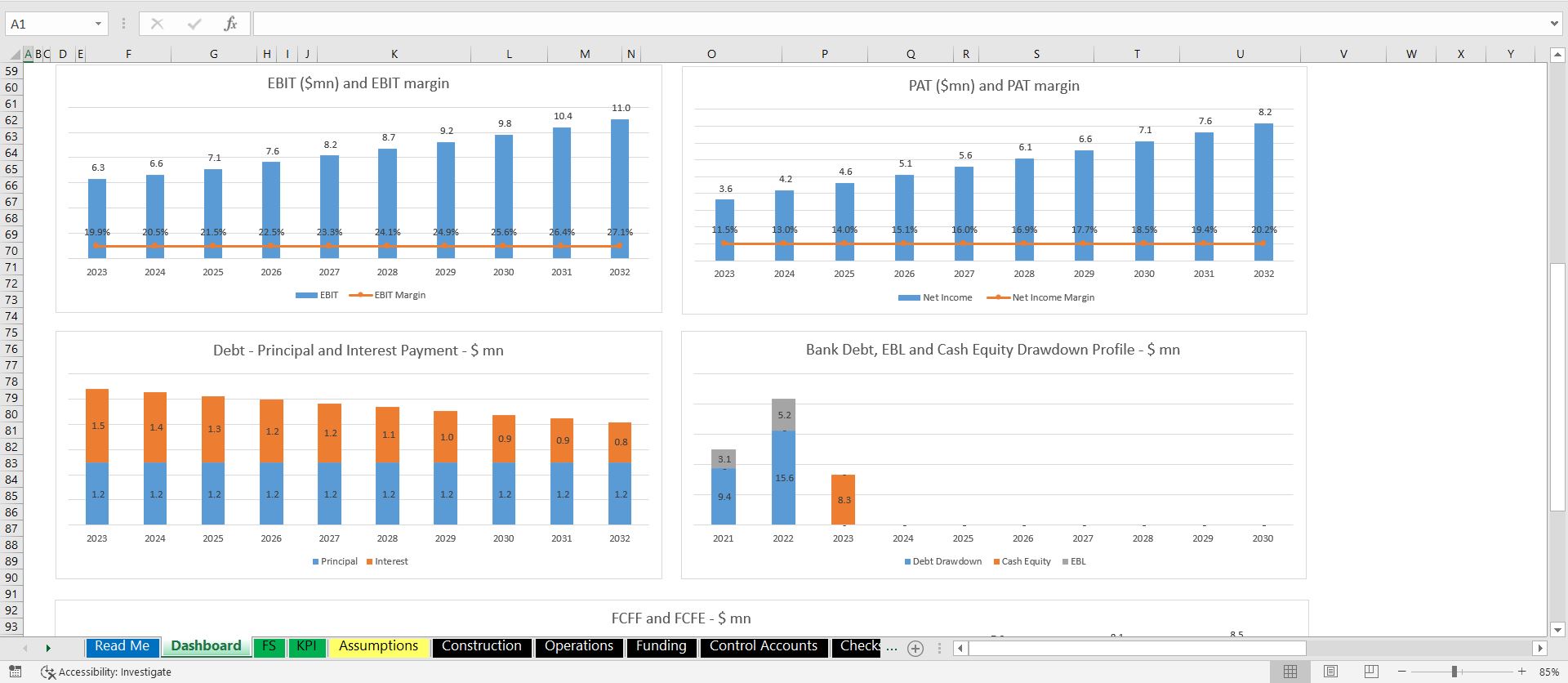

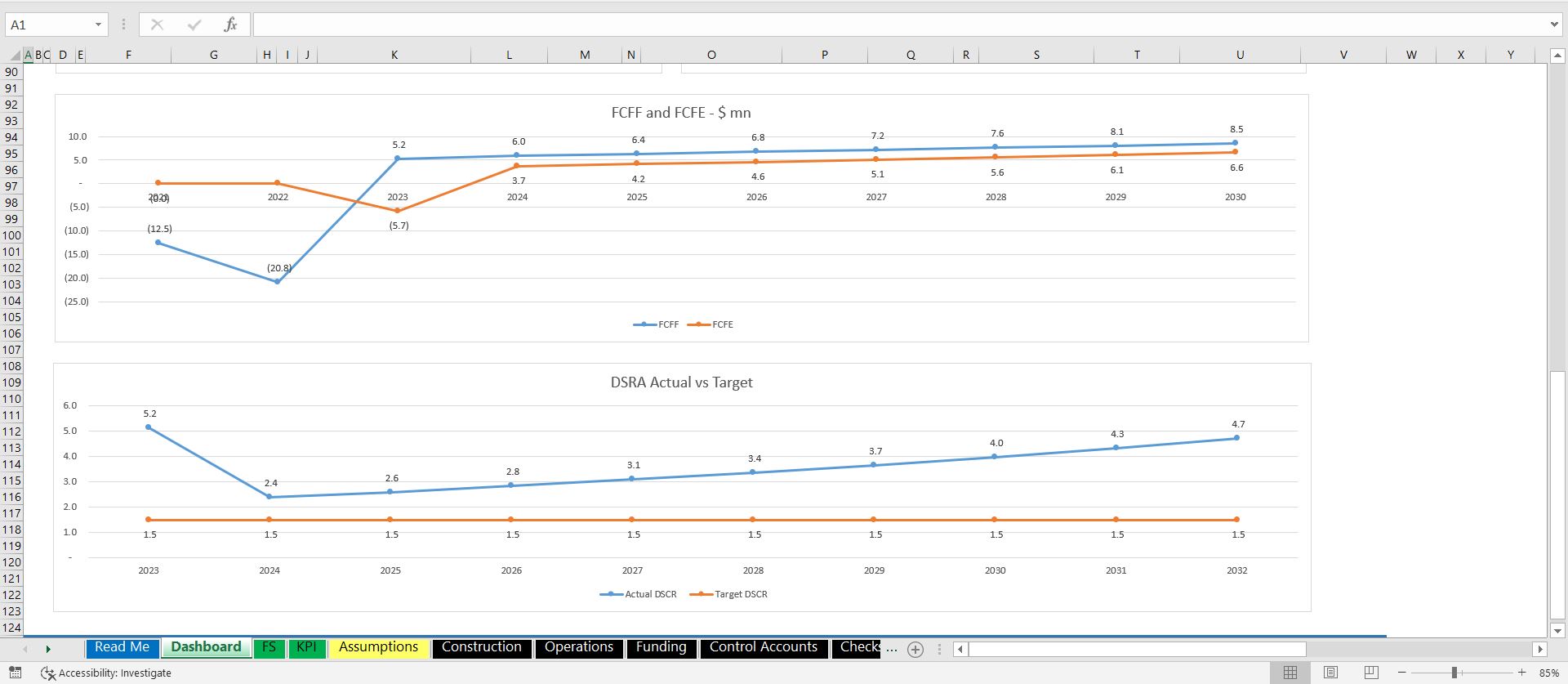

Model Output includes:

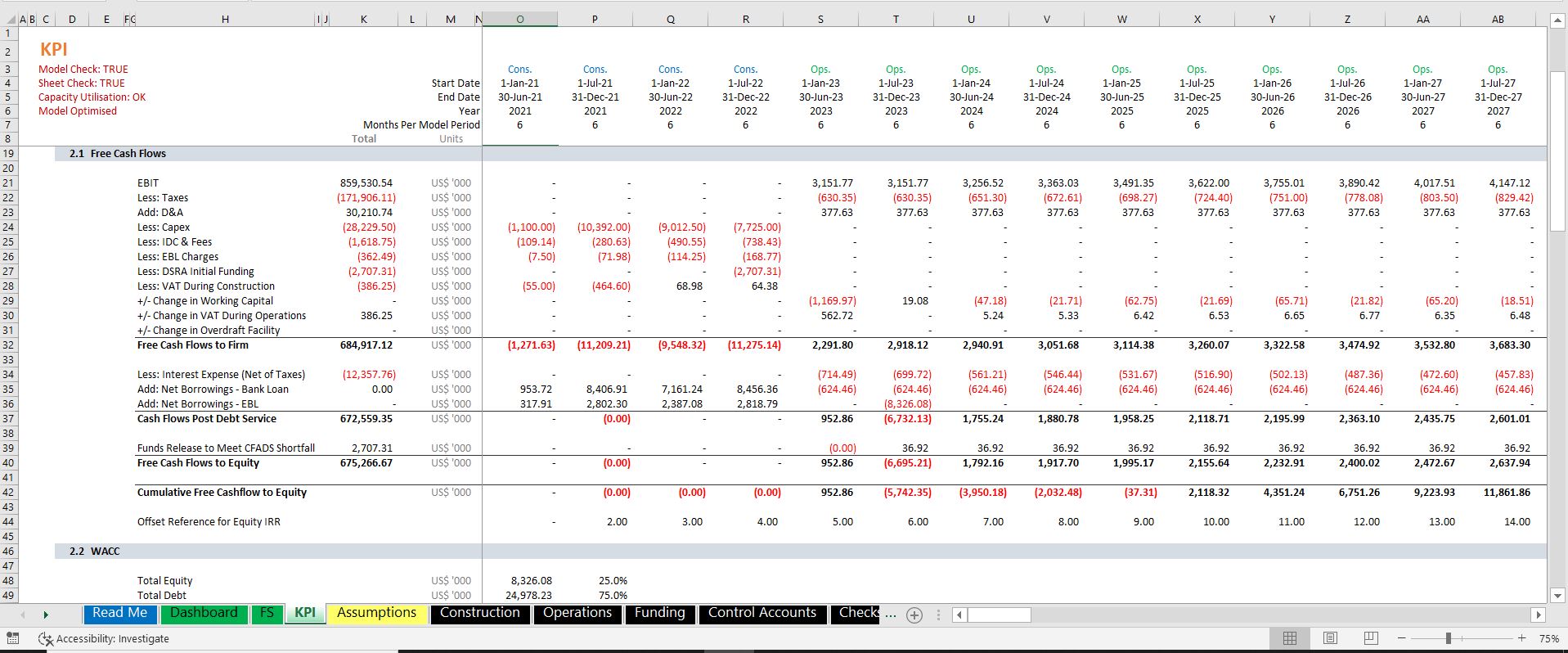

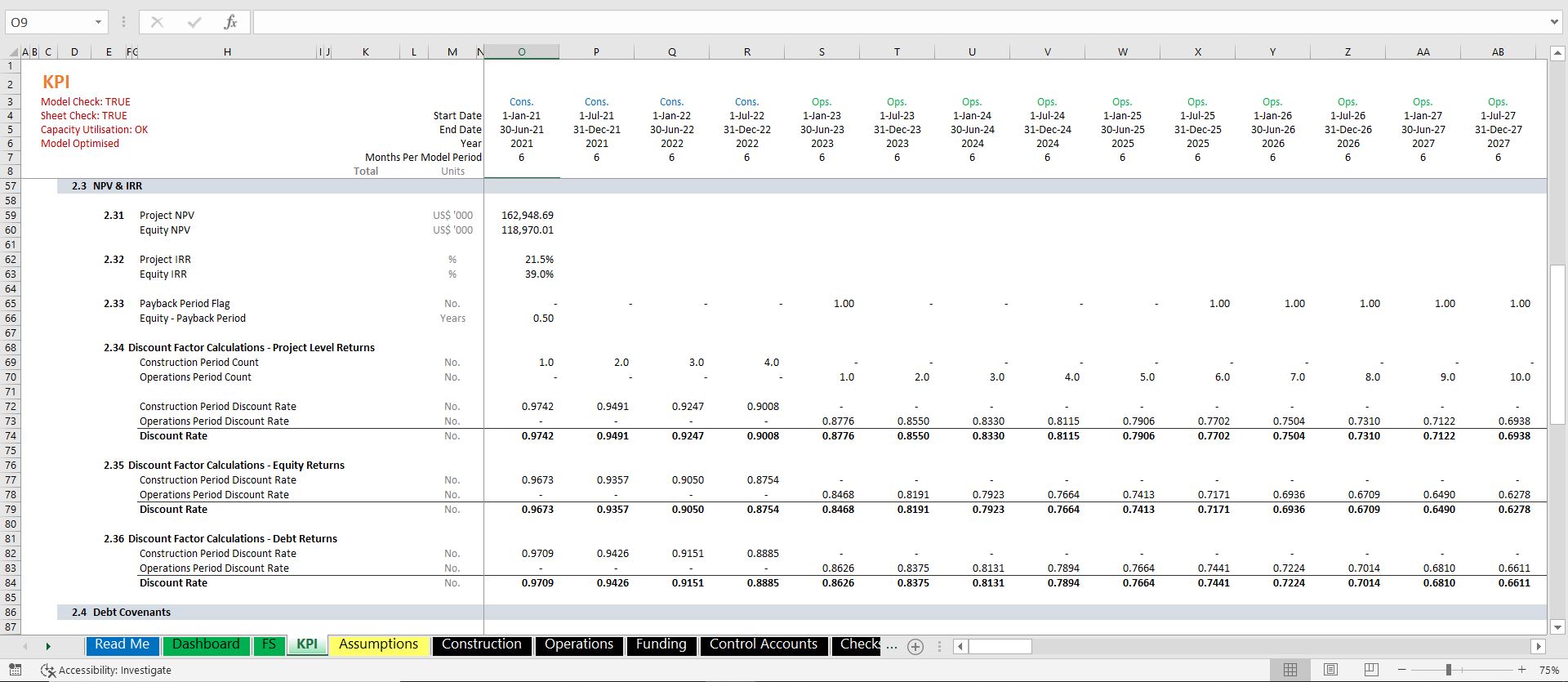

- Project IRR & NPV

- Equity IRR & NPV

- Minimum and Average DSCR

- LLCR and PLCR

- Equity Payback Period

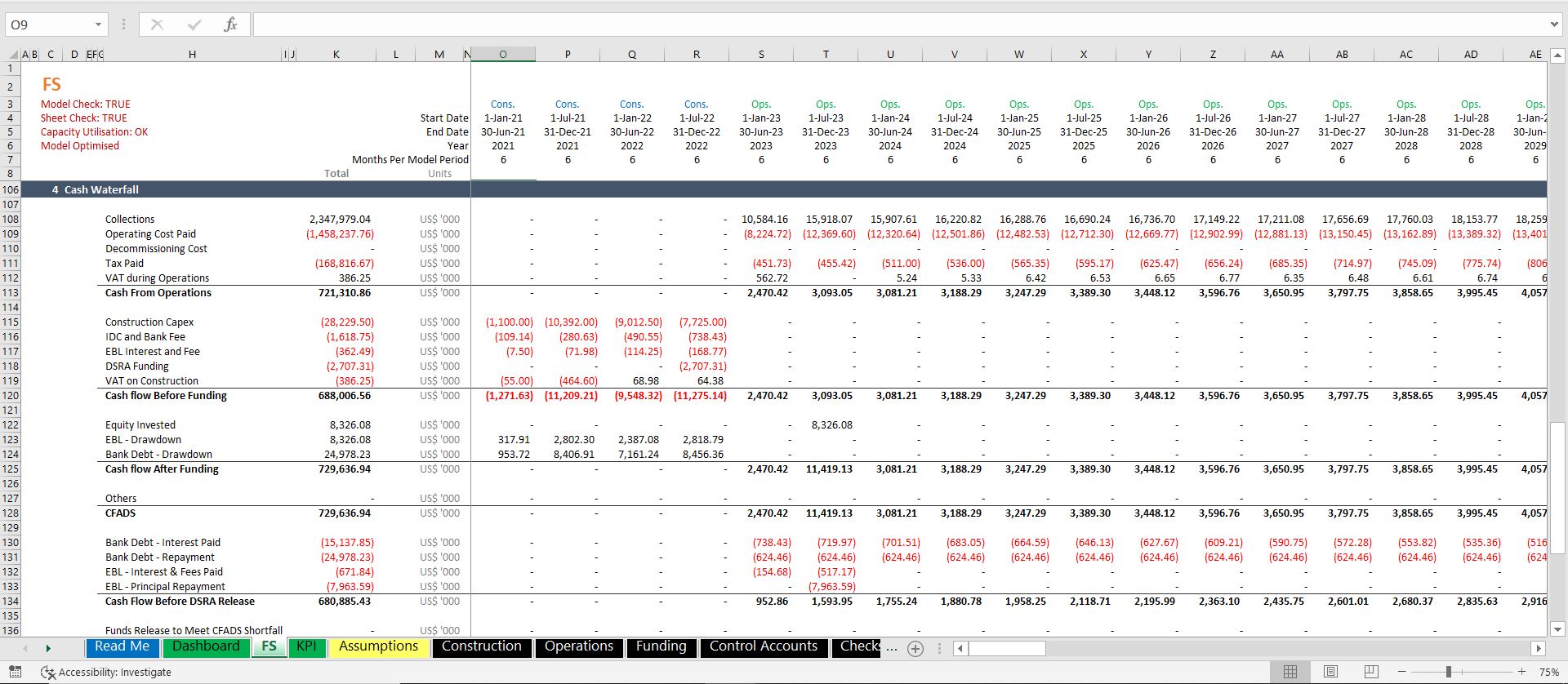

- Cash Waterfall

- Debt Service Profile

- Integrated Financial Statements

- Fully Integrated Dashboard

Model Package includes:

- Excel-based financial model (Excel binary format i.e. xlsb)

- Model Heat Map (FWA Maps) – The file includes a heat map of the model with color codes on

F: Unique formula

<: Formula is a copy of the one to the left

^: The formula is a copy of the one above

+: Formula is a copy of the one to the left and above (i.e. it is a copy of both)

L: Label

N: Numeric input

A: Unique array formula - Name Range List (FWA Name Listing) – This file includes information about all names used in the workbook. The Names Listing contains a column labeled “Visible”. A “Yes” in this column means the name is visible (i.e. appears in the list accessed through Formulas Tab|Defined Names|Name Manager). A “No” indicates a hidden name (i.e. a name created by the solver add-in, autofilter names, etc).

- Macro Word Document – This includes the VBA Code used in the model for the user’s reference

Why Fin-wiser’s Financial Model Template:

- Our model allows greater flexibility in terms of deciding upon the forecast period length. Users can choose from Monthly, Quarterly, Semi-Annual, or Annual forecast period lengths. This provides more detailed data for Analysis.

- The model is divided into two phases i.e. Construction and Operations. The user has the flexibility to decide upon each period length individually and can also choose to populate each model phase on a monthly, quarterly, semi-annual, or annual basis.

- All revenue and cost assumptions can be input into 3 scenarios. This helps the user to assess the impact of multiple business scenarios in one model. This can be operated simply with a click of a button.

- The Debt funding drawdown has 3 scenarios that can help user to assess the impact on the IRR and make the best possible negotiations with the financial institutions.

- The debt repayment has been profiled with 3 scenarios i.e. Annuity payment, Even Principal Payment, and Debt sculpted repayment. You can change the scenario with a click of a button and assess the impact on IRR.

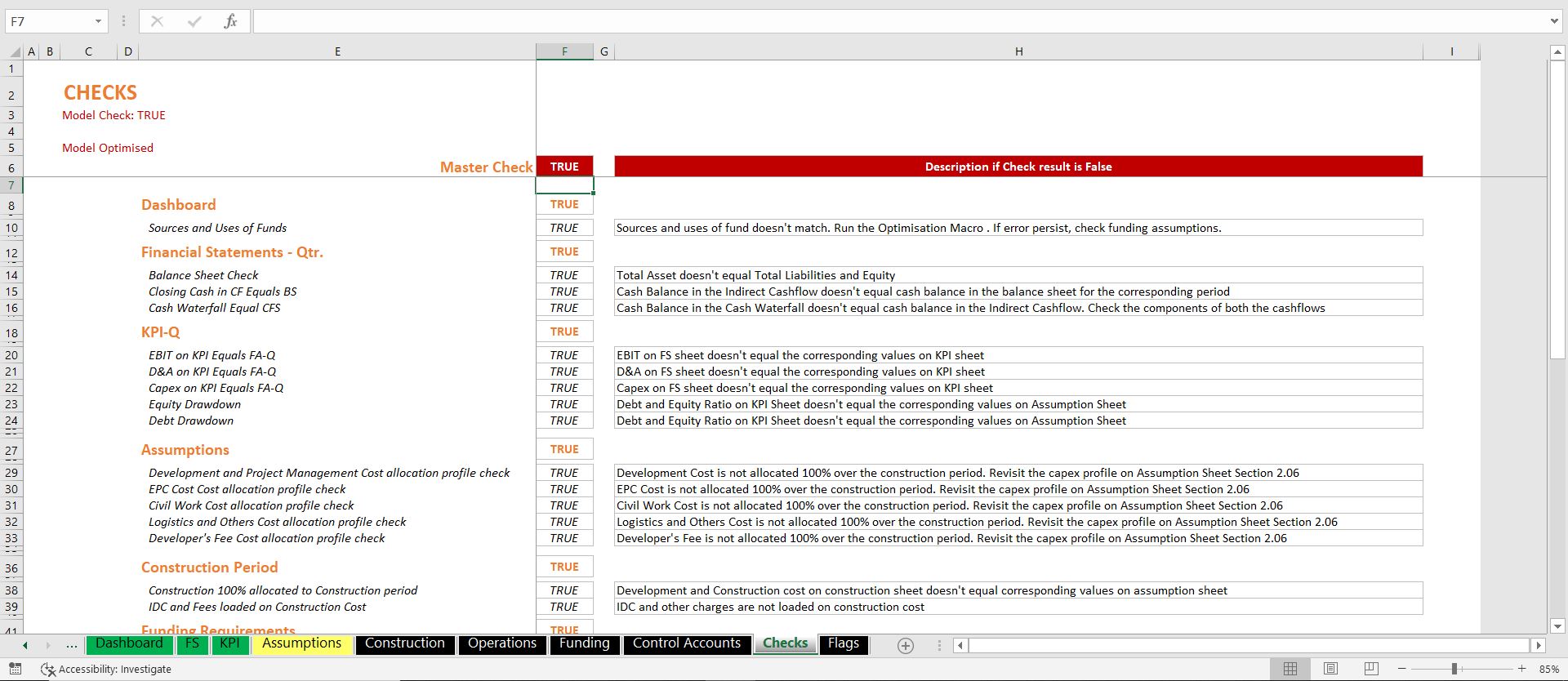

- The model is built with Financial Modeling Best Practices and has clearly defined input, calculations, output cells, and tabs to help even a rookie Excel user to operate the model efficiently.

- Our Models are thoroughly reviewed and Quality checked for Arithmetic and Logical flow

Technical Specifications:

- The Model uses Macros (VBA) especially to consider the interest during the construction phase in the Uses of Funds Table. To run the model optimally, keep macros enabled. In case you do not like Macros, you could manually disable or remove the Macros and will have to rework the model’s logic to be used without Macros but it is not recommended by the author.

- The Model is built using Microsoft Excel 2019 version for Windows. Please note, on certain Mac laptops or MS Excel prior to 2007, Excel with Macros can slow down your computer if your PC does not have enough processing power.

- We advise you not to delete or insert rows and columns into the model if you are not aware of the model structure as it can distort model functioning. If you need assistance with customizing the model template, the author is more than willing to help you. Simply contact us at pushkarkumar@fin-wiser.com and send your model template as well as specifications. We will then get back to you with a quotation for the customization service (billable hours & completion date).

- The model uses Cell Styles