Understanding Internal Rate of Return (IRR) in Financial Analysis

In the realm of finance, making informed decisions is crucial for individuals and businesses alike. Whether it’s investing in a new project, assessing the viability of a business venture, or evaluating potential acquisitions, understanding the financial metrics involved is essential. One such metric that holds significant importance in financial analysis is the Internal Rate of Return (IRR). In this comprehensive guide, we delve into what IRR is, how it is calculated, its significance, and its applications in real-world scenarios.

What is the Internal Rate of Return (IRR)?

Internal Rate of Return, often abbreviated as IRR, is a financial metric used to evaluate the profitability of an investment or project. It represents the discount rate at which the net present value (NPV) of all cash flows from a project or investment equals zero. In simpler terms, IRR is the rate at which an investment breaks even, meaning the present value of cash inflows equals the present value of cash outflows.

Calculating IRR

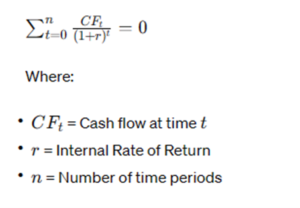

The calculation of IRR involves determining the discount rate that equates the present value of expected cash flows with the initial investment or cost. The formula for calculating IRR can be represented as follows:

The IRR is computed iteratively, typically using numerical methods like the trial-and-error method or mathematical algorithms like Newton’s method.

Significance of IRR

- Profitability Assessment: IRR provides a clear measure of the potential profitability of an investment. A higher IRR indicates a more profitable investment, while a lower IRR suggests lower profitability.

- Comparison Tool: IRR serves as a useful tool for comparing different investment opportunities. By calculating the IRR for each option, investors can determine which investment offers the highest potential return.

- Decision Making: Businesses and individuals use IRR to make informed decisions regarding investment projects. Projects with IRRs exceeding the cost of capital are typically accepted, while those with lower IRRs may be rejected.

- Capital Budgeting: In capital budgeting, where firms allocate financial resources to various projects, IRR helps in prioritizing projects based on their potential returns.

Real-World Applications

- Capital Expenditure Projects: Companies use IRR to evaluate the viability of capital expenditure projects such as building new facilities, purchasing equipment, or launching new products.

- Real Estate Investments: Real estate developers analyze IRR to assess the potential returns from property investments, taking into account factors like rental income, property appreciation, and operating expenses.

- Corporate Investments: When corporations consider mergers, acquisitions, or expansion projects, IRR analysis helps in assessing the financial impact and potential returns of such ventures.

- Personal Finance: Individual investors use IRR to evaluate investment options such as stocks, bonds, mutual funds, or real estate properties to make informed decisions aligned with their financial goals.

Limitations of IRR

While IRR is a valuable metric, it has certain limitations that should be considered:

- Multiple IRRs: In certain scenarios, a project may generate multiple IRRs, making it challenging to interpret the results accurately.

- Reinvestment Assumption: IRR assumes that cash flows generated by the investment are reinvested at the same rate, which may not always be feasible or practical.

Misleading Results: In cases where cash flows fluctuate significantly over time, IRR may provide misleading results, leading to inaccurate investment decisions.

Example: Calculating Internal Rate of Return (IRR) for a Business Investment

Let’s consider a hypothetical scenario where a small business owner is evaluating an investment opportunity to purchase new equipment for their manufacturing facility. The initial investment cost is $100,000, and the equipment is expected to generate cash flows over a five-year period. The estimated annual cash flows from the equipment are as follows:

- Year 1: $30,000

- Year 2: $35,000

- Year 3: $40,000

- Year 4: $25,000

- Year 5: $20,000

To determine the internal rate of return (IRR) for this investment, we need to calculate the discount rate at which the present value of these cash flows equals the initial investment cost.

Step 1: Calculate the Net Present Value (NPV)

Using a discount rate, let’s assume 10%, we can calculate the present value of each cash flow and then sum them up to find the net present value (NPV).

- Year 1: $30,000 / (1 + 0.10)^1 = $27,273

- Year 2: $35,000 / (1 + 0.10)^2 = $28,512

- Year 3: $40,000 / (1 + 0.10)^3 = $31,818

- Year 4: $25,000 / (1 + 0.10)^4 = $17,735

- Year 5: $20,000 / (1 + 0.10)^5 = $12,955

NPV = \sum_{t=1}^{5} \frac{CF_t}{(1 + 0.10)^t} = $117,293

Step 2: Determine IRR

Next, we need to find the discount rate (IRR) that makes the NPV equal to zero. Since the NPV at a 10% discount rate is positive ($117,293), we need to adjust the discount rate downwards to find the IRR.

Using trial and error or computational methods, we find that at a discount rate of approximately 7.8%, the NPV becomes zero. Therefore, the Internal Rate of Return (IRR) for this investment is approximately 7.8%.

Interpretation of Results

The calculated IRR of 7.8% indicates that the investment in the equipment is expected to yield a return of 7.8% annually over the five-year period. In other words, if the business owner invests $100,000 in purchasing the equipment, they can expect to earn an average annual return of 7.8% on that investment.

Since the IRR (7.8%) exceeds the cost of capital or the discount rate (10%), the investment is considered financially feasible and potentially profitable. Therefore, the business owner may proceed with the investment in the new equipment, expecting to generate positive returns over the specified time horizon.

However, it’s essential to note that the IRR is just one of many factors to consider when evaluating investment opportunities. Other factors such as risk, market conditions, and strategic alignment should also be taken into account before making a final investment decision.

In conclusion, the Internal Rate of Return (IRR) provides valuable insights into the potential profitability of an investment by calculating the discount rate that equates the present value of expected cash flows with the initial investment cost. By interpreting the IRR in conjunction with other financial metrics and qualitative factors, investors can make well-informed investment decisions aligned with their objectives and risk tolerance.