WHAT IS ENTERPRISE VALUE?

Enterprise value (EV) is a financial matrix reflecting the market value of the entire business after considering both holders of debt and equity. EV, also called firm value or total enterprise value (TEV), tells us how much a business is worth.

It is the theoretical price an acquirer might pay for another firm and is useful in comparing firms with different capital structures since the value of a firm is unaffected by its choice of capital structure. EV is one of the fundamental metrics used in business valuation, financial modelling, accounting, portfolio analysis, etc.

METHODS TO CALCULATE ENTERPRISE VALUE

Enterprise Value can be calculated using one of the following valuation methods:

- DCF Valuation

- Multiple Based Valuation/Relative Valuation

- EV Equation

DCF VALUATION

A DCF analysis yields the overall value of a business (i.e. enterprise value), including both debt and equity. The DCF method of valuation involves projecting FCF over the forecast period, calculating the terminal value at the end of that period, and discounting the projected FCFs and terminal value using the discount rate to arrive at the NPV of the total expected cash flows of the business or asset.

Steps in the Calculating EV from DCF Analysis:

- Project Free Cash Flows (FCFs)

- Choose a discount rate.

- Calculate the TV

- Calculate the enterprise value (EV) by discounting the projected UFCFs and TV to net present value.

- Calculate the equity value by subtracting net debt from EV.

Note: For detailed DCF Analysis please read https://fin-wiser.com/2020/02/05/maecenas-sit-amet-tincidunt-habitant-morbi-dolor/

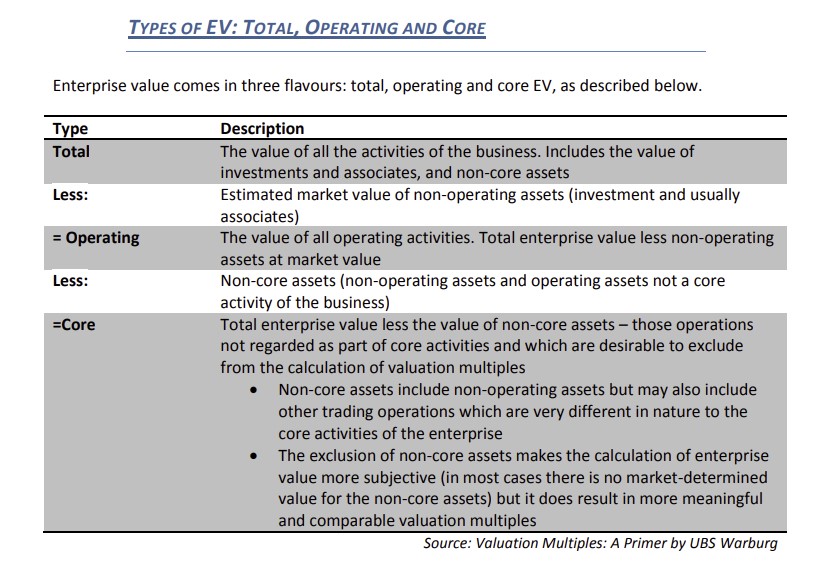

MULTIPLE BASED VALUATION/RELATIVE VALUATION

Enterprise Value can also be derived via EV based multiples. Some of the most used EV multiples are:

- EV/EBITDA: is one of the most used valuation metrics, as EBITDA is commonly used as a proxy for cash flow available to the firm.

- EV/EBIT: Unlike EBITDA, EBIT recognizes that depreciation and amortization expense. When D&A expenses are small, as in the case of a non-capital-intensive company, EV/EBIT and EV/EBITDA will be similar.

- EV/Sales: When a company has negative EBITDA, the EV/EBITDA and EV/EBIT multiples will not be material. In such cases, EV/Sales may be the most appropriate multiple to use. However, revenue is a poor metric by which to compare firms, since two firms with identical revenues may have wildly different margins.

- EV/NOPAT: NOPAT is post-tax EBIT. NOPAT is a more sophisticated and complete form of EBIT that allows for differences in tax efficiency and effective tax rates. If the company were all equity-financed, NOPLAT would equal earnings.

- EV/FCF: FCF is like operating cash flow but is calculated using actual working capital changes, capital spending and other non-cash adjustments.

Where:

EV = Enterprise Value

EBITDA = Earnings before Interest, Taxes, Depreciation and Amortization

EBIT = Earnings before Interest and Taxes

NOPAT = Net Operating Profit after Tax

FCF = Free Cash Flows (refer to https://fin-wiser.com/2020/02/05/maecenas-sit-amet-tincidunt-habitant-morbi-dolor/

One very important point to note about multiples is the connection between the numerator and denominator. Since enterprise value (EV) equals equity value plus net debt, EV multiples are calculated using denominators relevant to all stakeholders (both stock and debt holders). Therefore, the relevant denominator must be computed before interest expense, preferred dividends, and minority interest expense.

For example, an EV/Net Income multiple is meaningless because the numerator applies to equity holders and debtors, but the denominator is attributable only to equity holders.

EV EQUATION

EV equals market capitalisation plus seasonally adjusted net debt, pension provisions, the value of minorities and other provisions deemed debt.

EV = Equity Value + Net Debt + Non-controlling Interest + Preferred Stock – Investment in Associates

- Equity Value: It is calculated as the current share price multiplied by the number of diluted shares outstanding. To calculate diluted shares, you need to first find the number of basic shares and add to that number any restricted shares and net shares resulting from the exercise or conversion of options, warrants, and convertible securities to get diluted shares outstanding.

- Net Debt: Net debt is equal to total debt less cash and cash equivalents. When calculating total debt, be sure to include both the long-term debt and the current portion of long-term debt, or short-term debt. Any in-the-money (ITM) convertible debt is treated as if converted to equity and is not considered debt. When calculating cash and equivalents, you should include such balance sheet items as Available for Sale Securities and Marketable Securities, even if they are not classified as current assets on the balance sheet.

- Non-Controlling Interest: Also known as minority interest, it represents the interest of non-controlling shareholders in the net assets of a company and is reported in the shareholders’ equity section of the balance sheet.

- Preferred Stock: Preferred equity that is not convertible into common stock is treated as a financial liability equal to its liquidation value and included in net debt.

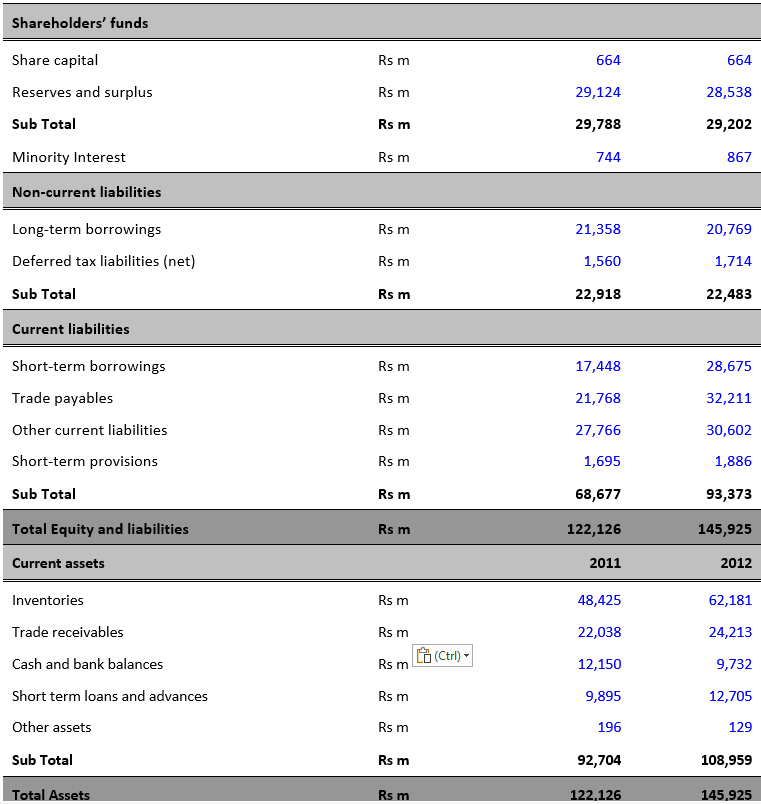

Example: From the given balance sheet, calculate the enterprise value of the company. The company has 250 million shares outstanding currently trading at Rs 200 each.

Problem Statement:

From the given balance sheet, calculate the enterprise value of the company. The company has 250 million shares outstanding currently trading at Rs 200 each.

Solution:

EV =Equity Value + Net Debt + Minority Interest + Preferred Capital – Investment in Associates

Equity Value =Shares Outstanding x Current Share Price

Equity Value = 250 x 200 = Rs 50,000 million

Net Debt = Long Term Borrowings + Short Term Borrowings – Cash and Cash Equivalents

Net Debt = 20,769 + 28,675 – 9,732 = Rs 39,712 million

So, what is the EV?

EV= 50,000 + 39,712 + 867 + 0 + 0 = Rs 90,579 million

EQUITY VALUE VS ENTERPRISE VALUE

WHAT IS EQUITY VALUE?

Equity Value is another term for Market Capitalization. It is calculated as the current share price multiplied by the number of diluted shares outstanding. To calculate diluted shares, you need to first find the number of basic shares and add to that number any restricted shares and net shares resulting from the exercise or conversion of options, warrants, and convertible securities to get diluted shares outstanding.

Equity Value = Current Share Price x No. of Diluted Shares Outstanding

For example, if a company’s stock is currently trading at $100 per share and there are total 5 million shares outstanding, then equity value or market capitalisation of the company is $500 million ($100 per share x 5 million shares = $500 million).

EQUITY VALUE VERSUS ENTERPRISE VALUE

Enterprise value multiples | Equity multiples |

Allow the user to focus on statistics where accounting policy differences can be minimized (EBITDA, OpFCF) | More relevant to equity valuation |

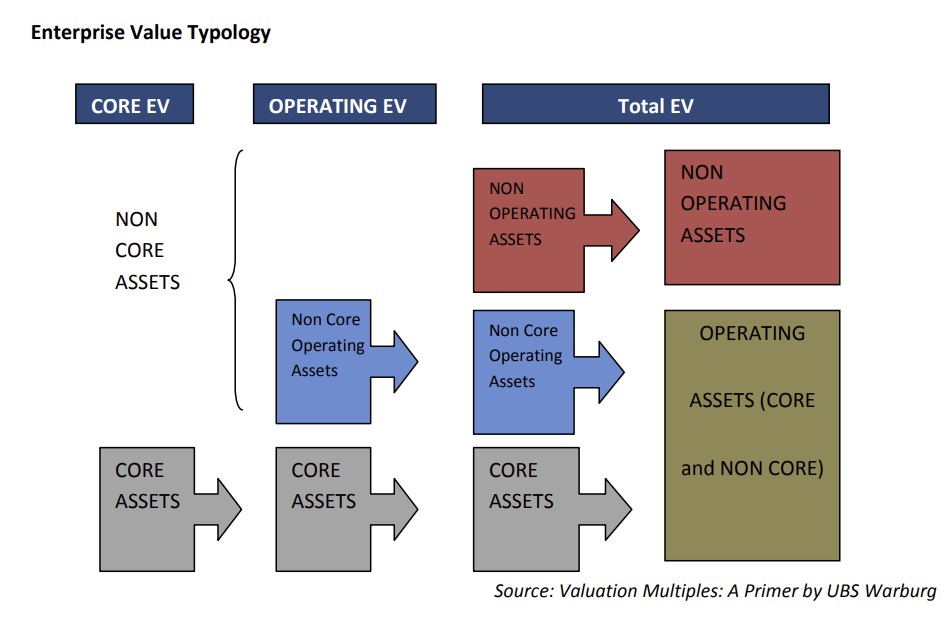

Avoid the influence of capital structure on equity value multiples | More reliable (estimating enterprise value involves more subjectivity, especially in the valuation of non-core assets) |

More comprehensive (apply to the entire enterprise) | More familiar to investors |

Wider range of multiples possible |

|

Easier to apply to cash flow |

|

Enables the user to exclude non-core assets |

|