Building an Operations and Maintenance (O&M) financial model for bidding on a Facility Management contract involves analyzing various costs and revenue streams associated with providing both soft and hard services. Here’s a step-by-step guide on how to build such a financial model:

- Define Scope of Services:

Clearly define the scope of services to be provided under the Facility Management contract. This includes both soft services (e.g., janitorial, landscaping, security) and hard services (e.g., maintenance of HVAC systems, electrical systems, plumbing).

2. Identify Cost Categories:

Break down the costs into different categories such as labor, materials, subcontractors, equipment, overheads, and administrative expenses. Allocate costs to each service category based on the anticipated requirements.

3. Estimate Direct Costs:

Estimate the direct costs associated with delivering each service. For example, calculate labor costs based on the number of personnel required, their salaries, benefits, and productivity levels. Estimate material costs based on historical usage or market prices.

4. Estimate Indirect Costs:

Factor in indirect costs such as overheads, administrative expenses, insurance, and other overhead costs associated with managing the facility. Allocate these costs proportionally to each service category based on their usage or as a percentage of total costs.

5. Consider Capital Expenditures:

Include any capital expenditures required for purchasing equipment, tools, or technology necessary to deliver the services effectively. Amortize these costs over their useful life and include them as part of the ongoing operational expenses.

6. Forecast Revenue Streams:

Estimate the revenue streams associated with the Facility Management contract. This may include recurring fees charged to the client for each service provided, as well as any additional revenue from upselling or cross-selling complementary services.

7. Consider Contractual Terms:

Take into account the contractual terms of the Facility Management contract, including the duration of the contract, pricing structure, payment terms, and any penalties or incentives tied to performance metrics such as service level agreements (SLAs).

8. Discounted Cash Flow Analysis:

Use discounted cash flow (DCF) analysis to calculate the net present value (NPV) of future cash flows associated with the contract. Discount future cash flows to their present value using an appropriate discount rate, taking into account the time value of money.

9. Sensitivity Analysis:

Conduct sensitivity analysis to assess the impact of variations in key parameters (e.g., labor costs, material prices, client retention rates) on the financial viability of the contract. Identify which factors are most sensitive to changes and develop contingency plans to mitigate risks.

10. Documentation and Presentation:

Document the assumptions, methodologies, and data sources used in the financial model. Present the findings in a clear and professional manner, highlighting key financial metrics such as NPV, internal rate of return (IRR), and payback period to demonstrate the attractiveness of the contract.

By building a comprehensive O&M financial model, companies can make informed decisions when bidding for Facility Management contracts, ensuring that their pricing is competitive while also maintaining profitability and managing risks effectively.

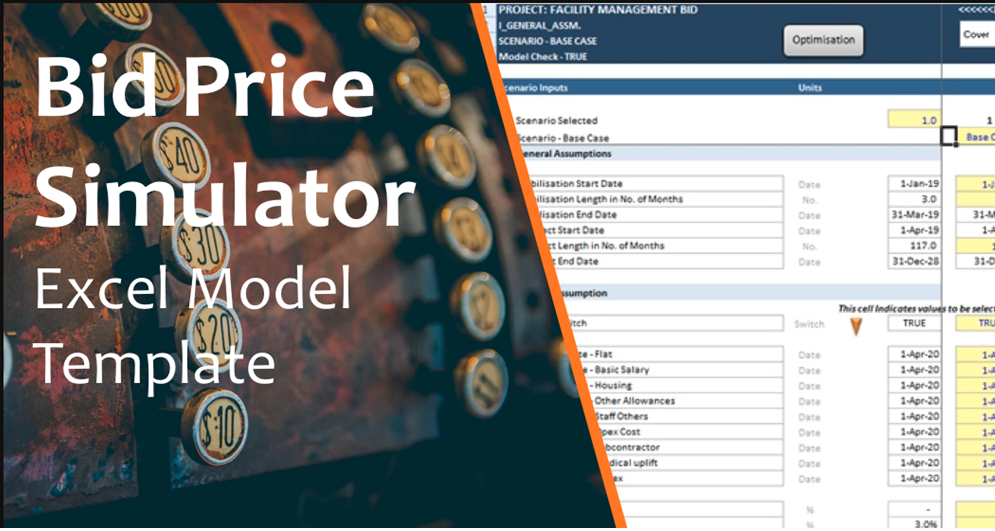

Download our ready-to-use operations and maintenance bid model by clicking on the image above. Example:

Let’s create a simplified example of an Operations and Maintenance (O&M) financial model for bidding on a Facility Management contract. We’ll include both soft and hard services.

For this example, let’s consider a commercial office building.

Assumptions:

- Soft Services: Cleaning services, security services, landscaping, pest control, waste management, etc.

- Hard Services: HVAC maintenance, electrical maintenance, plumbing repairs, elevator maintenance, fire safety systems maintenance, etc.

- Contract Duration: 3 years

Steps to Build the Financial Model:

Category | Service | Monthly Cost ($) | Yearly Cost ($) | Total Contract Value ($) |

Soft Services | Cleaning | $5,000 | $60,000 | |

Security | $3,000 | $36,000 | ||

Landscaping | $1,500 | $18,000 | ||

Pest Control | $500 | $6,000 | ||

Waste Management | $1,000 | $12,000 | ||

Hard Services | HVAC Maintenance | $2,000 | $24,000 | |

Electrical Maint. | $1,500 | $18,000 | ||

Plumbing Repairs | $1,000 | $12,000 | ||

Elevator Maint. | $1,200 | $14,400 | ||

Fire Safety Maint. | $800 | $9,600 | ||

Total | $17,500 | $210,000 | $630,000 |

Calculate Monthly Costs:

Total Monthly Soft Services Cost: Sum of all soft services costs

Total Monthly Hard Services Cost: Sum of all hard services costs

Estimate Yearly Costs:

Multiply monthly costs by 12 to get yearly costs for both soft and hard services.

Determine Total Contract Value:

Total Contract Value = (Yearly Soft Services Cost + Yearly Hard Services Cost) * Contract Duration

Sensitivity Analysis:

Perform sensitivity analysis on key variables such as discount rate, inflation rate, or any variable costs that may change over time.

Considerations:

- Inflation: You may need to account for inflation in your cost projections, especially for multi-year contracts.

- Contingency: It’s wise to include a contingency amount to cover unforeseen expenses.

- Profit Margin: Ensure that your bid includes a reasonable profit margin to cover overheads and generate profits.

- This is a simplified example. Real-world financial models may involve more complex calculations and considerations. Always validate your assumptions and inputs before making bidding decisions.