Engineering and Construction – Discounted Cash Flow (DCF) Valuation Model

$120.00

Description

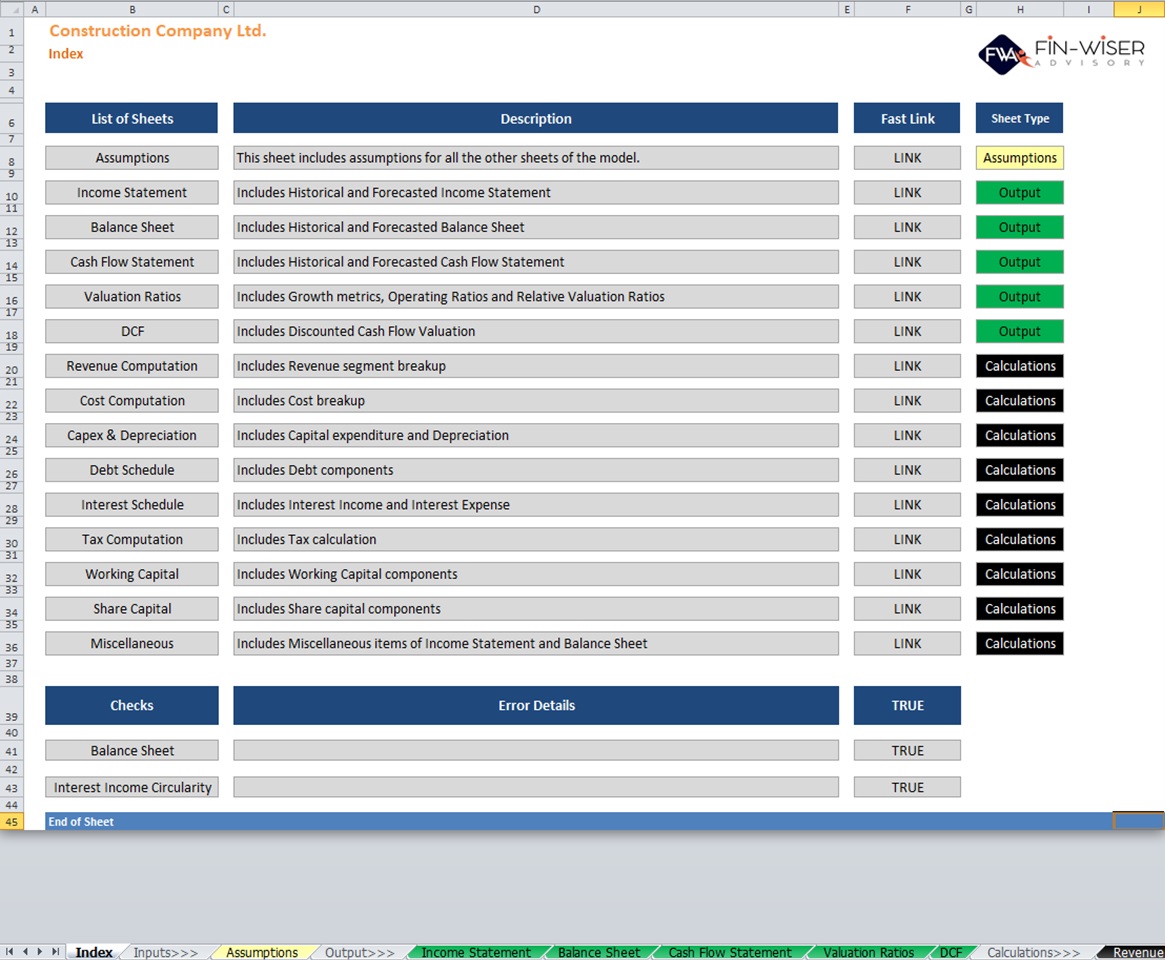

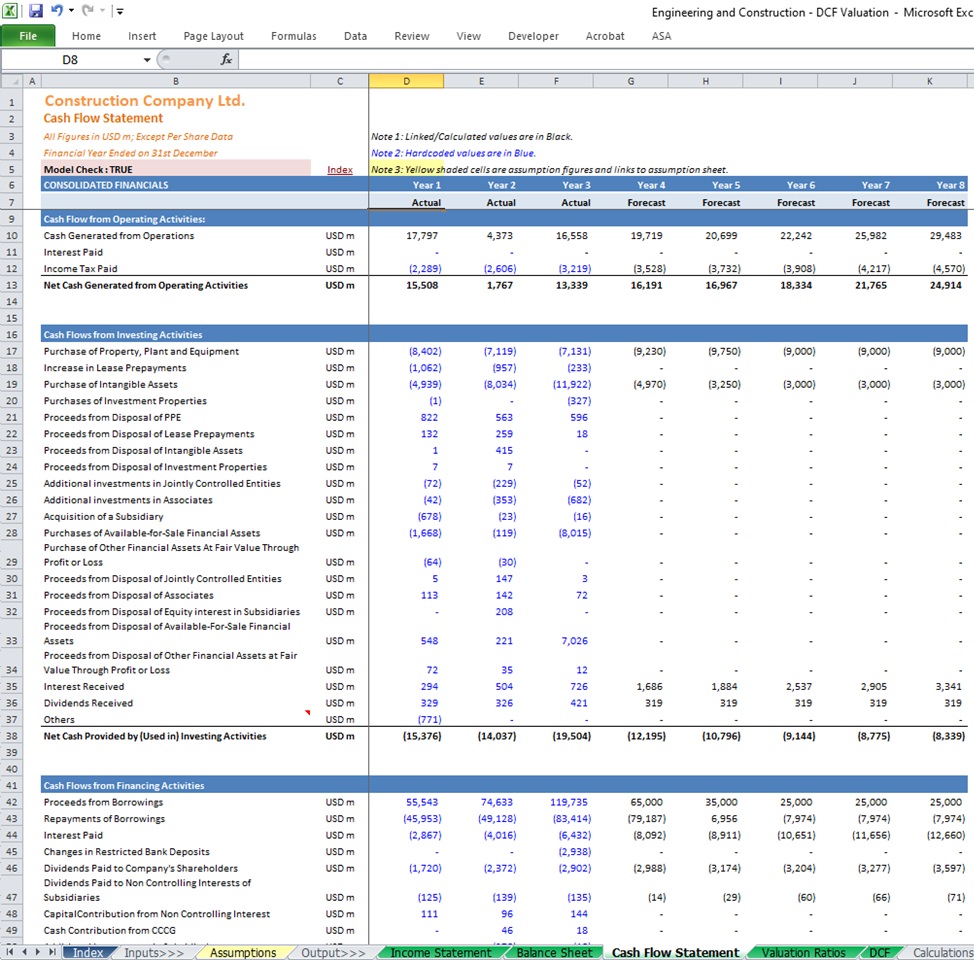

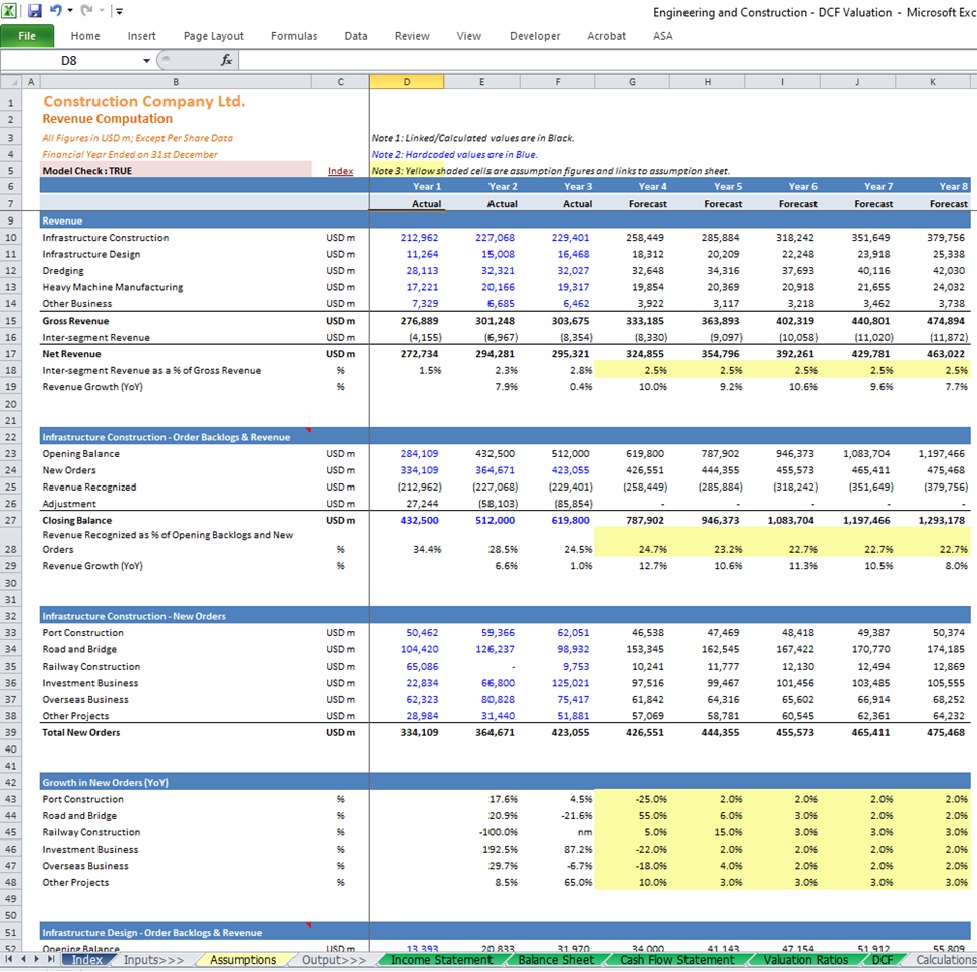

This is a detailed and user-friend financial model for an Engineering and Construction (EPC) Company with three financial statements, i.e., Income Statement, Balance Sheet, and Cash Flow Statement, and detailed calculations around DCF-based valuation and financial analysis.

The model captures 3 years of Historical + 5 Years of the forecast period. Valuation is based on the 5-year forecast using Discounted Cash Flow methodology and Comparable Company Analysis (Relative valuation).

The assumption sheet allows you to input various financial data for your business. These inputs cover a wide range of financial data:

- Revenue Assumption (Order Intake, Order Conversion, and Backlog)

- Costs Assumptions (Raw Material, Subcontracting Cost & More)

- Income tax

- Working Capital Assumptions (Receivables, Payable, Inventory)

- Capital Expenditure and Depreciation/Amortization (Tangle and Intangible Assets)

- Long-Term and Short-Term Debt

- Share Capital (Issue of New shares, Reserve Accounts)

- Dividend Calculation (Interim and Final Dividend along with Tax impact)

- Interest Income and Expense calculations

The model runs comprehensive calculations based on the inputs provided by the user to generate very accurate outputs, which include:

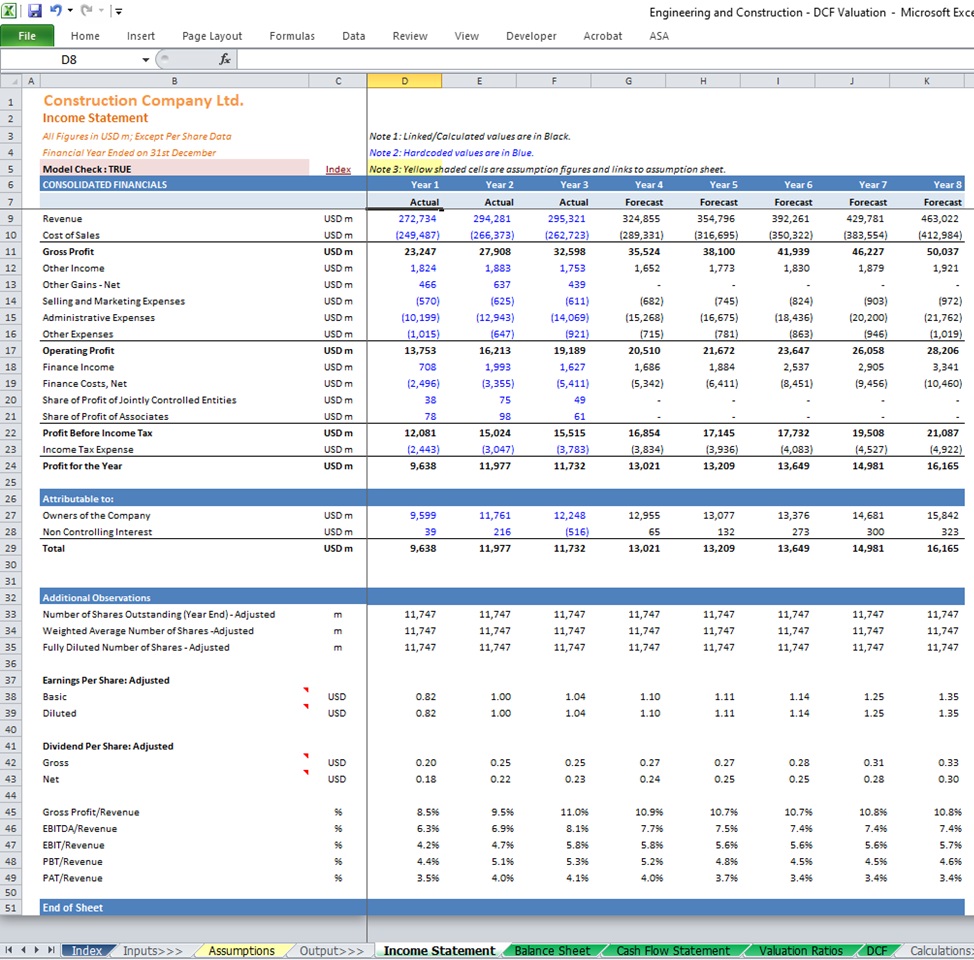

- Income Statement: Includes Historical and Forecasted Profit and Loss statement

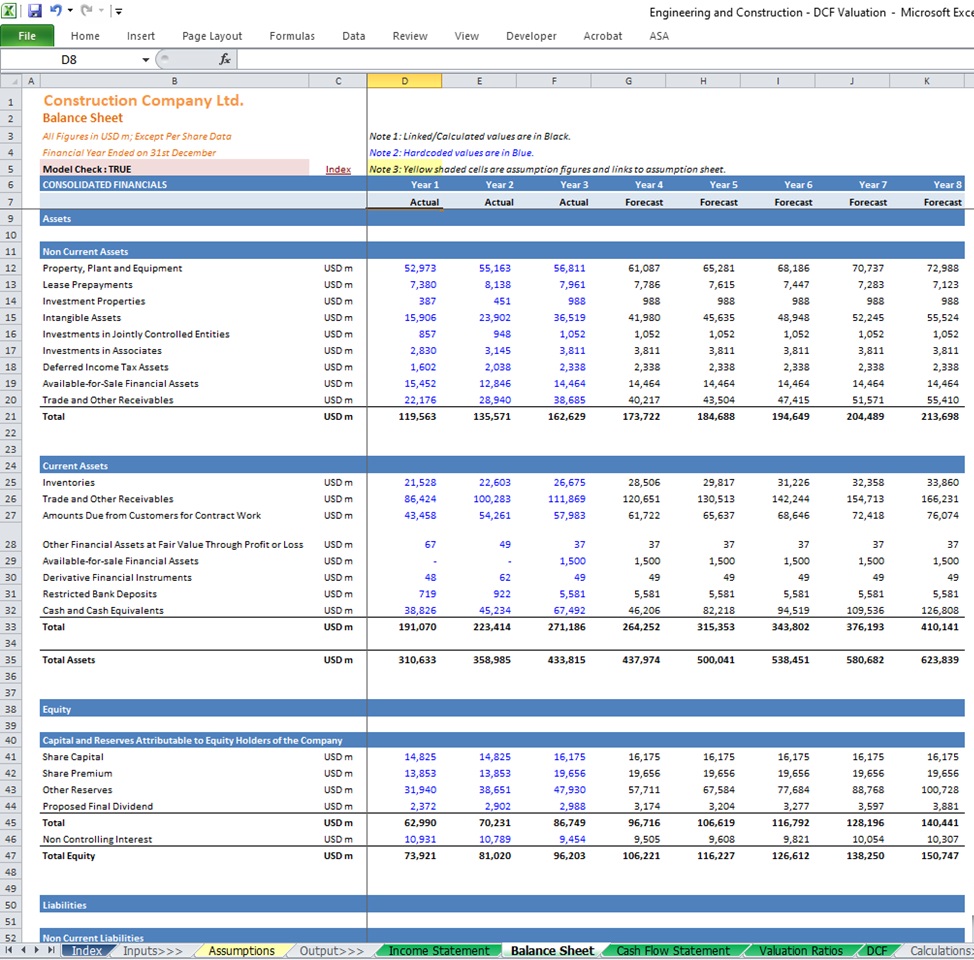

- Balance Sheet: Includes Historical and Forecasted Balance sheet

- Cash Flow Statement: Includes Historical and Forecasted cash flows

- Valuation: DCF-based valuation is based on the Forecasted cash flows and discount rate assumptions

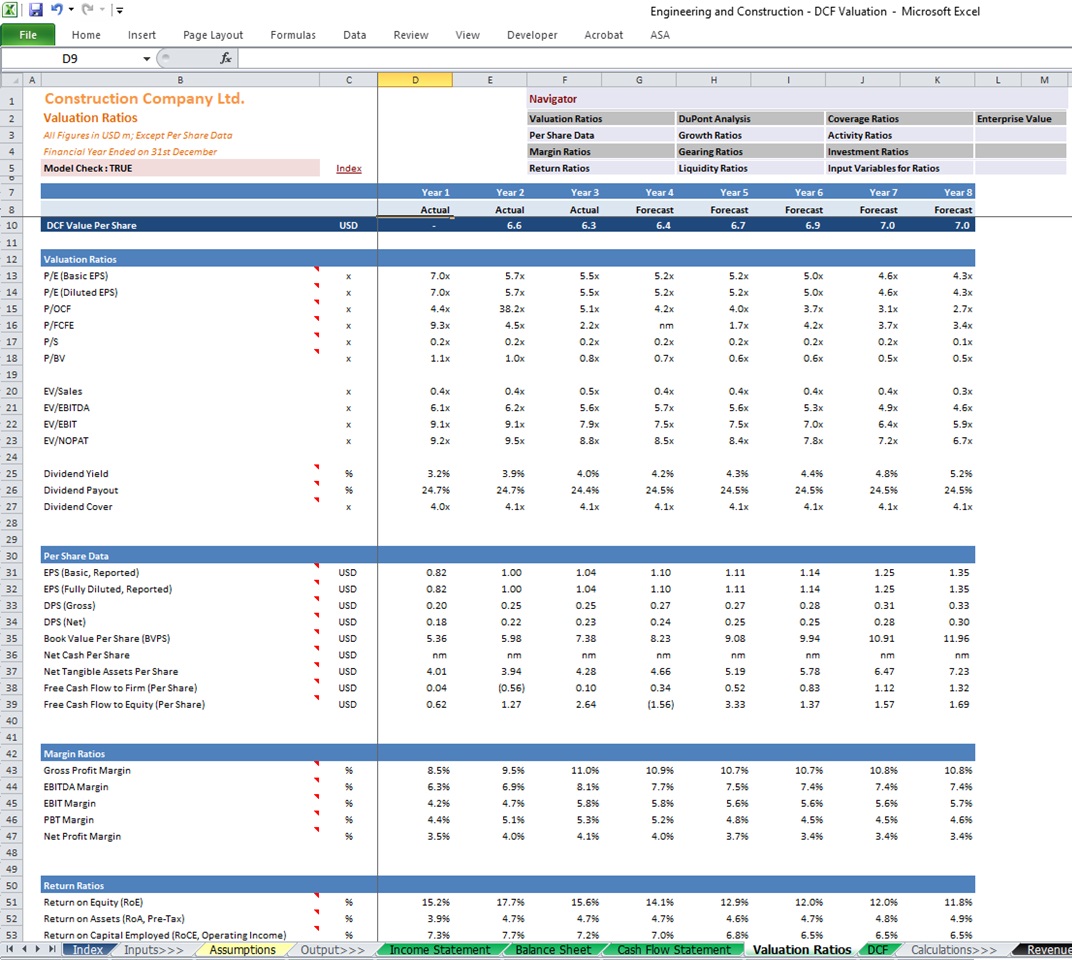

- Valuation Ratio: A very detailed financial analysis covering:– Price and EV-based valuation ratios

– Per Share Data like EPS, DPS, FCFF per share & more

– Margin ratios

– Return ratios

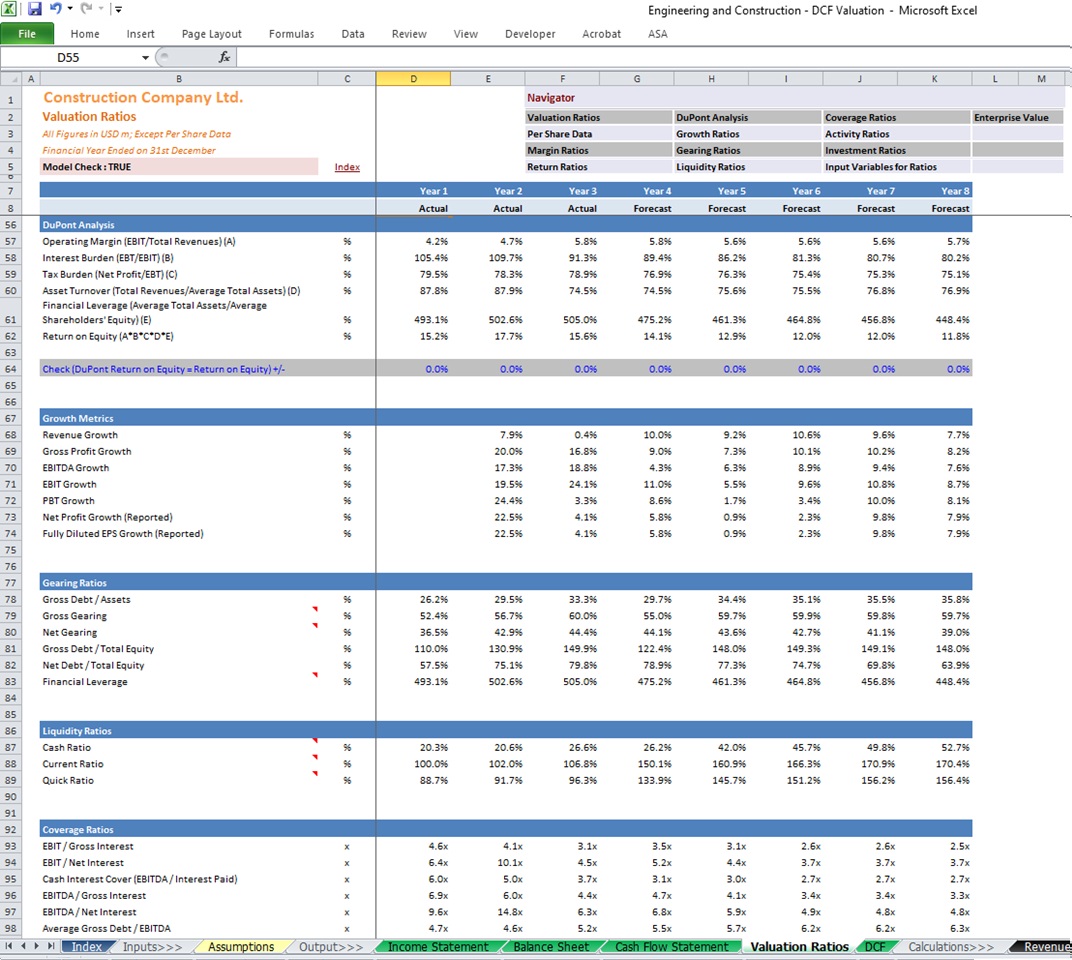

– Dupont Analysis

– Gearing Ratios

– Liquidity ratios

– Coverage Ratios

– Activity Ratios

– Investment rations

– Enterprise value