Wind Farm – 3 Statements Financial Model with Flexible Timeline, NPV, IRR, Debt Covenants and Cash Waterfall

$149.00

Categories: Best Selling, Featured Products, Financial Model, Project Finance & PPP Models, Renewable Energy

Tags: Accounting Accounts Payable Accounts Receivable Business Valuation Cash Flow Analysis Cash Flow Projections CFO Cost Projections Dashboard Debt Amortization Debt Schedule Debt Service Coverage Discount Rate Dividends excel Financial Debt Financial Feasibility financial model financial modeling Financial Planning Financial Projections Financial Reporting financial statements Financing Forecast Forecasting Fundraising Inventory Investment Multiple Investor Cash Flows Investors IRR (Internal Rate of Return) KPIs (Key Performance Indicators) Macros NPV (Net Present Value) Offshore Wind Payback Period Private Equity Profitability Analysis Revenue Projections ROI Tariff Calculator Uses and Sources of Funds valuation Venture Capital WACC (Weighted Average Cost of Capital) wind Wind Development Wind Farm

Description

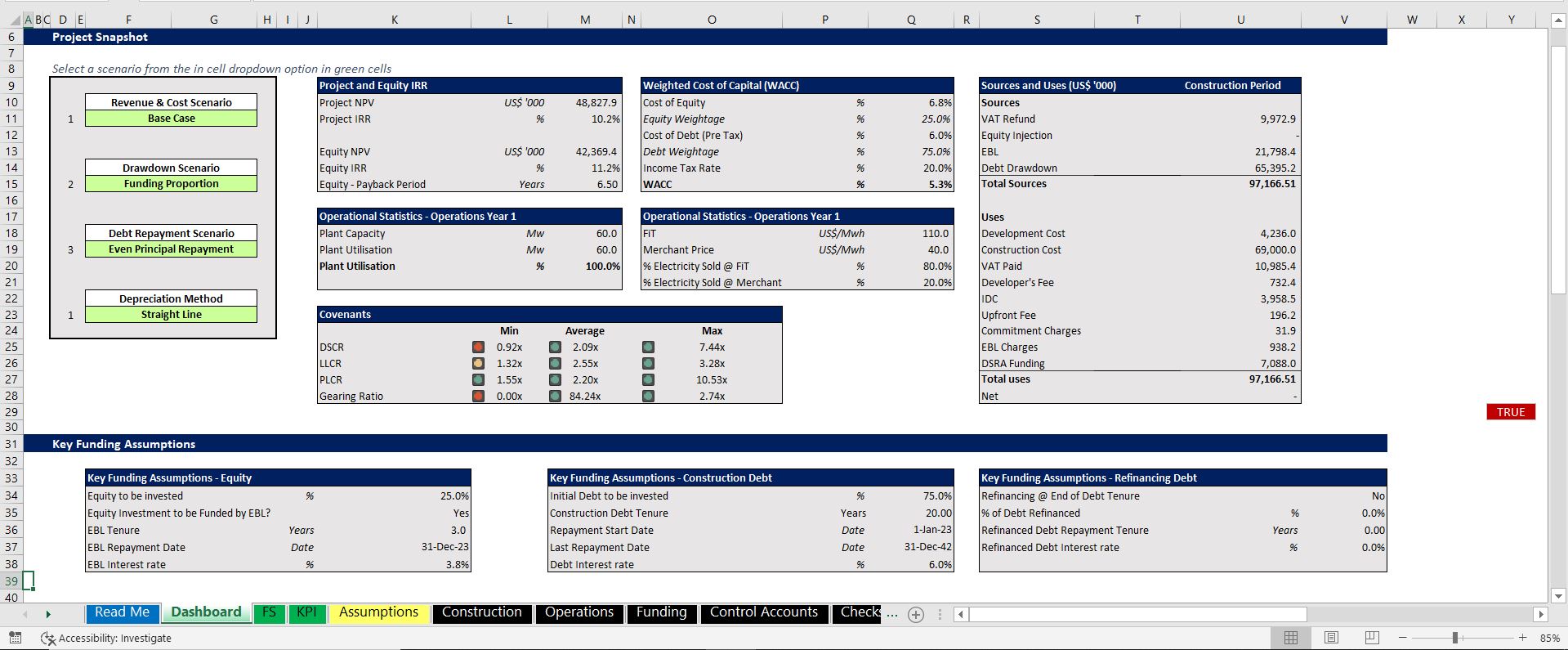

The Wind Farm PPP model helps the user to assess the financial viability of a wind farm concession by capturing all the essential inputs related to construction, operation, and financing.

The Model includes assumptions related to:

- Development cost, Construction costs, and Developer’s Fee

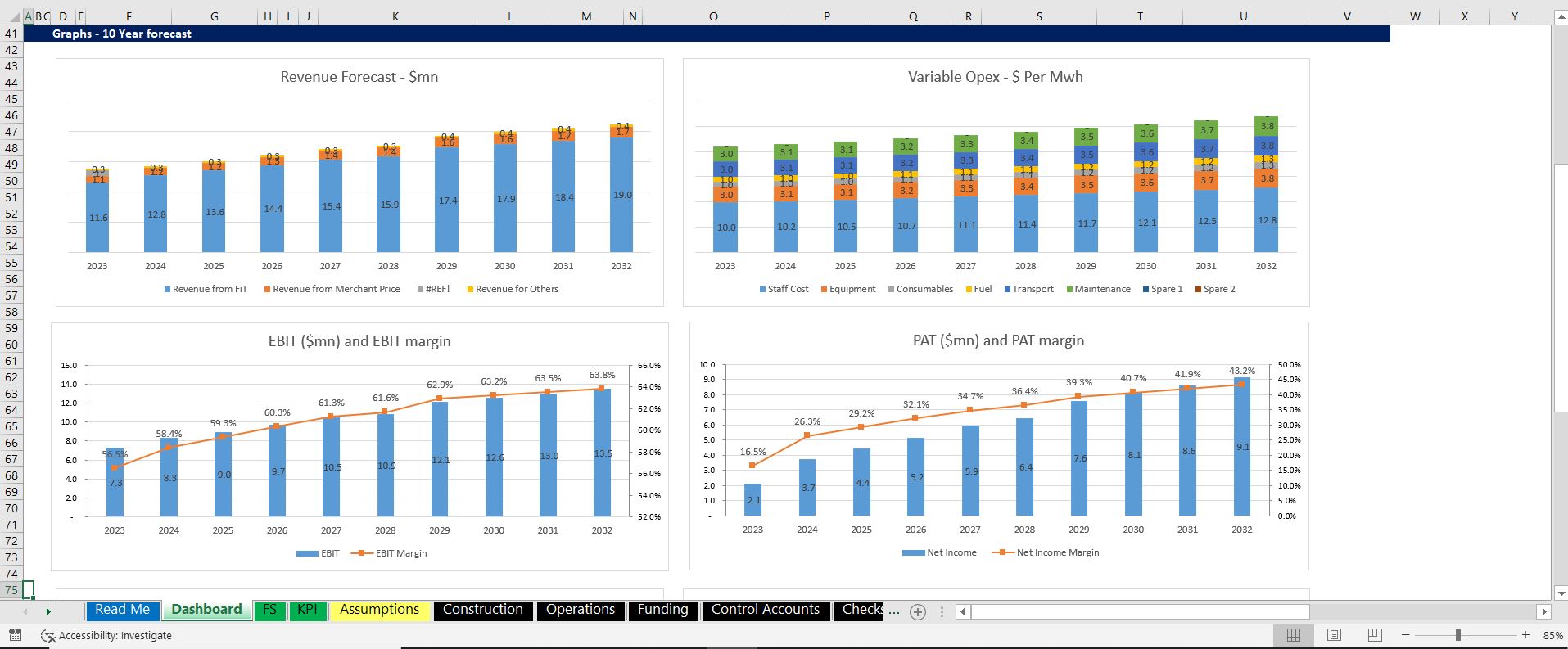

- Plant Capacity and utilization, Capacity Factor (P50 or P90), Electricity Produced

- Feed In Tariff, Merchant Price, and other sources of revenue

- Variable O&M cost per tonne (divided into 8 sub heads such as staff, electricity, consumables, transport, and fuel) and other fixed costs (SPV, insurance, land lease, community payment, management fee & more)

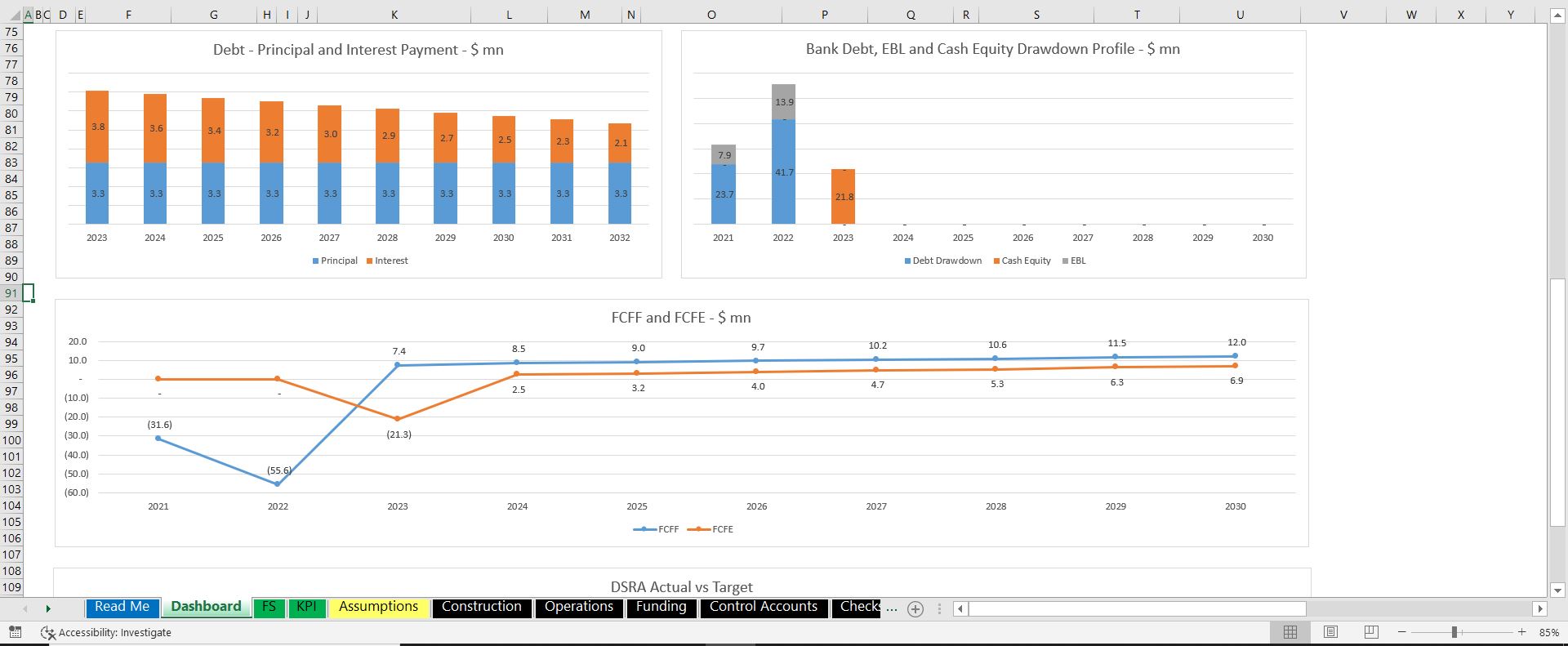

- Flexible Funding Profile – Cash equity, Bridge Loan, Bank Debt, DSRA, and Bank overdraft

- Working Capital Assumptions related to accounts receivables and payables

- Straight Line and Accelerated Depreciation option

- Annuity, Sculpted Debt, and Even Principal Repayment options

- Inflation and Indexation

- VAT during the construction and operations phase

- Decommissioning cost and reserve, if required

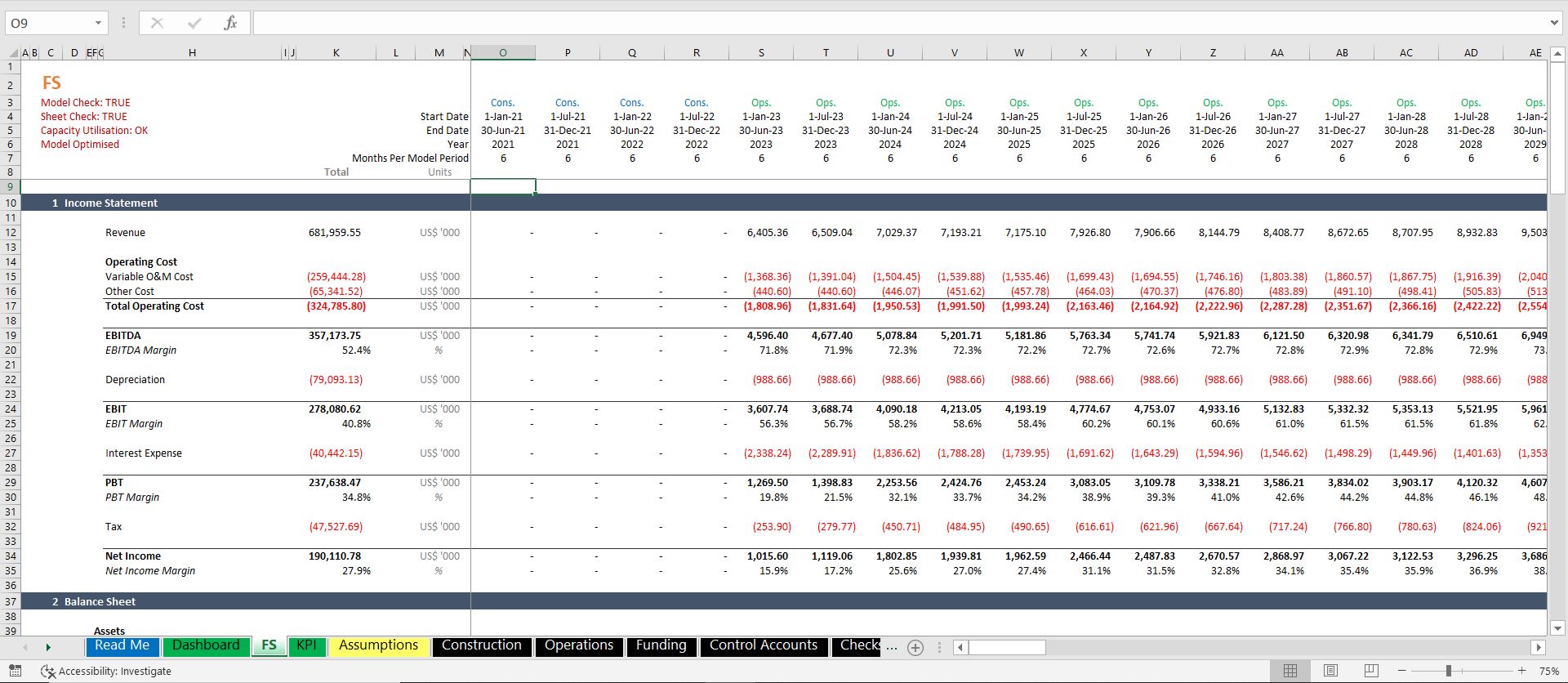

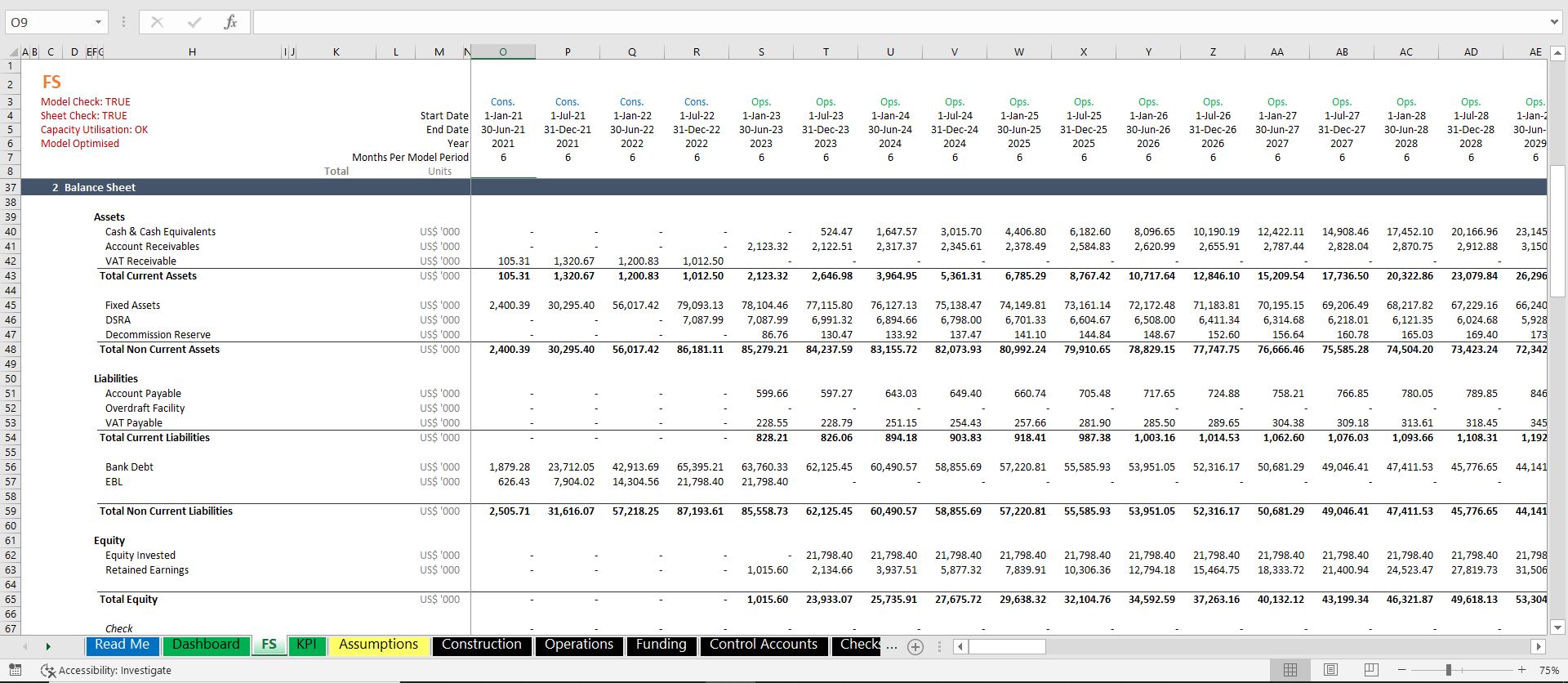

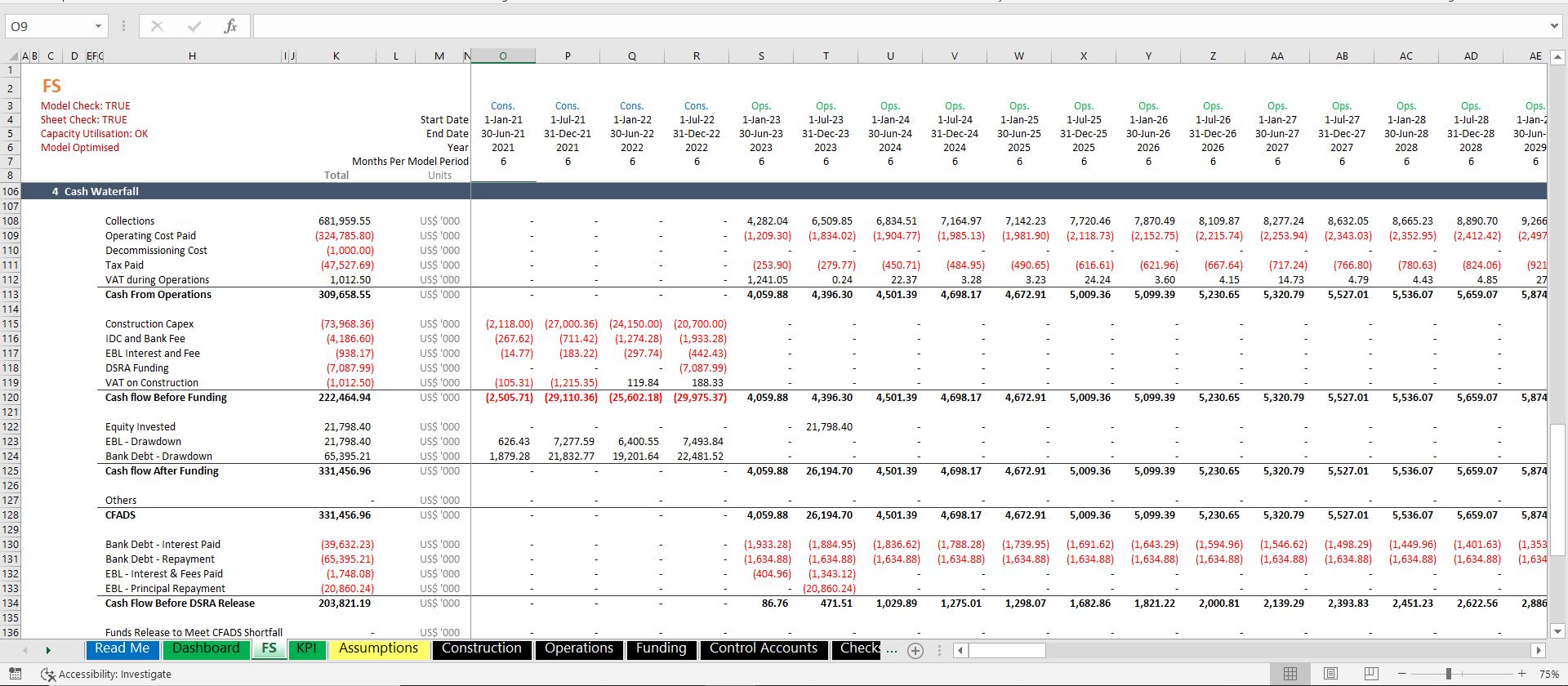

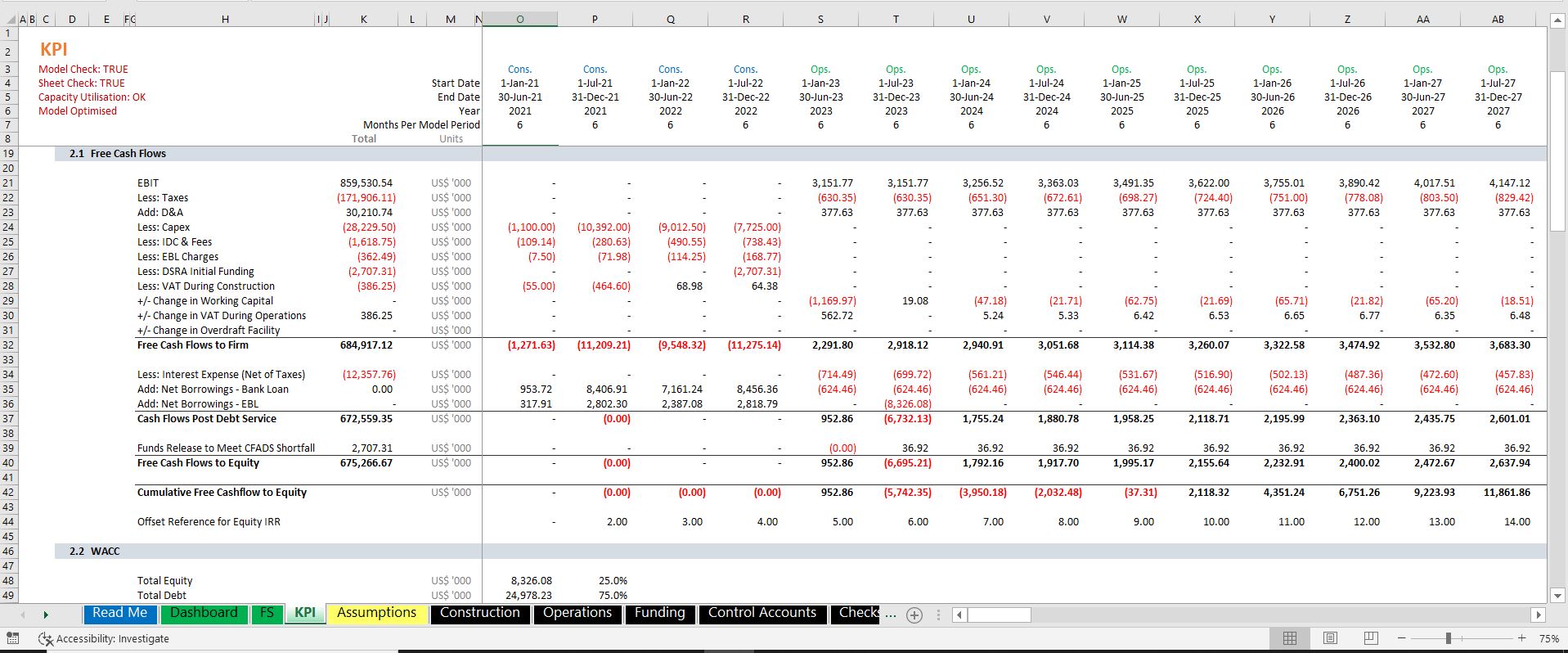

Model Output includes:

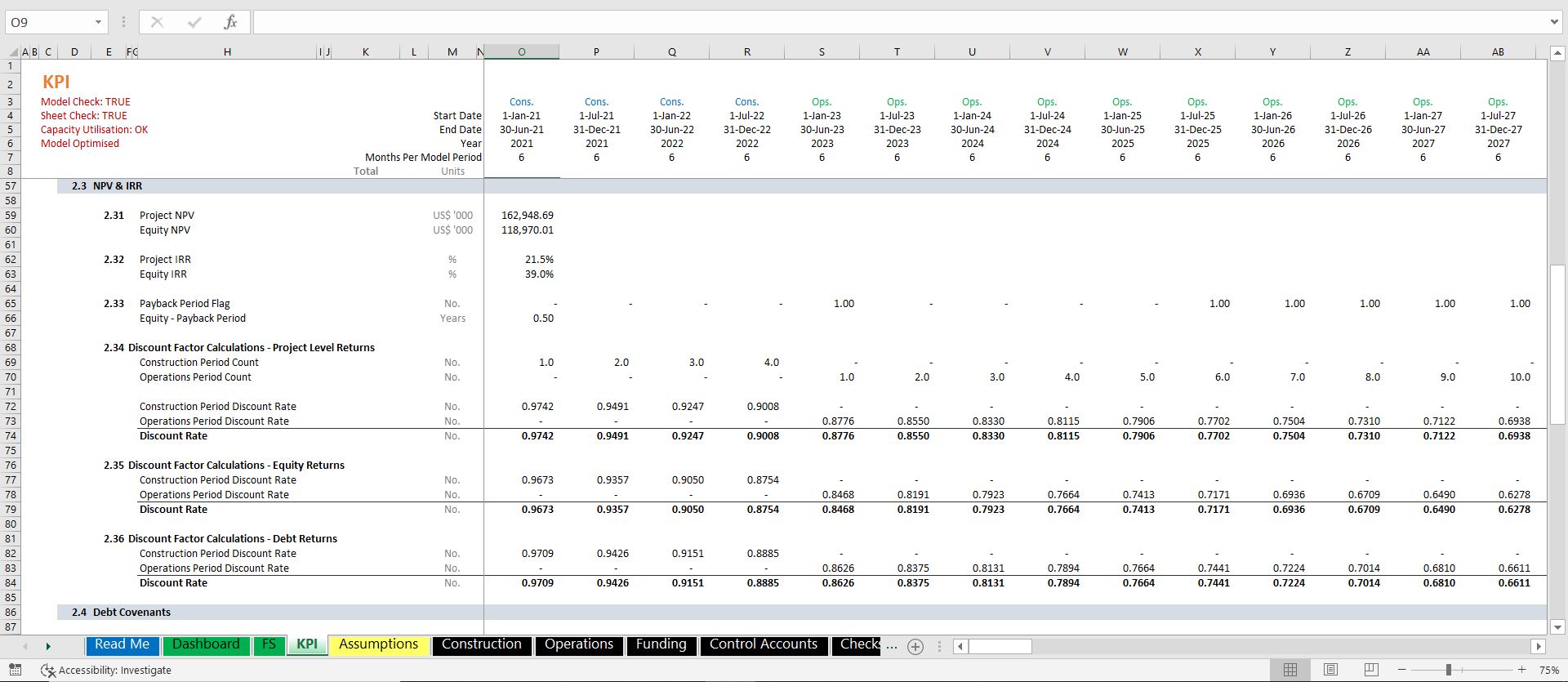

- Project IRR & NPV

- Equity IRR & NPV

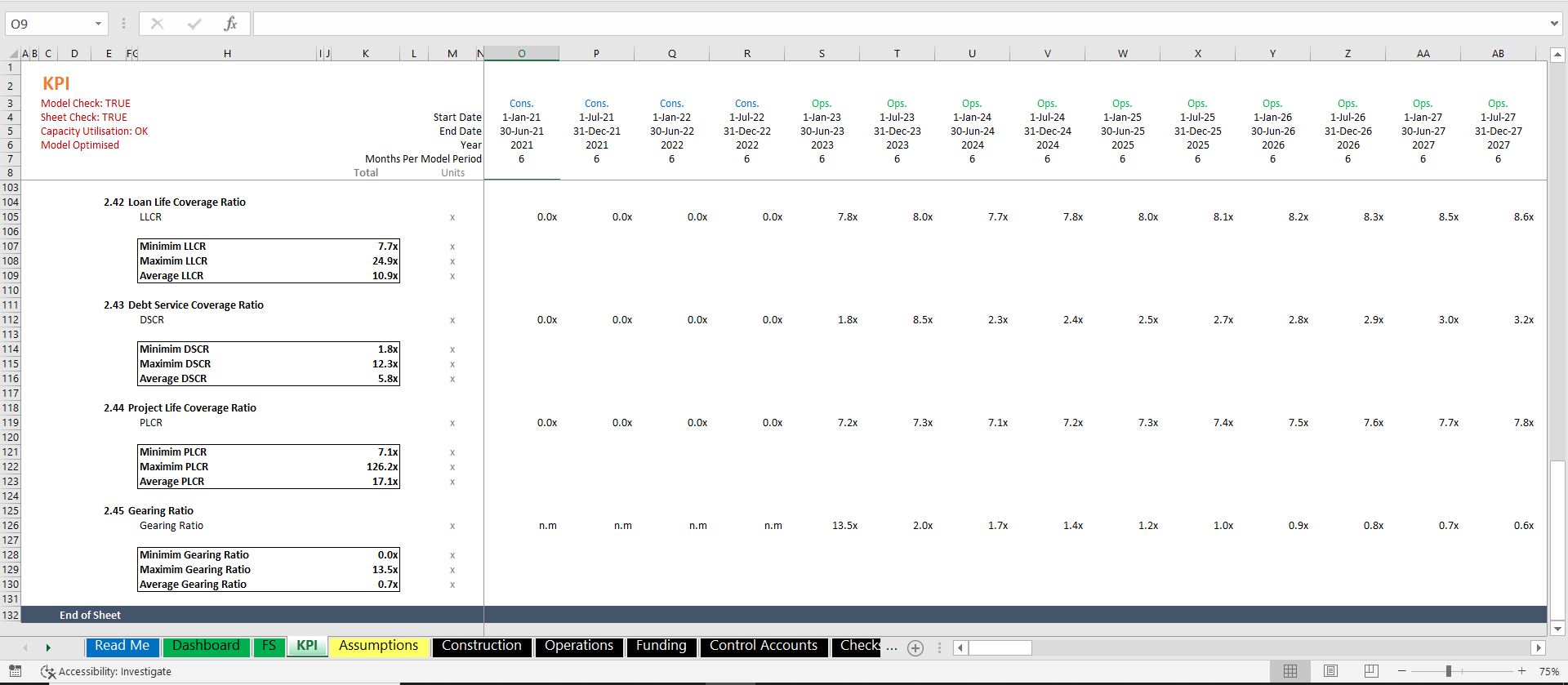

- Minimum and Average DSCR

- LLCR and PLCR

- Equity Payback Period

- Cash Waterfall

- Debt Service Profile

- Integrated Financial Statements

- Fully Integrated Dashboard

Technical Specifications:

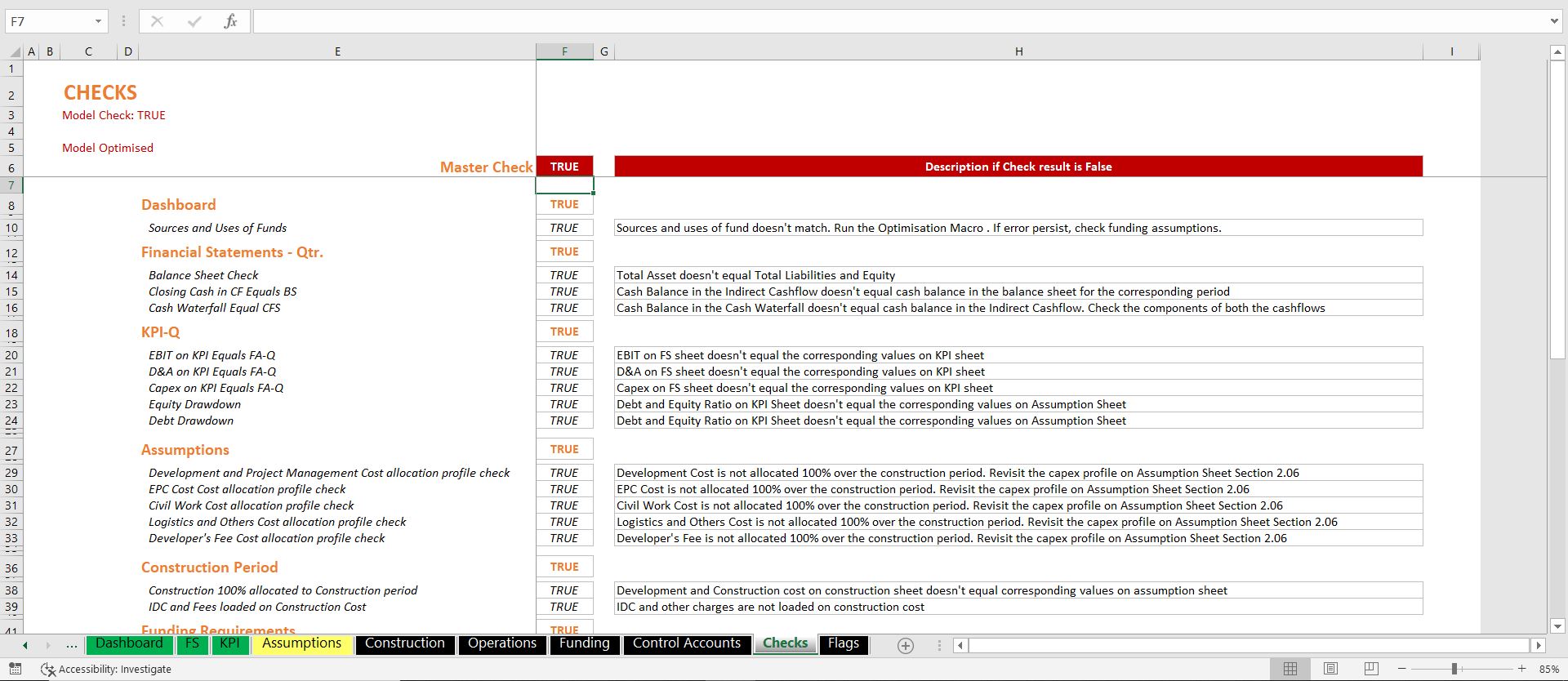

- The model uses Macros (VBA) especially to consider the interest during the construction phase in the Uses of Funds Table. To run the model optimally, keep macros enabled. In case you do not like Macros, you could manually disable or remove the Macros and will have to rework the model’s logic to be used without Macros but it is not recommended by the author.

- The Model is built using Microsoft Excel 2019 version for Windows. Please note, on certain Mac laptops or MS Excel prior to 2007, Excel with Macros can slow down your computer if your PC does not have enough processing power.

- We advise you not to delete or insert rows and columns into the model if you are not aware of the model structure as it can distort model functioning. If you need assistance with customizing the model template, the author is more than willing to help you. Simply contact us at pushkarkumar@fin-wiser.com and send your model template as well as specifications. We will then get back to you with a quotation for the customization service (billable hours & completion date).

- The Model uses Cell Styles