Real Estate – Lease or Sell Quarterly Excel Model with 3 Statements, valuation and Development & Operations Phase

$149.00

Description

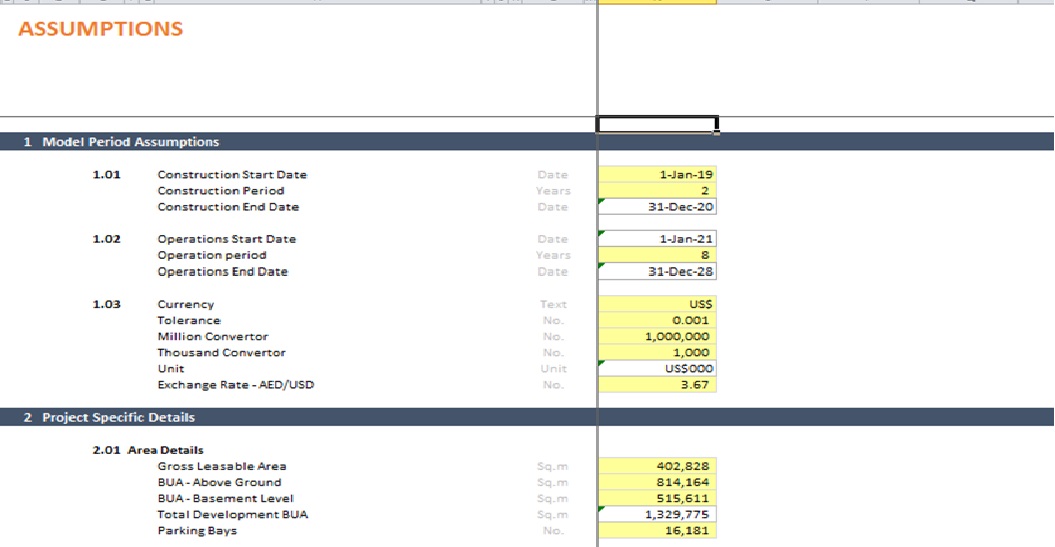

This Real Estate – Lease or Sell Model is a perfect tool for a financial feasibility study on developing a commercial property. The model can be used by developers to create projections during the construction phase.

The user can incorporate the following scenarios:

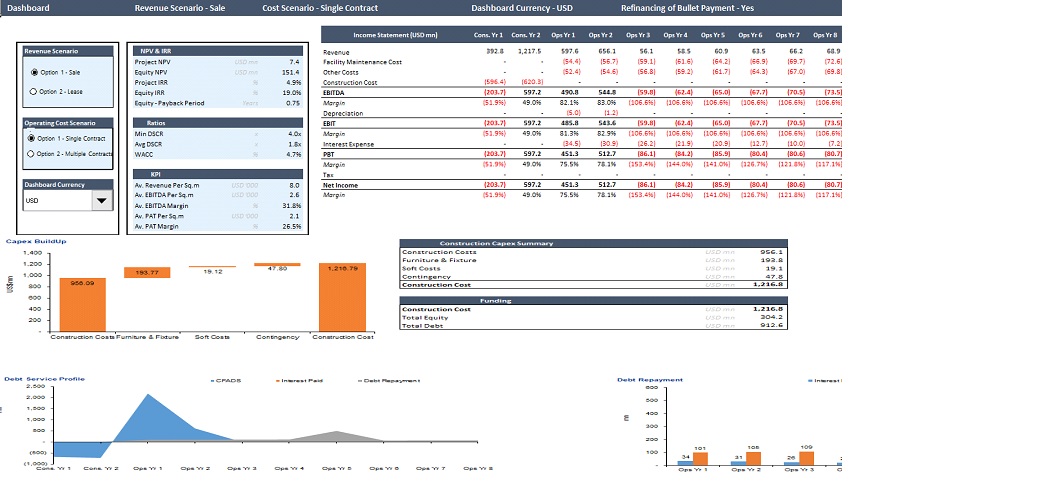

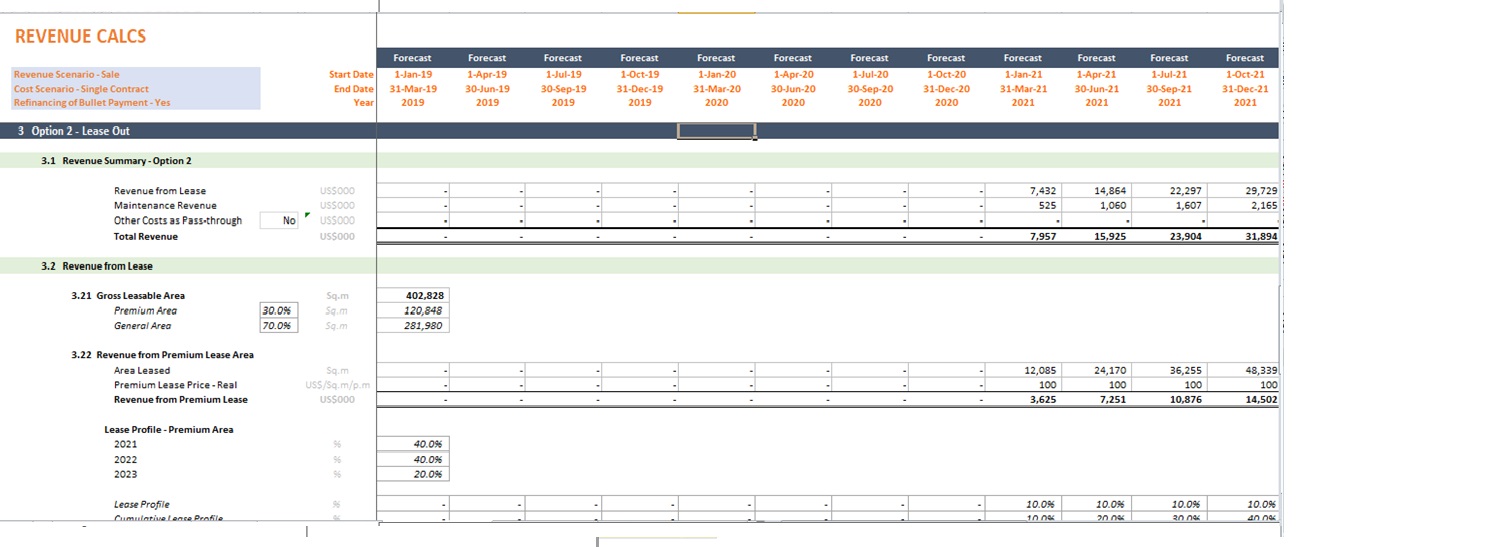

1. For Revenue calculation, Gross Developed Area is assumed to be Leased or Sold. Users can switch between the scenarios from Dashboard Sheet and correspondingly see its impact on the Financials and Key KPIs.

2. For Cost calculation, a maintenance contract for Gross Developed Area can be assumed to be given to a single contractor with a bucket rate or specialized service providers to control cost. Users can switch between the scenarios from Dashboard Sheet and correspondingly see its impact on the Financials and Key KPIs.

The Model includes assumptions related to:

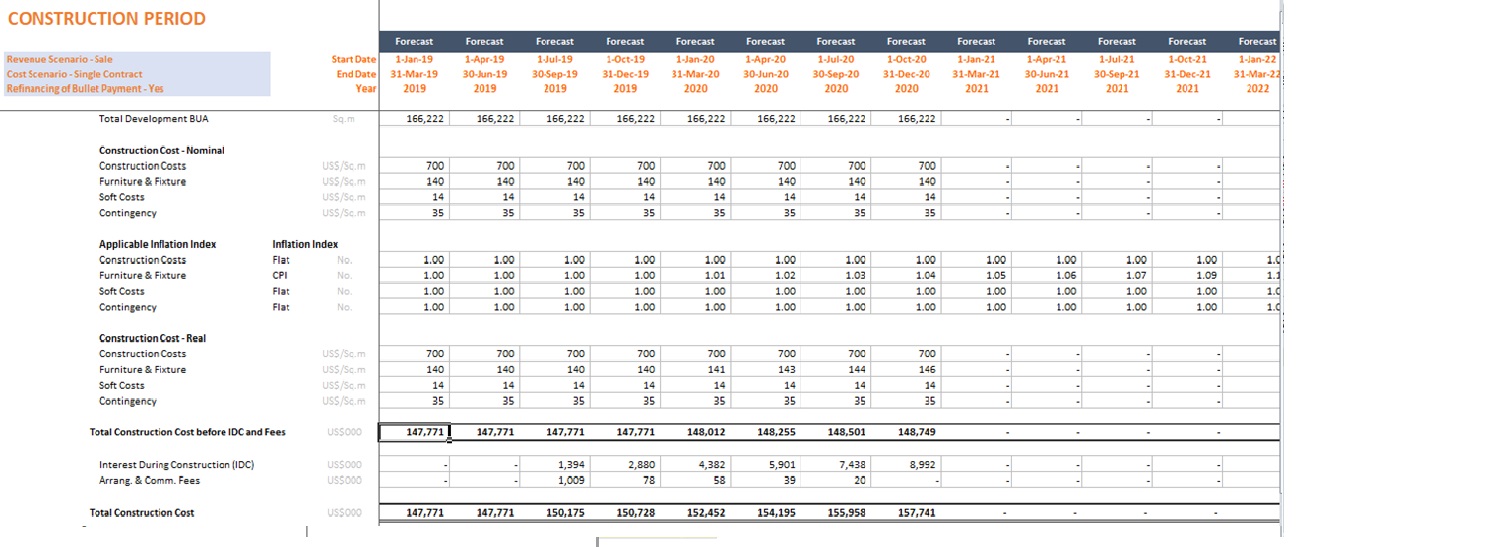

1. Construction Period Cost

2. Revenue is assumed from either the lease or sale option. Assumptions for revenue include Sales Price, Maintenance revenue, Lease revenue (divided into premium and general area with different lease rates), lease term, lease rate escalation % & more.

3. Operating costs can be assumed either from a Single Facility management contract (for all the services) or Specialized service contracts to different contractors. Both scenarios include the option to add Fixed cost as well.

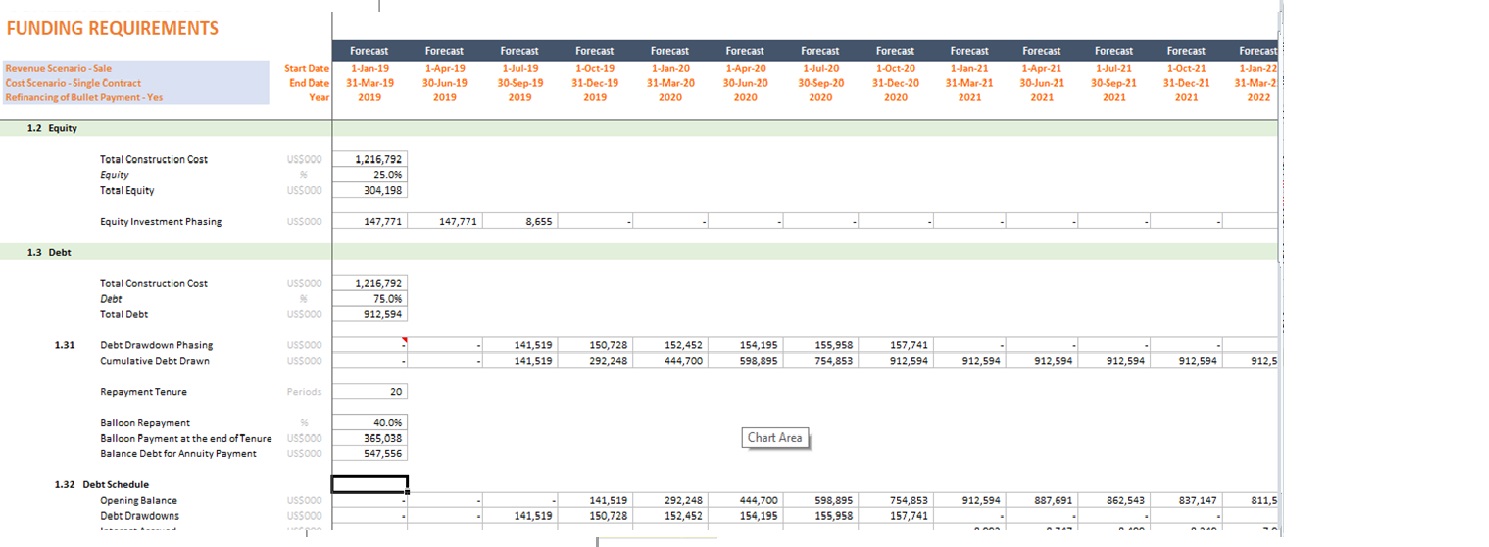

4. Flexible Funding Profile – Cash equity, Bank Debt, and Bank overdraft

5. Working Capital Assumptions related to accounts receivables and payables

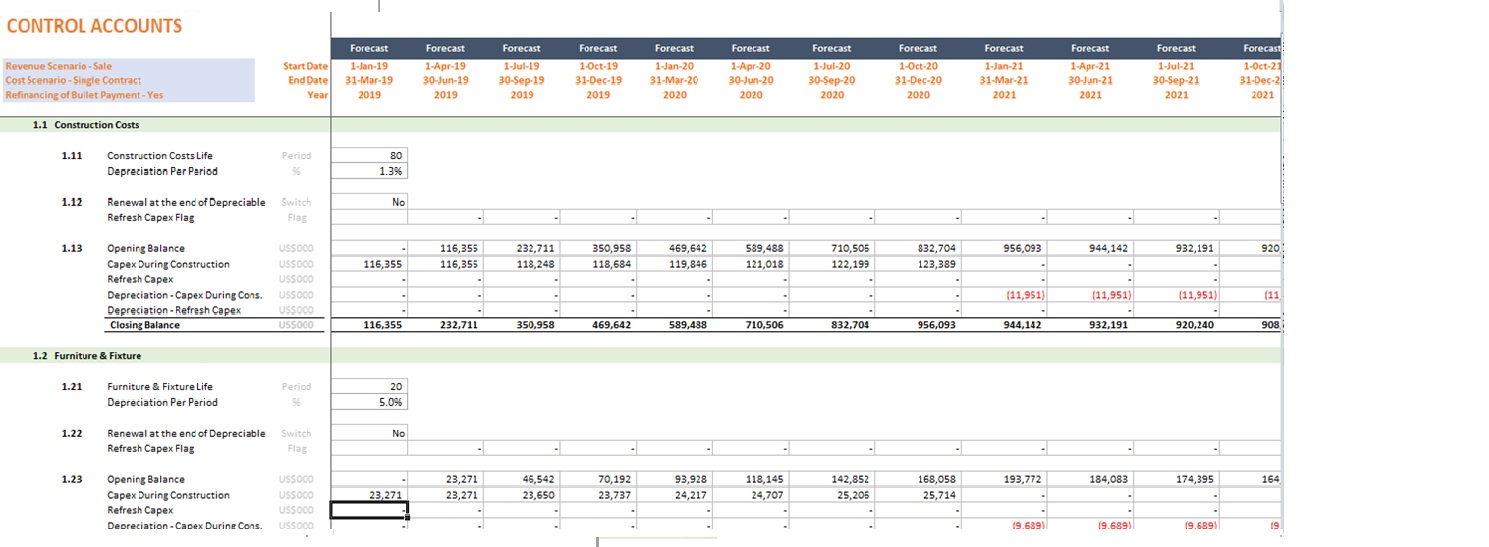

6. Straight Line Depreciation with the option to renew the asset at the end of its useful economic life.

7. Inflation and Indexation

8. Tax Assumptions with tax loss utilization option

Model Output includes:

1. Project IRR & NPV

2. Equity IRR & NPV

3. Equity Payback Period

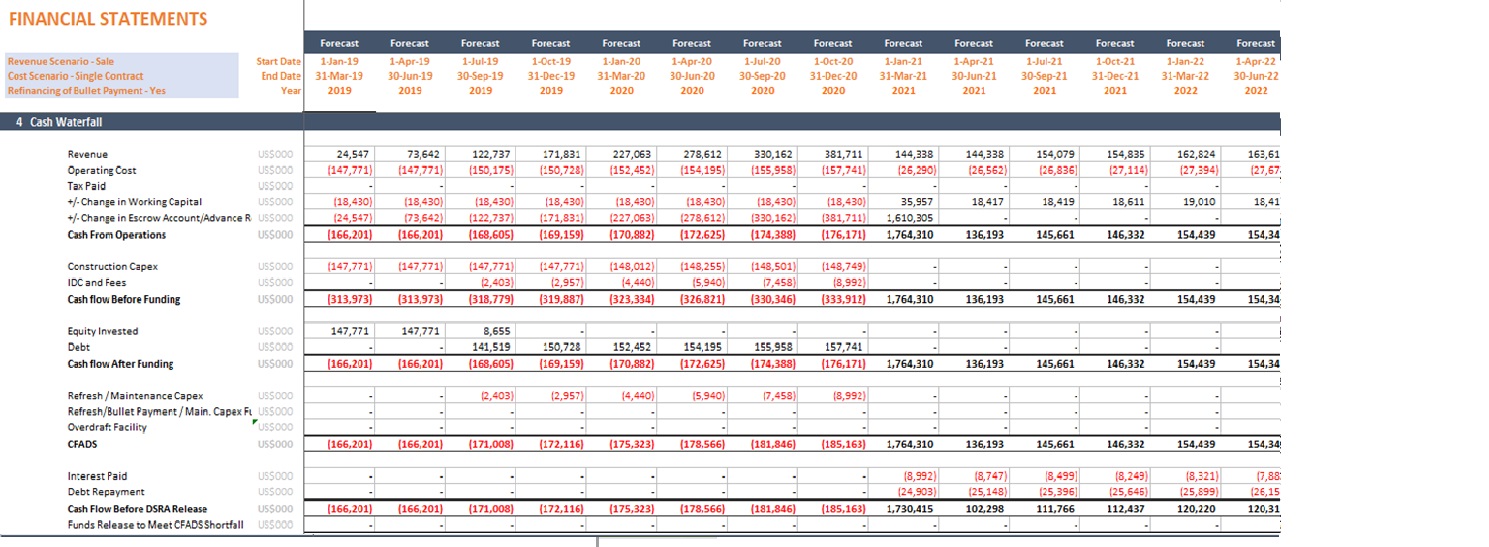

4. Cash Waterfall

5. Debt Service Profile

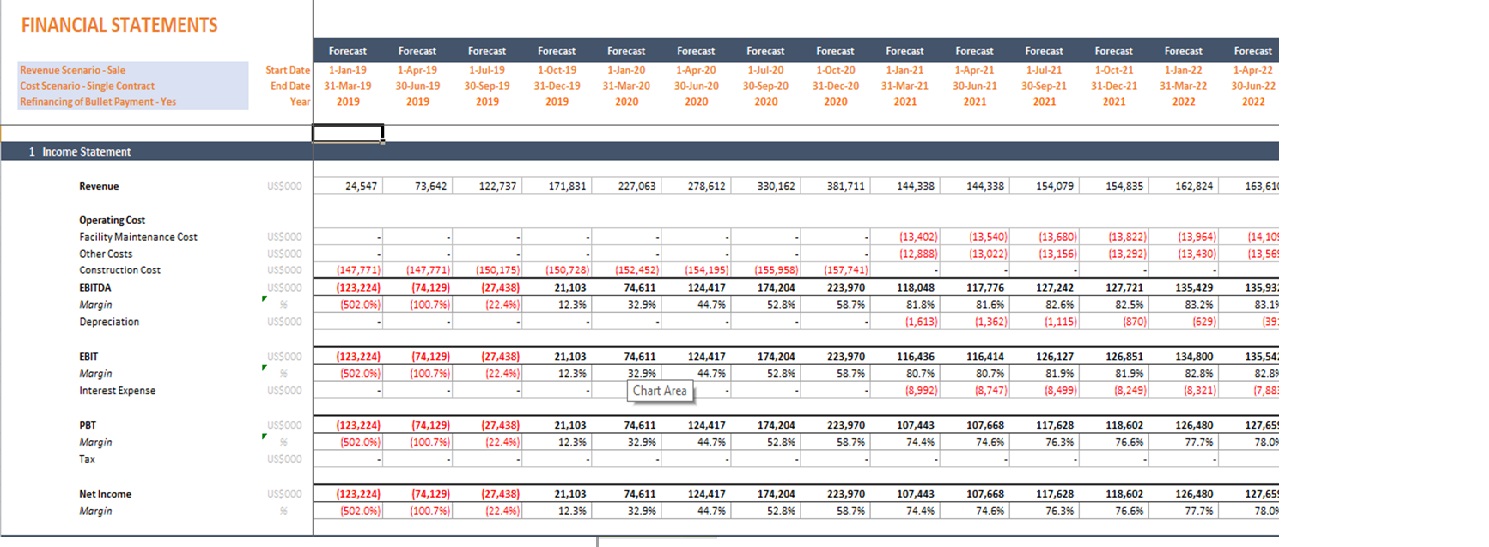

6. Integrated Financial Statements

7. Fully Integrated Dashboard

Why Fin-wiser’s Financial Model Template:

1. Our model is built on the quarterly timeline which provides more detailed data for the Analysis

2. The model is divided into two phases i.e. Construction and Operations

3. All revenue and cost assumptions can be input into 2 scenarios. This helps the user to assess the impact of multiple business scenarios in one model. This can be operated simply with a click of a button.

4. The model is built with Financial Modeling Best Practices and has clearly defined input, calculations, output cells, and tabs to help even a rookie Excel user to operate the model efficiently.

5. Our Models are thoroughly reviewed, and Quality checked for Arithmetic and Logical flow

Technical Specifications:

1. Model uses Macros (VBA) especially to consider the interest during the construction phase in the Uses of Funds Table. To run the model optimally, keep macros enabled. In case you do not like Macros, you could manually disable or remove the Macros and will have to rework the model’s logic to be used without Macros but it is not recommended by the author.

2. Model is built using Microsoft Excel 2019 version for Windows. Please note, on certain Mac laptops or MS Excel prior to 2007, Excel with Macros can slow down your computer if your PC does not have enough processing power.

3. We advise you not to delete or insert rows and columns into the model if you are not aware of the model structure as it can distort model functioning. If you need assistance with customizing the model template, the author is more than willing to help you. Simply contact us at pushkarkumar@fin-wiser.com and send your model template as well as specifications. We will then get back to you with a quotation for the customization service (billable hours & completion date).

4. Model uses Cell Styles