Hydrogen Gas Sales & Tolling Business Plan and Valuation Model with 3 Statements

$149.00

Categories: Best Selling, Featured Products, Financial Model, Paid, Project Finance & PPP Models, Renewable Energy

Tags: airhydrogen biomass cash waterfall clean energy Debt Schedule debt service coverage ratio dscr energy equity equity funding equity irr equity payback equity payback period Financial Debt Financial Feasibility financial model Financial Ratios financial statement fuelcell gas pipeline gas transport gas truck green energy green hydrogen greenhydrogen greenlife grey hydrogen greyhydrogen hidrigin hidrogênio hidrógeno hidrojen hydro hydrogen hydrogen sale hydrogène hydrogenwater idrogeno Investment Multiple Investor Cash Flows irr IRR (Internal Rate of Return) KPIs (Key Performance Indicators) natural gas npv NPV (Net Present Value) oiland gas Profitability Analysis project finance renewable tank Tariff Calculator truck väte WACC (Weighted Average Cost of Capital) Wasserstoff waterstof водород هيدروجين 氢 水素 수소

Description

Hydrogen Gas Sales & Tolling Fee business plan and valuation model is an excellent tool to assess the financial feasibility of setup and operating a gas sales and distribution business.

If you would like to start a business in the hydrogen space and explore the Hydrogen Gas sales business profitability then you can use this template for your analysis. The template is user-friendly and includes detailed analysis which can help you to make informed decisions regarding the financial aspects of venturing into this business.

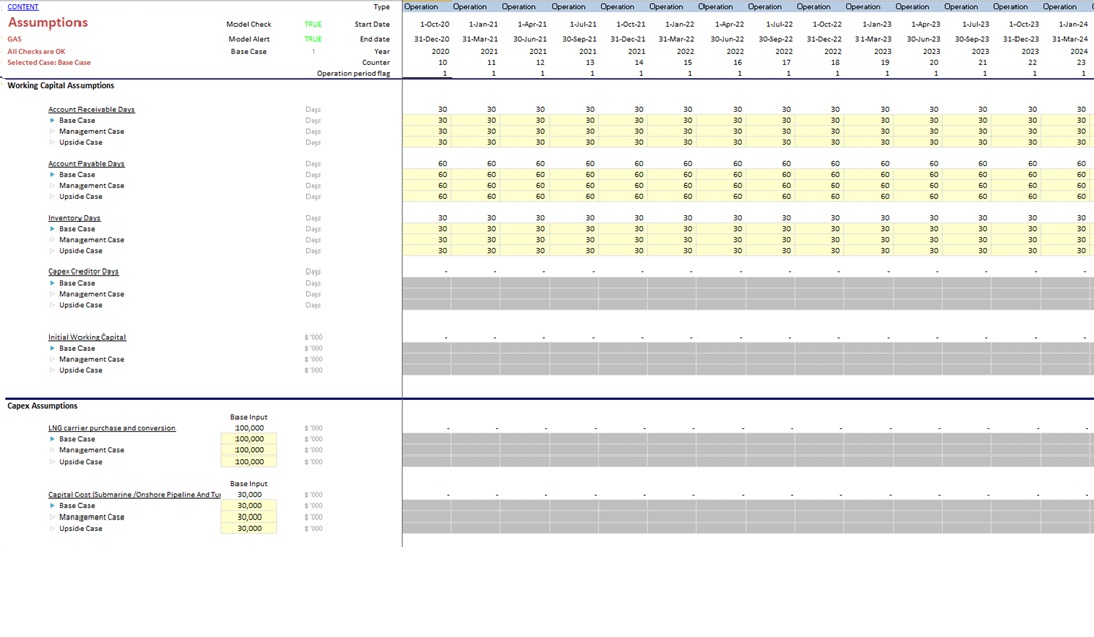

The Model includes assumptions related to:

- Gas carrier purchase and conversion Capex

- Pipeline and Submarine CAPEX

- Gas volume Sold Power Plant

- Gas volume sold to the Third party

- Fuel Cost

- Fixed and variable Capex

Model Output includes:

- Project IRR & NPV

- Equity IRR & NPV

- Minimum and Average DSCR

- Equity Payback Period

- Cash Waterfall

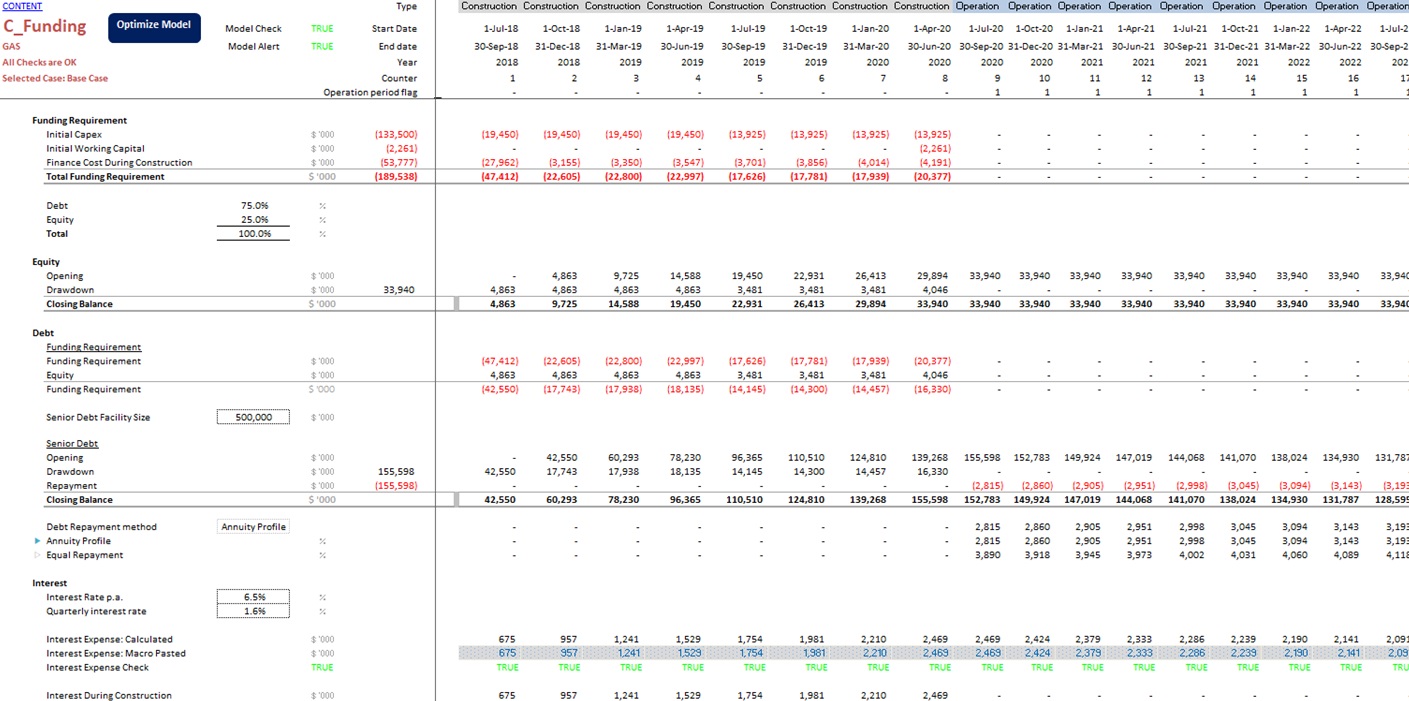

- Debt Service Profile

- Integrated Financial Statements

- Dashboard

Model Package includes:

- Excel-based financial model (Excel binary format i.e. xlsb)

- Macro Word Document – This includes the VBA Code used in the model for the user’s reference

Why Fin-wiser’s Financial Model Template:

- Our model allows greater flexibility in terms of deciding upon the forecast period length. Users can choose from Monthly, Quarterly, Semi-Annual, or Annual forecast period lengths. This provides more detailed data for Analysis.

- The model is divided into two phases i.e. Construction and Operations. The user has the flexibility to decide upon each period length individually and can also choose to populate each model phase on a monthly, quarterly, semi-annual, or annual basis.

- All revenue and cost assumptions can be input into 3 scenarios. This helps users to assess the impact of multiple business scenarios in one model. This can be operated simply with a click of a button.

- The Debt funding drawdown has 3 scenarios that can help users to assess the impact on the IRR and make the best possible negotiations with the financial institutions.

- The debt repayment has been profiled with 3 scenarios i.e. Annuity payment, Even Principal Payment, and Debt sculpted repayment. You can change the scenario with a click of a button and assess the impact on IRR.

- The model is built with Financial Modeling Best Practices and has clearly defined input, calculations, output cells, and tabs to help even a rookie Excel user operate the model efficiently.

- Our Models are thoroughly reviewed and Quality checked for Arithmetic and Logical flow

Technical Specifications:

- The model uses Macros (VBA) especially to consider the interest during the construction phase in the Uses of Funds Table. To run the model optimally, keep macros enabled. In case you do not like Macros, you could manually disable or remove the Macros and will have to rework the model’s logic to be used without Macros but it is not recommended by the author.

- The model is built using Microsoft Excel 2019 version for Windows. Please note, on certain Mac laptops or MS Excel prior to 2007, Excel with Macros can slow down your computer if your PC does not have enough processing power.

- We advise you not to delete or insert rows and columns into the model if you are not aware of the model structure as it can distort model functioning. If you need assistance with customizing the model template, the author is more than willing to help you. Simply contact us at pushkarkumar@fin-wiser.com and send your model template as well as specifications. We will then get back to you with a quotation for the customization service(billable hours & completion date).

- The model uses Cell Styles