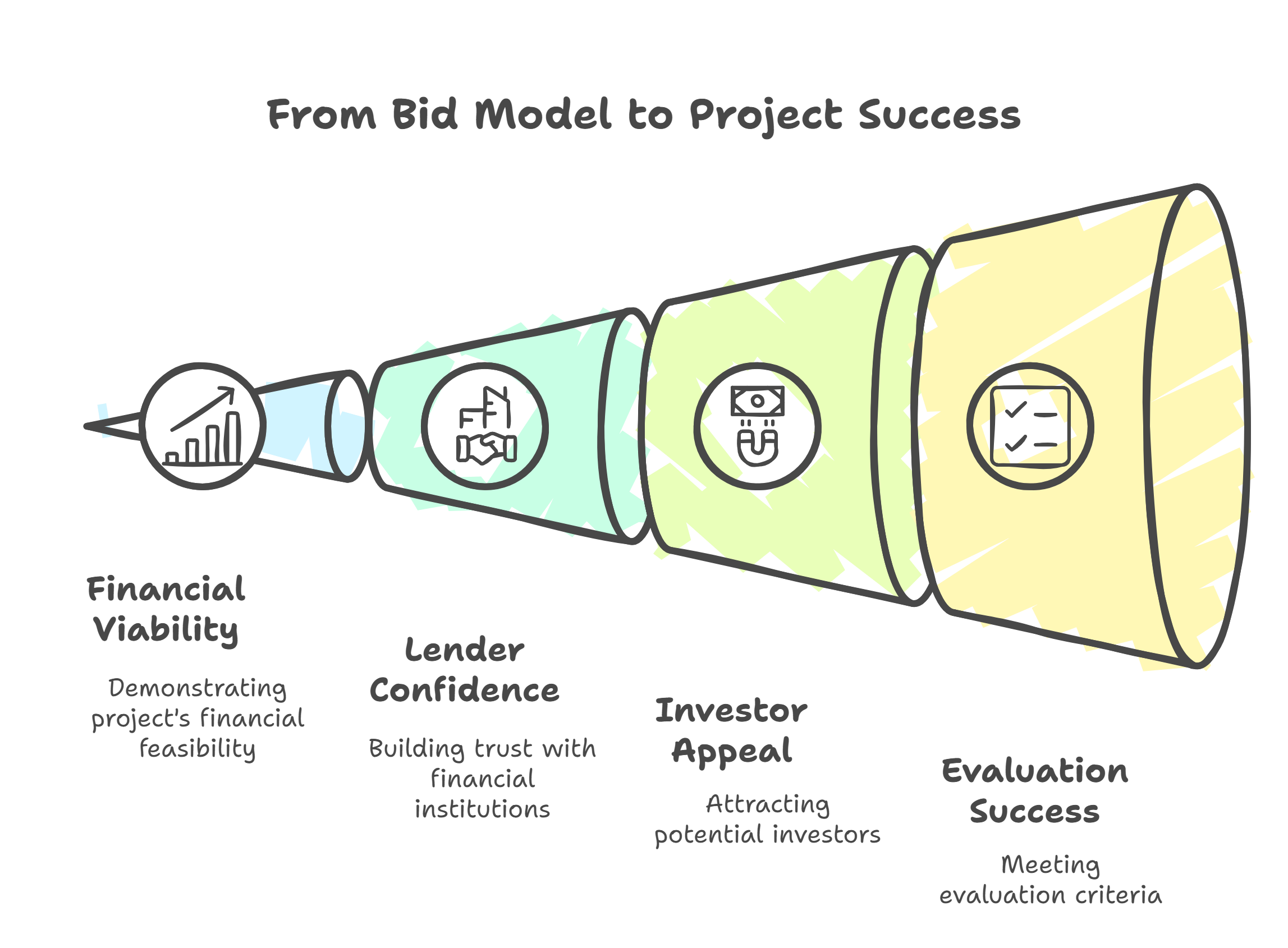

In the high-stakes world of infrastructure and energy development, success often comes down to one thing: a well-structured, data-driven bid model. Whether it’s a government-led PPP project, a competitive renewable energy auction, or a privately funded infrastructure concession, the ability to submit a credible, financeable, and investor-friendly bid is what separates winners from the rest.

At the heart of any winning bid is a robust project finance model—a model that not only demonstrates financial viability but also builds confidence among lenders, investors, and evaluating authorities. A strong bid model does more than forecast numbers; it tells a compelling story of how the project will be built, funded, operated, and returned to profitability within clearly defined timelines and constraints.

In infrastructure and energy tenders, the financial model isn’t just a supporting document—it’s a primary evaluation tool. Bids are often scored based on financial strength, affordability, value for money, and the ability to meet debt service obligations over time. A model that fails to reflect true costs, misjudges revenues, or glosses over risk can result in rejection, disqualification, or post-award financial distress.

This is where expert modeling support becomes essential. At Fin-Wiser, we specialize in helping developers, advisors, and financiers create bankable bid models that win real-world projects. Our infrastructure and energy project finance templates are built with proven structures, automated calculations, and lender-ready formats that help clients submit bids with confidence.

Core Components of a Winning Bid Model

A successful bid in infrastructure or energy projects depends on more than a competitive price. It requires a financial model that accurately reflects the project’s full lifecycle, funding plan, and operational profile—while staying compliant with the tender’s financial evaluation metrics.

Below are the key components every winning infrastructure bid model or energy project finance model must include to satisfy investors, lenders, and awarding authorities alike.

1. Revenue and Tariff Structure

For most energy projects (like solar, wind, or hybrid renewables), modeling accurate tariff revenue streams is essential. This includes:

- Power Purchase Agreements (PPAs) or tariff assumptions

- Indexation (if applicable)

- Volume projections (based on PLF, capacity, degradation)

- Payment collection cycles

In transport or utility projects, this might include user charges, toll collections, or availability payments. A credible revenue forecast must be consistent with technical capacity and market demand.

Fin-Wiser’s renewable energy templates include dynamic tariff calculators and volume assumptions tailored to actual operating scenarios.

2. CapEx, OpEx, and Lifecycle Costs

A robust infrastructure financial model must lay out the project’s full cost structure:

- CapEx: Construction costs, contingencies, land, EPC contracts

- OpEx: Long-term maintenance, staffing, insurance, utility costs

- Lifecycle costs: Major repairs, overhauls, or end-of-life decommissioning

Winning models often include time-phased CapEx and inflation-adjusted O&M profiles. Many failed bids underestimate OpEx escalation, hurting DSCR and long-term viability.

Fin-Wiser provides pre-structured CapEx/OpEx modules designed for infrastructure and energy bids with multi-year inputs and built-in escalation logic.

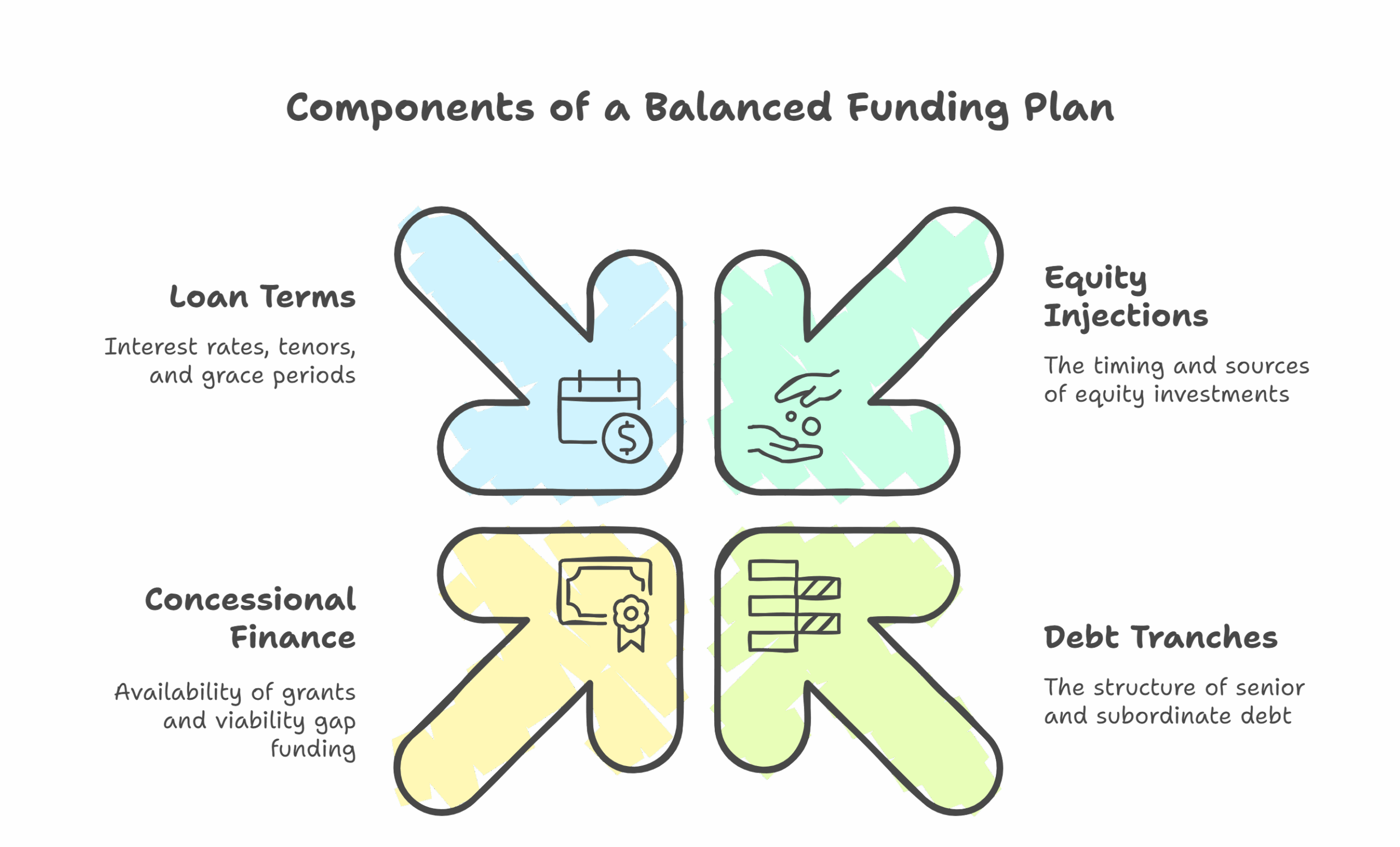

3. Funding Structure: Equity, Debt, and Grants

Bid evaluators and lenders both want to see a well-balanced funding plan. Your bid model should clearly show:

- Sources and timing of equity injections

- Senior and subordinate debt tranches

- Concessional finance, viability gap funding (VGF), or grants

- Interest rates, loan tenors, and grace periods

The funding section must integrate smoothly with the model’s cash flow waterfall and demonstrate repayment capacity through accurate DSCR analysis.

Fin-Wiser’s models come with integrated funding mix simulations, allowing users to adjust equity-debt ratios and test the impact on returns and cash flow.

4. Timeline Integration: Construction to Operation

Every infrastructure bid model must reflect project development phases. This includes:

- Construction start and end dates

- Commercial operations date (COD)

- Ramp-up period, if applicable

- Grace periods for debt repayment

Aligning costs, revenues, and financing with the construction and operational timeline is vital to avoid errors in cash availability and loan servicing.

5. Financial Statements and KPIs

Finally, the model must produce:

- Linked Income Statement, Balance Sheet, and Cash Flow Statement

- Key metrics like NPV, Project IRR, Equity IRR, DSCR (annual and minimum)

- Break-even analysis and payback periods

- Automated outputs for lender covenants or project evaluation matrices

Fin-Wiser’s infrastructure and energy financial models deliver these outputs in investor-ready formats, designed for due diligence, bid submissions, and internal evaluation.

What Sets Winning Bid Models Apart

While many bid models meet the basic eligibility and compliance requirements, only a few go on to win the project. What sets these models apart isn’t just technical accuracy—it’s the ability to balance financial robustness, strategic alignment, and bid-specific flexibility. A winning infrastructure or energy bid model isn’t just a spreadsheet—it’s a strategic weapon.

Here are the key attributes that separate winning bid models from the rest:

1. Transparent and Verifiable Assumptions

Bidders that succeed present clear, well-justified assumptions supported by market data, third-party reports, or engineering inputs. Whether it’s CapEx estimates, escalation rates, or load factors, every input should be:

- Traceable to an external or contractual source

- Aligned with the project’s technical feasibility

- Defensible during lender and authority due diligence

Fin-Wiser’s templates allow assumption mapping and documentation, making it easier for your bid model to pass the validation phase.

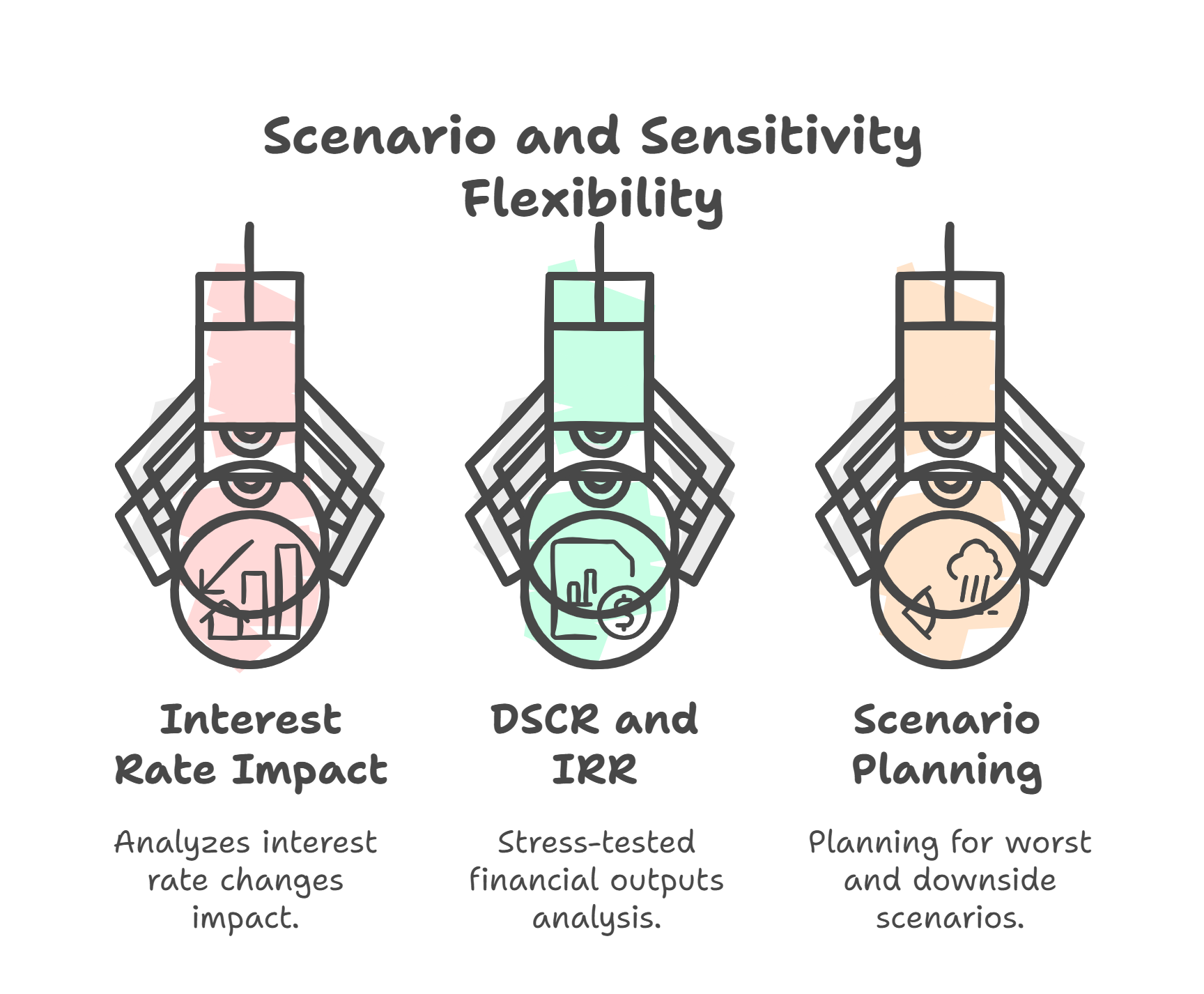

2. Scenario and Sensitivity Flexibility

No project finance bid model is complete without robust sensitivity analysis. Bid evaluators and investors want to see:

- Impact of interest rate or tariff changes

- Stress-tested DSCR and IRR outputs

- Worst-case and downside-case planning

Winning models are built to be flexible, not fragile. They let the developer test pricing thresholds, funding gaps, or construction delays—all in real time.

Fin-Wiser models come with built-in scenario toggles and one-click stress testing tools so users can demonstrate model resilience without rebuilding logic from scratch.

3. Risk Allocation and Contingency Planning

Infrastructure projects are inherently risky—winning bids demonstrate that risks are understood, quantified, and mitigated within the model:

- Construction delays and cost overruns

- Currency and inflation risks

- Payment delays (especially in government-backed PPAs or annuity models)

- Lifecycle maintenance costs and performance guarantees

Top-performing models often include risk reserves, contingency buffers, or escalating O&M forecasts to stay realistic.

At Fin-Wiser, our energy and PPP bid models account for key risks in cost and revenue drivers, enabling accurate forecasting even under uncertain conditions.

4. Alignment with Tender Evaluation Metrics

Authorities and agencies evaluate bids using specific financial metrics—such as lowest tariff (L1), highest NPV, or best Value for Money (VfM). Winning bidders structure their models to optimize against these exact metrics, rather than using a generic financial strategy.

Example: In renewable energy bids, the lowest viable tariff wins—but it must also meet minimum DSCR and equity IRR thresholds to remain bankable.

Fin-Wiser’s models help you optimize outputs like tariff rate, viability gap funding, or grant requirements based on the evaluation framework.

5. Lender and Investor Readiness

A winning bid model is only as good as its ability to attract finance post-award. That’s why successful developers build models that:

- Integrate lender terms and repayment profiles

- Meet DSCR or LLCR covenants

- Provide output sheets for due diligence and project finance structuring

Fin-Wiser templates are lender-ready by design, with outputs structured to be shared directly with financing institutions, making the transition from bid to financial close smoother.

Real-Life Example: Competitive Solar PPP Bid

To understand how a well-structured bid model can directly influence project success, let’s look at a real-world scenario: a competitive bid for a 100 MW grid-connected solar plant under a government-led Public-Private Partnership (PPP) framework. This case highlights how strong financial modeling helped a developer win the bid while ensuring long-term viability and bankability.

Project Overview

- Project Type: Solar Power Plant (PPP, Build-Own-Operate)

- Project Cost: $50 million

- Financing Mix: 70% senior debt, 30% sponsor equity

- Tariff Structure: Bid-based PPA (lowest tariff wins)

- Contract Duration: 25 years

- Evaluation Metric: Lowest Viable Tariff with Financial Close Readiness

Bid Model Strategy

The developer engaged a project finance team to build a model focused on achieving the lowest possible tariff without compromising the DSCR or equity IRR thresholds needed to secure debt.

Key highlights included:

✅ Accurate CapEx Forecasting

- Breakdown of EPC, land acquisition, and contingency

- Time-phased disbursement across a 14-month construction period

✅ Revenue Modeling

- Annual generation based on 19% PLF (plant load factor)

- Degradation factor built-in across the 25-year horizon

- PPA linked to bid tariff, with payment delay assumptions for risk testing

✅ Debt Structuring

- Senior loan with 15-year tenor, 2-year grace period

- Interest rate hedging modeled

- DSCR covenants embedded into repayment schedule

✅ Cash Flow Waterfall and KPI Tracking

- Cash allocated by priority: OpEx → Debt → Reserves → Equity

- DSCR (minimum 1.25), IRR (equity: 14.5%, project: 11.2%)

- Sensitivity for ±10% in CapEx, PLF, and tariff values

✅ Scenario-Based Bidding

- Model included a tariff optimization tool

- Ran 25+ scenarios adjusting for financing terms, insurance costs, and inverter degradation

The Outcome

- The developer won the bid by proposing a tariff just below the next-best competitor—while maintaining a viable equity return.

- Post-award, the model was repurposed to support lender due diligence and achieved financial close in under 5 months.

- Risk reserves and escalation assumptions helped withstand construction material cost spikes that affected other projects.

Lessons Learned

This example demonstrates that the winning bid wasn’t the one with the lowest price—it was the one with the strongest, most realistic bid model.

If the model had underestimated OpEx, ignored degradation, or assumed aggressive debt terms, the project could have become financially unfeasible post-award.

At Fin-Wiser, our project finance models for solar, wind, hybrid, and infrastructure PPPs are built using this same logic—so clients can submit bids that win and then perform.

Explore our renewable energy and infrastructure modeling templates to see how we help developers structure winning financial strategies.

How Fin-Wiser Helps You Build Winning Bid Models

Winning a competitive infrastructure or energy tender isn’t just about offering the lowest number—it’s about offering the right number, backed by a solid financial foundation. That’s where Fin-Wiser comes in.

We’ve worked with developers, advisors, and lenders across solar, wind, transport, utilities, and PPP sectors to deliver reliable, transparent, and investor-ready project finance models that are built to win.

Tailored for Infrastructure and Energy Projects

Our library of project finance modeling templates covers a wide range of asset types including:

- Solar, Wind, and Hybrid Renewable Energy

- Toll Roads, Airports, Ports, Rail, and Logistics Hubs

- Wastewater Treatment and Utility Infrastructure

- Government-backed PPP and concession models

Each template is purpose-built with industry-specific assumptions, structures, and outputs tailored to meet both bid evaluation and lender expectations.

Built-In Features That Make Your Bid Competitive

Every Fin-Wiser model includes the advanced tools needed to stand out in the bidding process:

- Cash flow waterfall logic to prioritize payments and equity distributions

- Dynamic tariff or user fee optimization tools

- Linked financial statements for full transparency

- Automated DSCR, IRR, NPV, and payback period outputs

- Risk-adjusted modeling with escalation, inflation, and performance variables

- Scenario toggles for base, upside, and downside stress testing

These features help our clients submit bids that are not only competitive, but financially viable over the long term.

Investor- and Lender-Ready Output Sheets

Fin-Wiser models generate:

- Bank-ready reports with clear metrics and covenants

- Summary dashboards for investment committee approvals

- Assumption logs for compliance and internal documentation

- Data rooms ready for due diligence and financial close

Winning the bid is only step one. Securing financing, managing risk, and delivering performance depends on having the right model structure from the beginning.

Speed, Accuracy, and Strategic Flexibility

Using Fin-Wiser, you save weeks of modeling time, eliminate spreadsheet errors, and gain the ability to adjust your bid confidently in response to feedback or market changes.

Whether you’re a seasoned developer or entering a tender for the first time, Fin-Wiser gives you a competitive edge with precision-built models that speak the language of authorities, banks, and investors alike.

Ready to Build a Winning Bid Model?

Explore our full range of infrastructure and energy financial models to get started today. Let Fin-Wiser be your modeling partner in the next big opportunity.

Because in project finance, the right model doesn’t just support the bid—it wins it.

Conclusion

A winning bid in infrastructure and energy is rarely the result of guesswork—it’s the outcome of detailed, disciplined, and strategically structured financial planning. In today’s competitive tender environments, a robust and flexible project finance model is not just helpful—it’s mission-critical.

Whether you’re bidding for a solar PPP, a toll road concession, or a government-funded utility project, your bid model must tell a clear story: how the project will be funded, how risks are managed, and how long-term financial performance will be achieved. It must meet investor requirements, pass lender scrutiny, and most importantly—score high under the authority’s evaluation framework.

As we’ve explored, what separates a winning bid model from the rest is its ability to combine technical soundness, realistic assumptions, and built-in flexibility to adapt to real-world uncertainties. With accurate inputs, scenario-based outputs, and a transparent structure, your model becomes more than a document—it becomes your competitive advantage.

At Fin-Wiser, we help developers, advisors, and financial professionals build that advantage. Our ready-to-use project finance models are built for speed, accuracy, and credibility—designed specifically to help you win and deliver high-value infrastructure and energy projects.