Oil & Gas Marketing and Distribution DCF Valuation Model with 5 Yrs Actual,1 Yr Budget & 5 Years Forecast

$149.00

Description

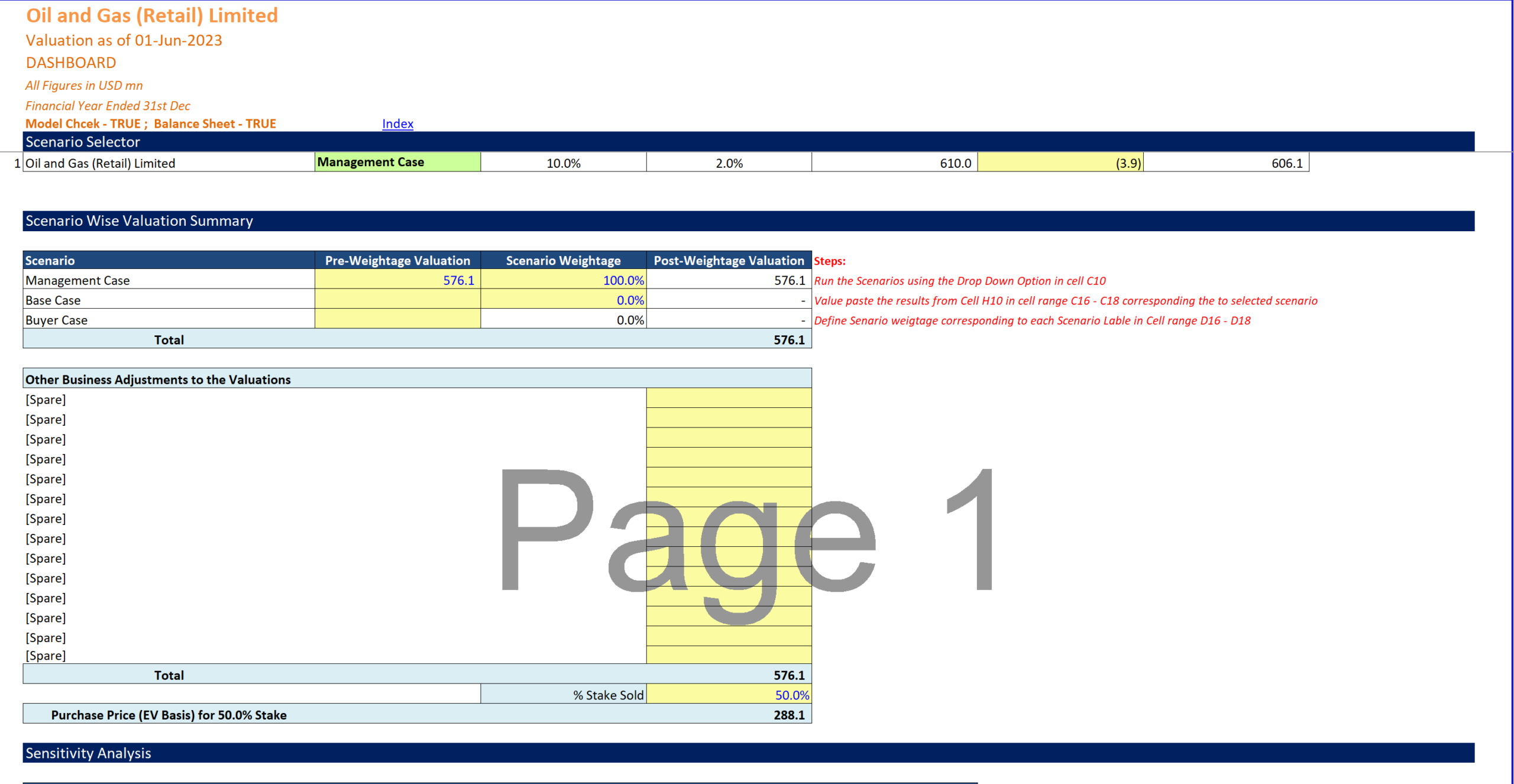

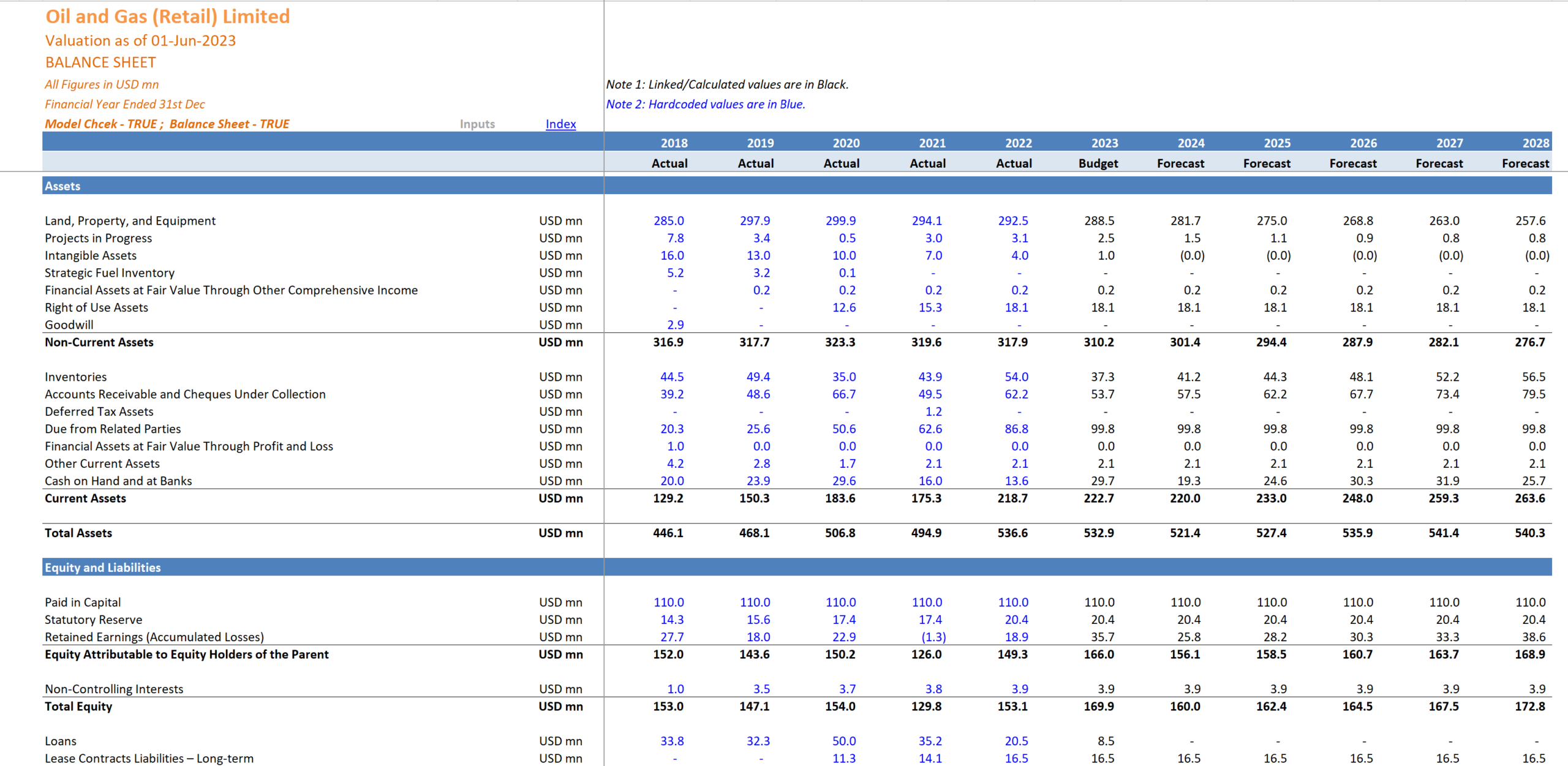

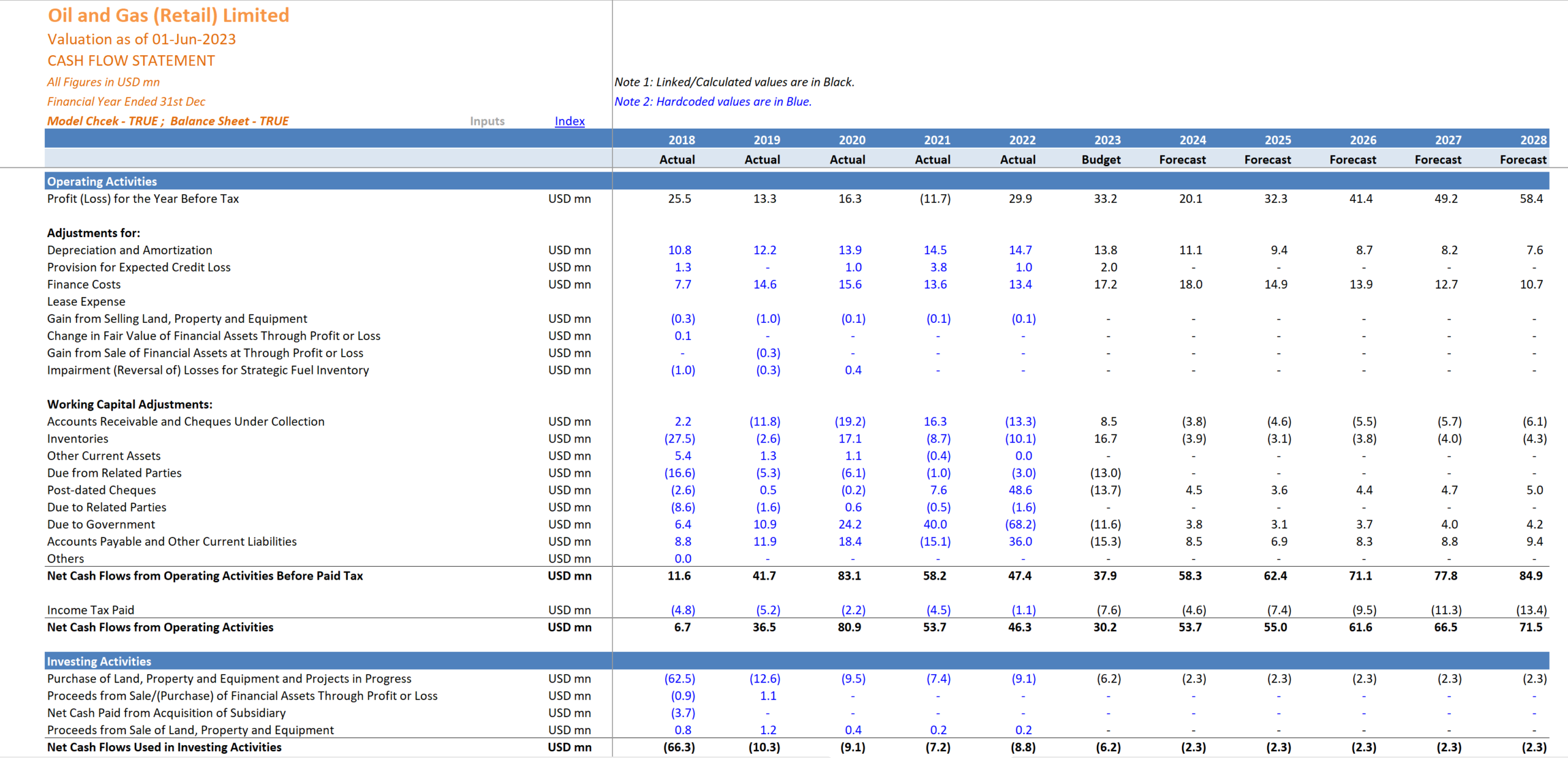

A detailed and user friend financial model that captures 5 years of Historical + 1 Year of Budget + 5 Years of the forecast period. The model includes three integrated financial statements, i.e., Income Statement, Balance Sheet and Cash Flow Statement, Discounted Cash Flow valuation, and in-depth financials & valuation analysis.

The model includes assumptions related to the following:

1. Business Drivers – Number of Stations [Company Owned Company Operated (CoCo) and Dealer Owned Dealer Operated (DoDo) Stations], Sales Volume by Product [Petrol, Diesel, Kerosine]

2. Revenue Assumption – Fuel and Oil Revenue, Fuel Transportation, Rental, Grocery & Export

3. Costs Assumptions – Fuel Cost, SG&A, and Other Overheads

4. Capital Expenditure and Depreciation/Amortization by Asset Class – Land, Building, Vehicles, Machinery & Tools, Computer & Systems, etc.

5. Working Capital Assumptions (Receivables, Payable, Inventory)

6. Long Term and Short-Term Bank Debt, Bank Overdraft

7. Share Capital (Issue of New shares, Reserve Accounts)

8. Dividend Payout

9. Interest Income and Expense calculations

10. Income Tax

The model runs comprehensive calculations based on the inputs provided by the user to generate precise outputs, which include:

1. Income Statement: Includes Historical and Forecasted Profit and Loss statement.

2. Balance Sheet: Includes Historical and Forecasted Balance Sheets.

3. Cash Flow Statement: Includes Historical and Forecasted cash flows.

4. Valuation: DCF-based valuation based on the Forecasted cash flows and discount rate assumptions

5. Valuation Ratio: A very detailed financial analysis covering:

– Price and EV-based valuation ratios

– Per Share Data like EPS, DPS, FCFF per share & more

– Margin ratios

– Return ratios

– Dupont Analysis

– Gearing Ratios

– Liquidity ratios

– Coverage Ratios

– Activity Ratios

– Investment rations

– Enterprise value