In the fast-moving world of startups, success hinges not just on innovation or product-market fit—but also on financial clarity and foresight. A well-structured startup financial model is a critical tool that enables founders to translate vision into numbers, understand capital requirements, and anticipate business sustainability. And yet, countless startups fail—not because the idea wasn’t great, but because their financial model was fundamentally flawed.

In early-stage environments, decisions are often made under uncertainty. This is precisely why financial modeling for startups is not a luxury—it’s a necessity. Your financial model is the framework that supports everything from fundraising and valuation to burn rate management and strategic planning. Whether you’re pitching a venture capitalist, hiring a finance lead, or planning your next growth phase, the model is often the first place stakeholders look for clarity and confidence.

However, many founders—especially non-finance founders—unknowingly make modeling mistakes that distort projections, misrepresent runway, or miscalculate dilution. These errors can cost startups millions in lost capital, missed funding opportunities, or irrecoverable equity giveaways. Worse, they erode trust with investors at critical fundraising moments.

At Fin-Wiser, we’ve worked with hundreds of startups across sectors and growth stages, helping them design investor-ready financial models that reflect both the upside potential and operational realities of their businesses. Our templates are not just about making spreadsheets look good—they’re about ensuring founders have the right financial roadmap to make confident, data-driven decisions.

If you’re an early-stage startup preparing for funding, or a growth-stage company refining your metrics, understanding the common financial modeling mistakes startups make is your first step toward building a resilient financial plan. In this blog, we’ll break down the most damaging missteps, backed by real-world examples, and offer solutions to help you avoid them using proven, professional modeling tools from Fin-Wiser.

The Most Costly Financial Modeling Mistakes Startups Make

Creating a startup financial model that looks good on a slide deck is one thing. Building one that holds up under investor scrutiny—and more importantly, guides real business decisions—is another. Many startups unknowingly introduce serious errors into their models that distort reality, mislead stakeholders, and create financial blind spots that can derail growth.

Below are the most common financial modeling mistakes for startups, each of which can be costly if not addressed early.

1. Overestimating Revenue Growth

Perhaps the most widespread issue in financial modeling for startups is overly optimistic revenue projections. Founders often assume steep growth curves with little or no justification, basing numbers on market potential rather than actual acquisition plans or historical performance.

What typically goes wrong:

- Projecting unrealistic month-over-month or year-over-year growth

- Ignoring customer acquisition cost (CAC), churn rates, and sales cycles

- Applying “hockey stick” growth without operational grounding

Why it matters:

Investors immediately notice when revenue assumptions are disconnected from go-to-market realities. This undermines credibility and can jeopardize funding discussions.

The smarter approach:

Use a bottom-up forecasting strategy driven by sales pipeline assumptions, conversion rates, and marketing performance. Fin-Wiser’s startup financial models include built-in drivers that tie revenue to actual business inputs—giving you projections that are aggressive but defendable.

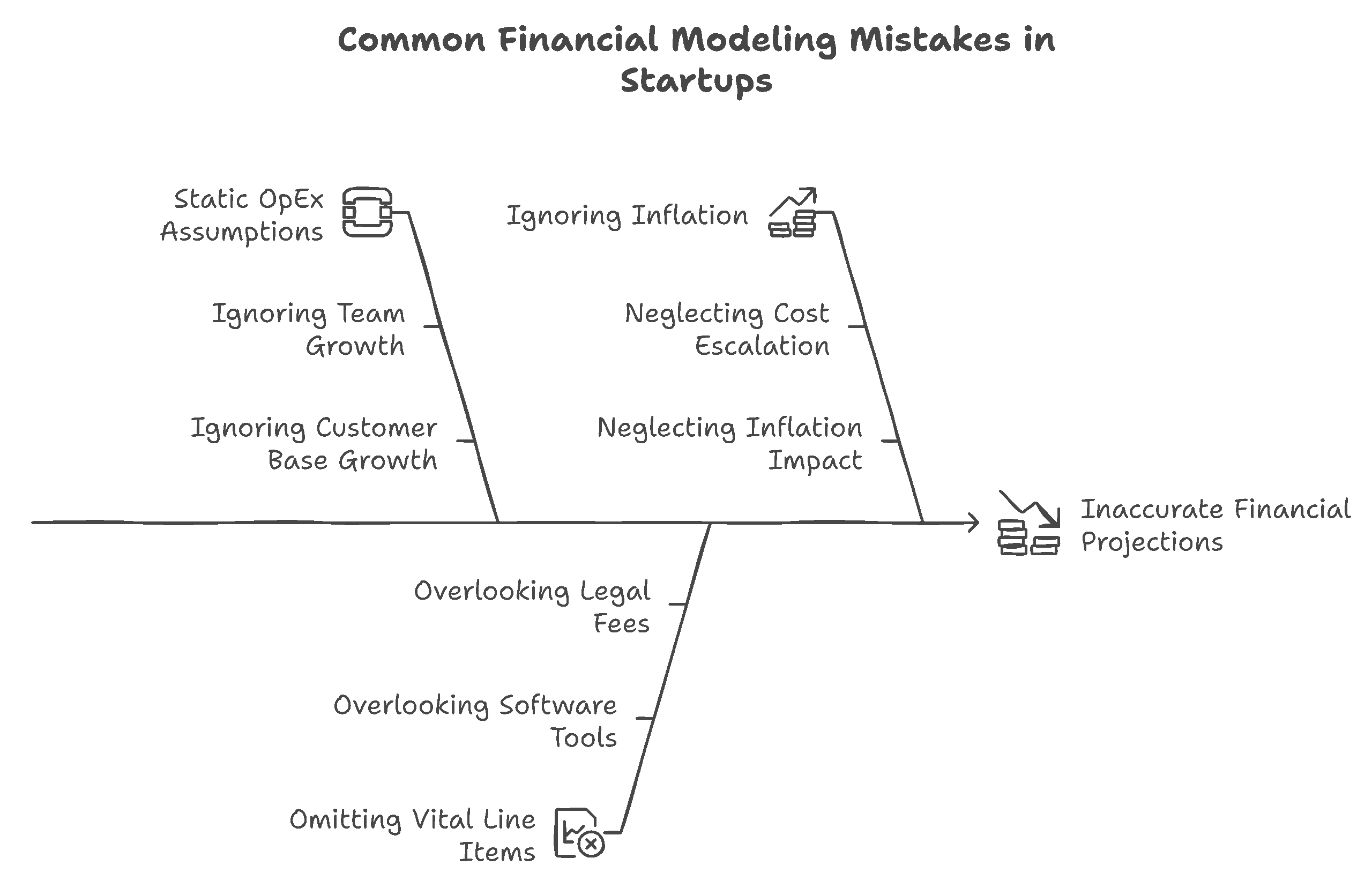

2. Underestimating Burn Rate and Operational Costs

Many early-stage founders neglect to model the full extent of their burn rate, especially as the business scales. They may forget to include team growth, rising infrastructure costs, compliance, legal, or customer service expansion.

Common mistakes:

- Assuming static OpEx despite team or customer base growth

- Omitting vital line items (e.g., software tools, legal fees, IT infrastructure)

- Ignoring inflation or cost escalation over time

Why it matters:

Underestimating expenses leads to poor runway visibility, unexpected cash crunches, and premature fundraising.

Best practice:

Forecast monthly OpEx with granular detail, including salaries by role, cloud infrastructure, tools, and recurring expenses. Fin-Wiser’s models help startups build department-level cost forecasts with escalation logic—ensuring no surprise burn gaps.

3. Confusing Profitability with Liquidity

It’s not uncommon for founders to believe that a profitable model equals a healthy business. But without proper cash flow modeling, startups can show strong net income on paper while simultaneously running out of cash.

Where this goes wrong:

- Not modeling working capital (receivables, payables, inventory)

- Ignoring timing gaps between revenue recognition and cash collection

- Missing CapEx or upfront payments that drain available cash

Why it matters:

Even profitable startups fail due to liquidity mismanagement. Cash—not accounting profit—is what pays salaries and bills.

Solution:

Always pair your P&L with a monthly cash flow statement. Fin-Wiser’s templates come with fully linked financial statements and detailed cash flow tracking, helping founders stay ahead of liquidity risks.

4. Ignoring Capital Structure and Dilution

Many founders simply input a “$1M equity raise” line without considering the ownership impact, cost of capital, or how future rounds will dilute existing stakeholders.

Common oversights:

- No cap table modeling across rounds

- Failure to estimate investor IRR or preferred return scenarios

- Not accounting for convertible notes, SAFEs, or debt instruments

Why it matters:

Without understanding dilution and capital stack mechanics, startups can inadvertently give away too much equity too early, limiting future control and returns.

Smart modeling tip:

Use an integrated cap table and investor return tracker. Fin-Wiser’s startup-ready financial models include built-in modules to simulate multiple funding rounds, calculate dilution, and forecast equity outcomes for founders and investors.

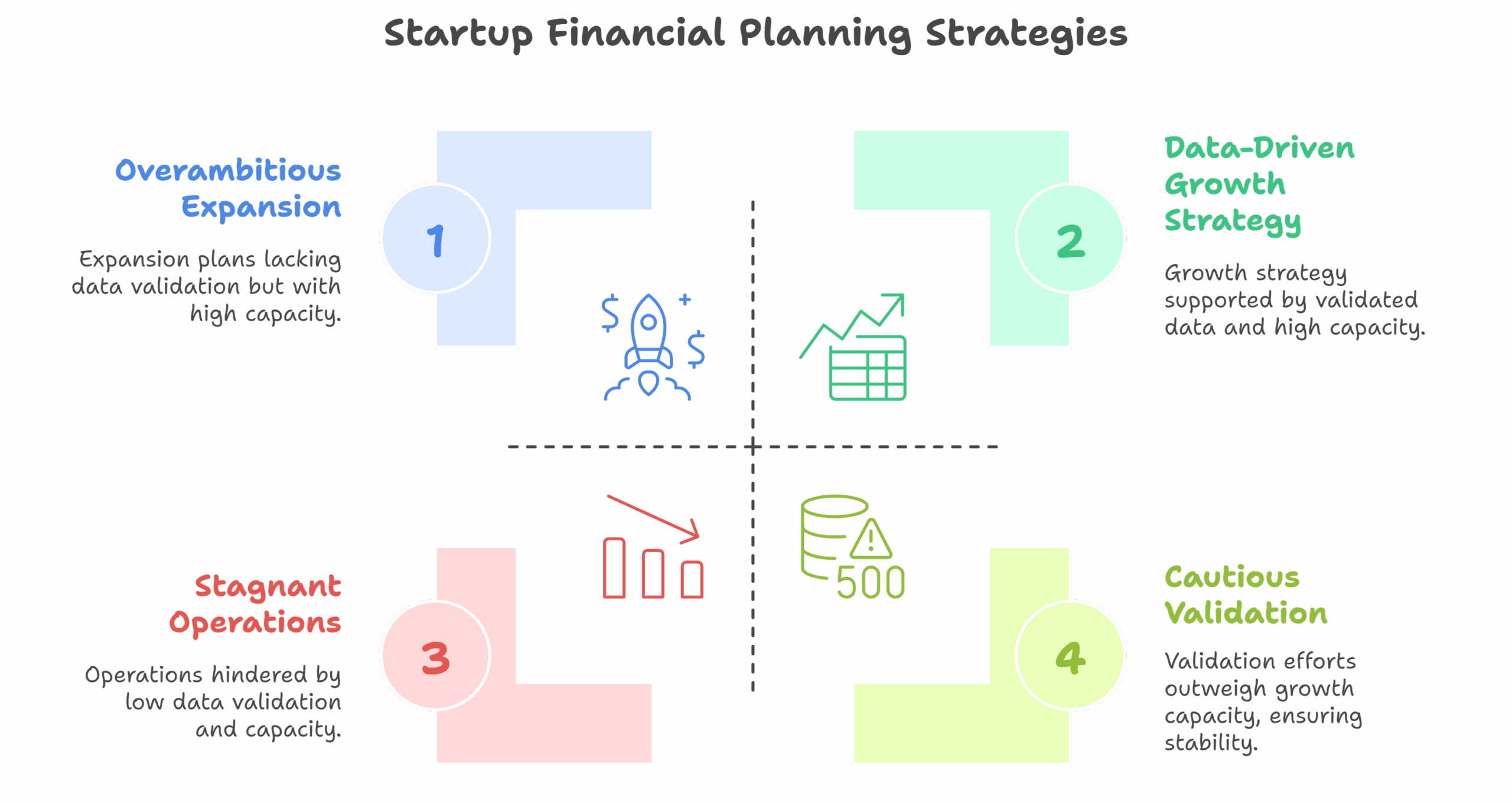

5. Modeling Only the Best-Case Scenario

Startups are built on optimism, but financial models need to reflect reality plus risk. Too often, founders present a single, sunny projection—without stress-testing for downturns, delays, or cost overruns.

What gets overlooked:

- No downside or base case scenario

- No sensitivity toggles (e.g., for pricing, churn, or CAC)

- Failing to demonstrate resilience under pressure

Why it matters:

Sophisticated investors expect to see how your model behaves under uncertainty. Without this, your model lacks credibility.

Proactive step:

Build multiple scenarios—base, upside, and downside—with clear assumptions and toggles. Every Fin-Wiser model supports this through built-in scenario planning functionality, so you’re always prepared for investor Q&A or real-world shifts.

Real-Life Examples That Highlight the Risks

Understanding common financial modeling mistakes is one thing—but seeing them unfold in real scenarios brings their impact into focus. Below are three real-world-inspired examples where startups paid a heavy price for missteps in their financial models. Each case could have been avoided with a more grounded, investor-ready, and data-driven approach—like the one enabled by Fin-Wiser’s financial modeling tools.

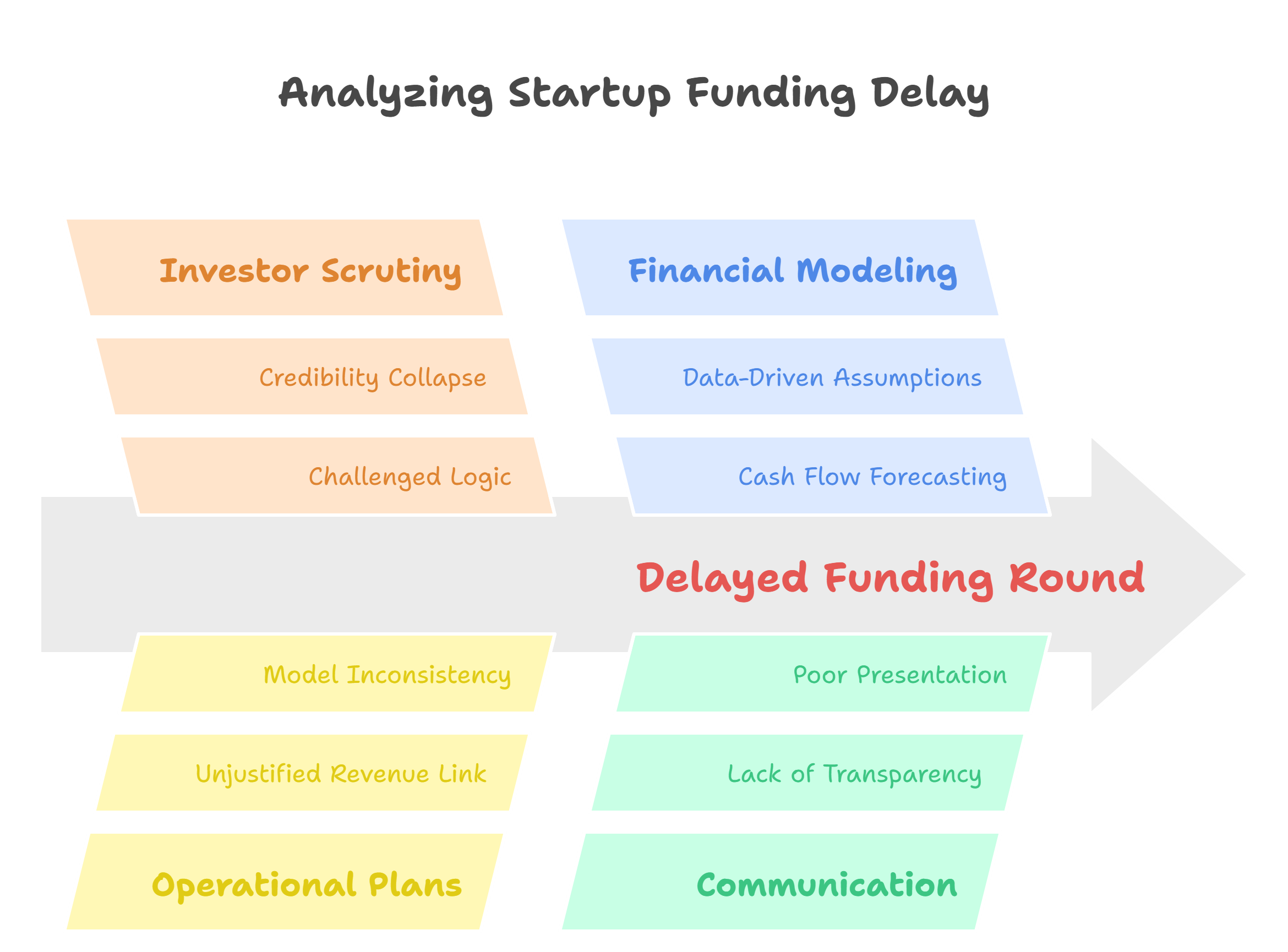

Example 1: Overconfident Revenue Forecasts Derail a SaaS Startup’s Series A

A SaaS startup entered its Series A pitch with a model projecting 300% year-over-year revenue growth based solely on total addressable market (TAM). Their model lacked real conversion assumptions, sales cycle timelines, or CAC analysis.

What went wrong:

- Investors challenged the logic behind the numbers

- The startup failed to justify how revenue was linked to operational plans

- Model credibility collapsed, leading to a delayed funding round

What could have fixed it:

A bottom-up model, built around sales team ramp-up, MRR growth, churn rates, and CAC, would have helped. Fin-Wiser’s SaaS startup templates include these drivers and let founders adjust assumptions based on real sales data.

Example 2: Cash Flow Misjudgment Forces Emergency Bridge Round

A health-tech mobile app startup projected profitability within 12 months and an 18-month runway on a $1.5M seed round. However, they failed to account for cash flow timing—revenue was recognized, but payments came in 45–60 days later. Simultaneously, infrastructure and marketing spend ramped quickly post-launch.

What went wrong:

- The startup ran out of cash in month 9 despite appearing profitable

- Payroll and vendor payments were delayed

- A rushed, unfavorable bridge round diluted founders significantly

What could have fixed it:

A monthly cash flow model with working capital assumptions, CapEx timing, and revenue collection lag would have shown the real runway. Fin-Wiser’s templates include all three, along with a visual runway tracker.

Example 3: Equity Dilution Shocks the Founding Team at Series B

A hardware startup gave away 25% of equity during a seed round without modeling the long-term impact. By Series B, additional dilution from SAFEs and preferred equity left founders with under 20% ownership—jeopardizing board control and future upside.

What went wrong:

- No cap table modeling beyond the current round

- No investor IRR forecasts

- Misjudged convertible note conversion impact

What could have fixed it:

Fin-Wiser’s startup financial models feature integrated cap tables, investor IRR tracking, and scenario tools for multiple funding rounds—ensuring founders are always clear on ownership and investor economics.

Each of these examples reveals how financial modeling mistakes can lead to very real consequences—from delayed funding to ownership loss and team demoralization. And in every case, the right modeling approach could have changed the outcome.

How to Avoid These Mistakes in Your Startup Model

Avoiding the most common financial modeling mistakes for startups isn’t about having a finance background—it’s about applying the right structure, tools, and thinking to your numbers. A well-built startup financial model doesn’t just forecast performance; it helps founders make better decisions, navigate funding rounds with confidence, and manage their business more effectively.

Here’s how you can avoid the errors that have cost other startups millions—and how Fin-Wiser’s financial modeling templates make it simpler to get it right.

1. Build with Realistic, Data-Driven Assumptions

Many startup models begin with best-case scenarios, but investors want to see assumptions grounded in real acquisition metrics, customer behavior, and operating efficiency.

Do this instead:

- Forecast revenues based on CAC, LTV, and sales conversion rates

- Use market benchmarks and internal traction to validate projections

- Structure growth around actual sales and marketing capacity

How Fin-Wiser helps:

Our models use bottom-up logic that ties growth to real-world levers—marketing spend, hiring plans, retention rates—so your projections are both aggressive and defensible.

2. Forecast Burn Rate in Detail—Monthly, Not Annually

One of the most overlooked areas is burn rate forecasting. Founders often miss how quickly costs escalate as teams grow, infrastructure scales, or operations expand.

Best practices:

- Build monthly forecasts for all key cost centers—marketing, tech, admin, HR

- Include step-wise cost increases based on scaling milestones

- Add inflation or contingency buffers for real-world variability

How Fin-Wiser helps:

Our startup financial models allow monthly cost forecasting with detailed inputs for salaries, software tools, services, and fixed expenses—providing a realistic view of future runway.

3. Model Cash Flow Separately from Profitability

Even if your startup is projected to be profitable on paper, you could still run out of cash due to mismatched payment cycles, upfront expenses, or revenue lags.

What you should include:

- Working capital (receivables, payables, inventory if applicable)

- Revenue recognition vs. collection timelines

- CapEx and loan disbursements

How Fin-Wiser helps:

All our models include fully integrated cash flow statements, plus runway and liquidity views—so you always know how much cash you’ll have on hand each month.

4. Include Full Capital Structure Planning and Cap Table Forecasting

Your financial model must account for multiple funding rounds, equity instruments, and their impact on ownership and investor returns.

Things to get right:

- Model SAFE conversions, equity dilution, and future rounds

- Project founder and investor ownership across funding stages

- Include IRR calculations for investors to show return scenarios

How Fin-Wiser helps:

Fin-Wiser’s templates come with built-in cap tables, equity tracking, and funding round simulation—giving founders a full view of how their ownership evolves and how investors benefit over time.

5. Add Scenario Planning from Day One

Single-scenario models are risky. You need to show how your business performs under multiple outcomes—not just the perfect one.

To include:

- Base case, downside case, and upside case

- Sensitivity toggles for growth, pricing, churn, CAC, or delay

- Cash runway under each condition

How Fin-Wiser helps:

Every Fin-Wiser model includes built-in scenario toggles, allowing you to adjust inputs on the fly and instantly visualize impacts across your projections.

How Fin-Wiser Helps Startups Build Smarter Financial Models

Creating an accurate, scalable, and investor-ready financial model is one of the most important strategic tasks for any startup. But doing it from scratch—while building a product, hiring a team, and raising capital—is overwhelming. That’s exactly why hundreds of early-stage founders trust Fin-Wiser.

We don’t just offer spreadsheets—we provide expert-built, real-world-tested financial models that help startups avoid costly mistakes and present with confidence.

Purpose-Built for Startup Realities

Every Fin-Wiser financial model is designed specifically for startup use cases. Whether you’re a SaaS platform, D2C brand, marketplace, or tech hardware company, our templates include:

- Fully integrated P&L, balance sheet, and cash flow statements

- Detailed burn rate tracking, by department and timeline

- Dynamic revenue and expense forecasting tied to real drivers

- Built-in funding modules, cap tables, and dilution calculators

- Scenario and sensitivity tools to test downside, base, and upside cases

Instead of wrestling with formulas or reinventing structure, you focus on strategy, fundraising, and growth.

Cap Table and Funding Round Simulation

Most startup financial models overlook the complexities of multi-round fundraising. Fin-Wiser’s templates solve this by providing:

- Pre-seed, seed, Series A/B/C funding layers

- Convertible instruments (e.g., SAFEs, notes)

- Ownership and dilution tracking

- IRR and return analysis for early investors

Whether you’re preparing for a seed pitch or modeling out your Series B, Fin-Wiser helps you stay fully informed and negotiation-ready.

Automated Cash Flow and Runway Forecasting

Cash is king—especially for startups. Fin-Wiser models provide automated cash flow views, helping you:

- Track monthly inflows and outflows

- Forecast your runway based on burn rate

- See when to raise your next round before it’s too late

Our templates eliminate manual errors and make sure your runway isn’t just a guess—it’s a number you can explain to any investor.

Investor-Ready by Design

Fin-Wiser models are designed to meet the expectations of VCs, angels, accelerators, and venture debt providers. With clean formatting, clear logic flows, and built-in dashboards, your model becomes a powerful communication tool during due diligence.

Why Startups Choose Fin-Wiser

- Save 30–50 hours of modeling work

- Avoid missteps in cap table planning, burn forecasting, and cash flow

- Present to investors with clarity, professionalism, and confidence

- Stay agile with editable, fully customizable templates

- Gain access to real-world-tested logic used in dozens of successful fundraising rounds

Ready to build a model that’s more than a spreadsheet?

Explore the full range of Fin-Wiser’s startup financial models and take the guesswork out of financial planning.

Conclusion

A well-built startup financial model is not just a tool for fundraising—it’s a blueprint for your business. It allows you to anticipate your burn rate, understand how much capital you really need, forecast your runway, and make informed strategic decisions. Most importantly, it builds trust with the investors and stakeholders who will help shape your company’s future.

As we’ve explored, the cost of financial modeling mistakes can be significant: from overstated revenue projections to poor cash flow visibility and underestimated dilution. These are not just technical errors—they’re missed opportunities, strained investor relationships, and operational missteps that could have been avoided with the right modeling foundation.

That’s where Fin-Wiser comes in. With our expert-built financial modeling templates, startups gain a ready-made structure that reflects real-world investor expectations, startup metrics, and capital planning dynamics. From pre-seed to Series A and beyond, Fin-Wiser’s startup financial models provide the clarity, flexibility, and depth founders need to move fast, raise confidently, and grow wisely.

If you’re serious about building a company that lasts—start by building a model that works.