In today’s capital-intensive world, launching a successful project—whether it’s a solar power plant, toll road, or industrial facility—requires more than a great idea. It demands a well-structured, data-driven Project Finance Model that clearly outlines how the project will be funded, operated, and generate returns.

A Project Finance Model serves as the backbone of any investment decision. It’s a comprehensive, Excel-based financial tool that forecasts a project’s cash flows, analyzes its risks, and calculates critical metrics like NPV (Net Present Value), IRR (Internal Rate of Return), and DSCR (Debt Service Coverage Ratio). Most importantly, it answers the question: Is this project financially viable, and how attractive is it to investors and lenders?

From startups raising capital to infrastructure developers bidding for PPP contracts, having a robust, transparent project finance model is no longer optional—it’s essential. It helps in negotiating with lenders, attracting equity partners, and guiding internal decision-making with confidence.

At Fin-Wiser, we work with businesses and investors across industries to build powerful, easy-to-use financial models that deliver clarity and drive funding success. Whether you’re new to modeling or looking to scale up your project evaluation capabilities, understanding how to build a project finance model from scratch is a vital skill for today’s financial professionals.

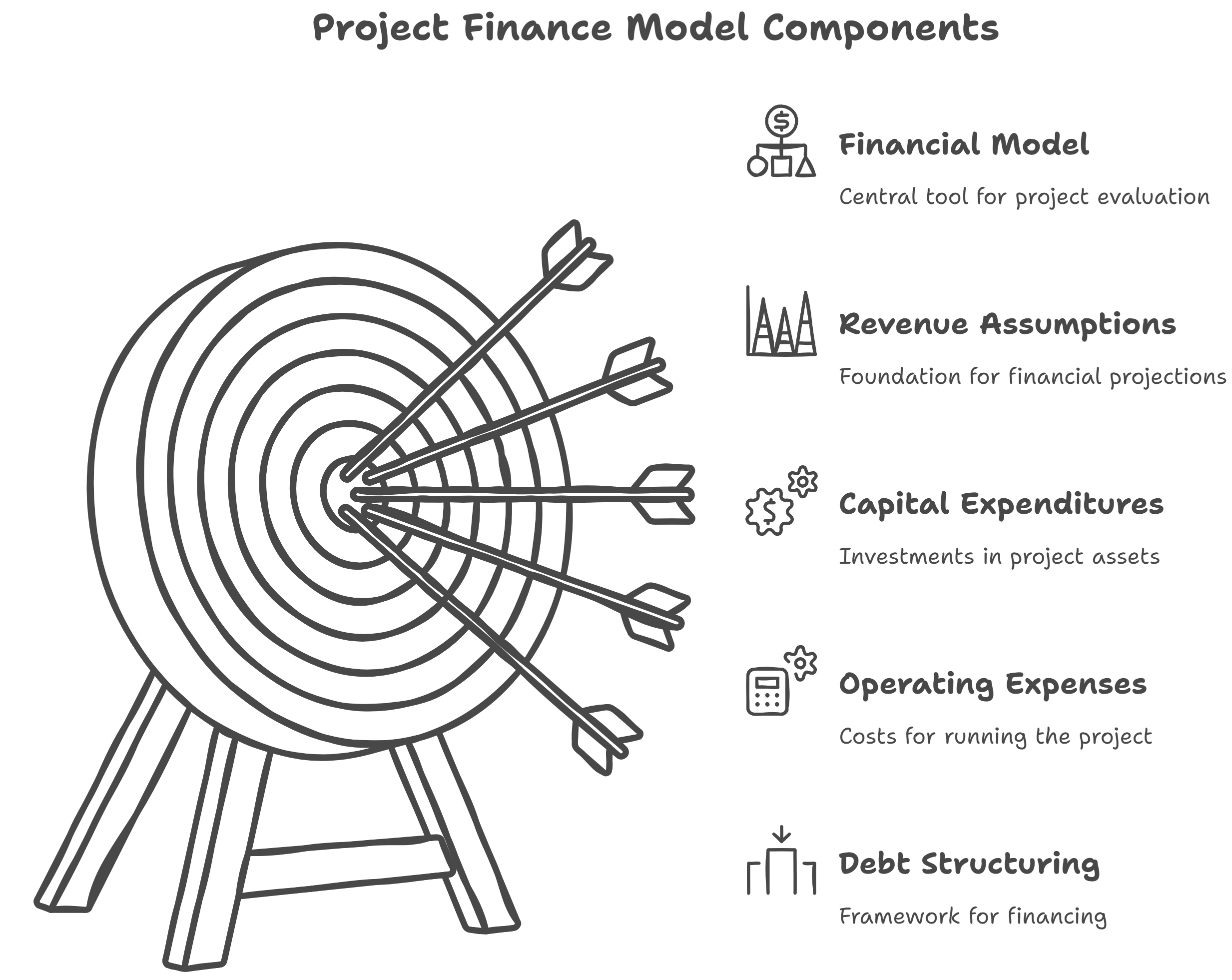

Key Components of a Project Finance Model

Before diving into how to build one, it’s crucial to understand what a solid project finance model is made of. Every model—whether for a renewable energy plant, infrastructure project, or real estate development—follows a structure built on a few foundational components. These elements work together to provide a comprehensive financial picture, from development to post-implementation.

At Fin-Wiser, every project finance model is designed with these core elements in mind to ensure accuracy, flexibility, and investor-readiness.

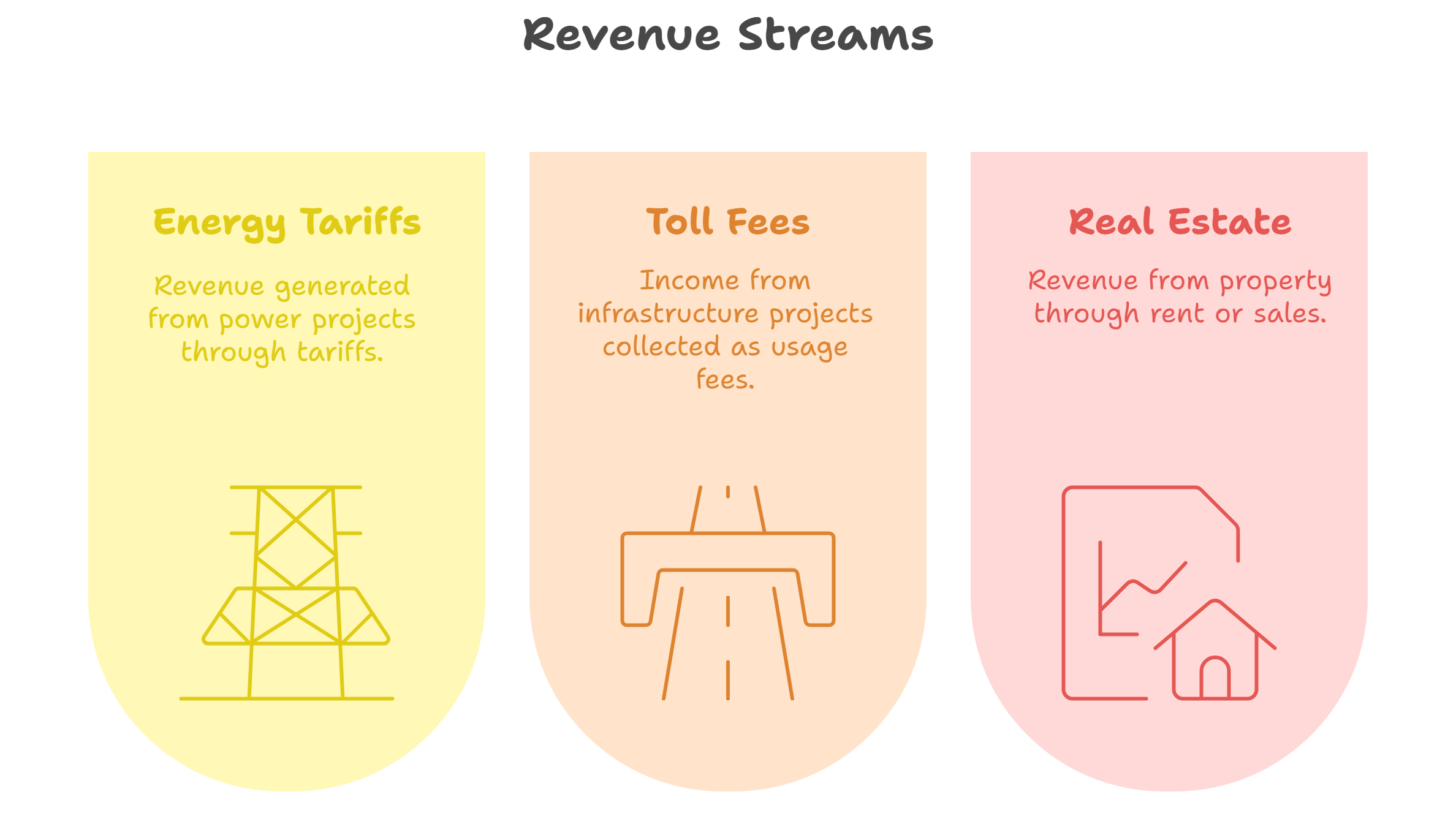

1. Revenue Assumptions

This section estimates how much money the project will earn over its lifecycle. Depending on the industry, this could include:

- Energy tariffs or PPA rates (for power projects)

- Toll or usage fees (for infrastructure)

- Rent or unit sales (for real estate)

A good model includes volume forecasts, price assumptions, escalation rates, and detailed drivers that affect income generation.

2. Capital Expenditures (CapEx)

CapEx refers to the initial costs of constructing the project, including equipment, land, engineering, and contingency. These costs are often incurred in multiple tranches over the pre-operational phase and can make or break an investment if not modeled accurately.

Your CapEx assumptions should be detailed, time-phased, and inflation-adjusted, forming the basis for funding requirement planning.

3. Operating Expenses (OpEx)

These are recurring costs to operate and maintain the project. A typical OpEx section includes:

- Staff salaries

- Maintenance and insurance

- Utilities and admin costs

Many businesses underestimate operating costs, which can distort profitability. A solid model includes realistic and escalating OpEx projections.

4. Debt Structuring and Repayment Schedule

One of the defining features of project finance is leveraging debt. The model must simulate:

- Loan drawdowns tied to project timelines

- Interest payments and principal repayments

- Debt covenants and DSCR triggers

Including senior and subordinate debt, grace periods, and refinancing options gives the model a bank-ready structure.

5. Integrated Financial Statements

A fully functional model connects all assumptions to generate:

- Income Statement

- Cash Flow Statement

- Balance Sheet

This integration ensures internal consistency and makes it easy for stakeholders to analyze key ratios, profitability, and liquidity.

6. Cash Flow Waterfall

This is a signature feature of project finance models. The cash flow waterfall shows the order of how available cash is distributed:

- Operating expenses

- Debt service

- Reserves

- Equity returns

A well-designed waterfall is essential for evaluating IRR for equity holders, and repayment capacity for lenders.

Understanding these components is step one to building a model that not only functions well but earns the confidence of financiers. All of these elements are pre-built and customizable in the templates offered by Fin-Wiser—making the modeling process both efficient and reliable.

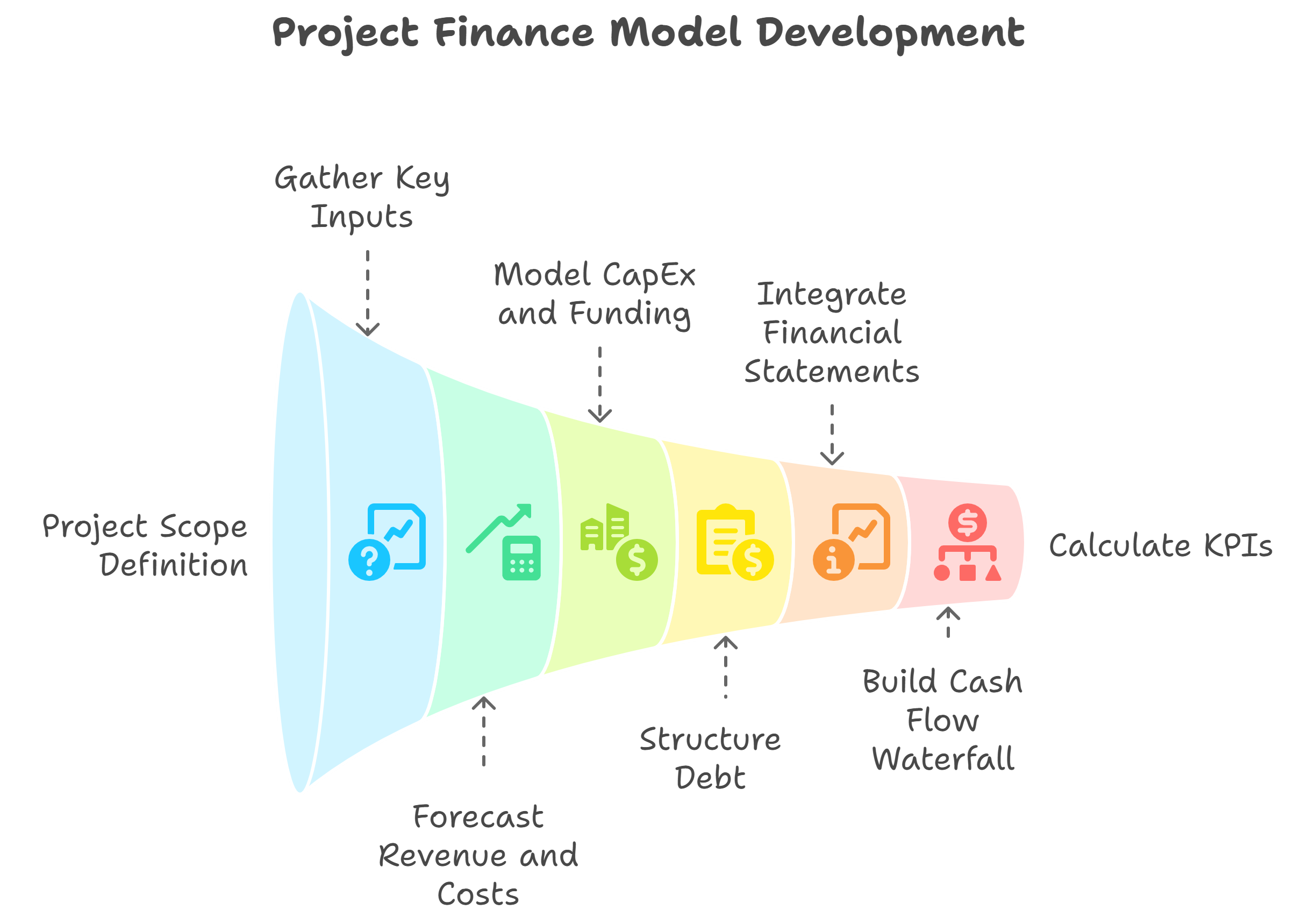

Step-by-Step Process to Build a Project Finance Model from Scratch

Building a project finance model from scratch may sound complex, but when approached methodically, it becomes a clear and logical process. Whether you’re creating a model for a solar energy project, a real estate development, or a logistics hub, the key is to maintain transparency, structure, and accuracy from the start.

At Fin-Wiser, we follow a step-by-step approach that’s been proven across sectors to build bankable models—models that investors and lenders trust.

Step 1: Define the Project Scope and Gather Data Inputs

Start by outlining the nature of the project:

- Is it greenfield or brownfield?

- What is the revenue model?

- What’s the project timeline?

Then collect relevant inputs:

- Market demand estimates

- Pricing contracts (e.g. Power Purchase Agreements, lease rates)

- Vendor quotes for CapEx and OpEx

- Financing terms

A reliable model starts with solid, realistic assumptions.

Step 2: Build Revenue and Cost Forecasts

Based on your assumptions:

- Create monthly or quarterly revenue schedules

- Factor in escalation, downtime, and seasonal effects

- Include all OpEx categories, with line-item granularity

For example, in a solar power plant, revenue would be derived from:

- Plant capacity (MW)

- Plant load factor (%)

- Tariff rate per kWh

- Degradation over time

Step 3: Model CapEx and Funding Sources

Lay out the entire project cost structure and funding plan:

- CapEx by phase or milestone

- Owner’s equity contribution

- Senior loan drawdowns

- Grant or subsidy inflows (if applicable)

Ensure you match the timing of expenditures and funding, maintaining cash flow discipline.

Step 4: Structure Debt, Repayments, and Covenants

Input financing terms such as:

- Loan tenor, grace period, and repayment frequency

- Interest rate (fixed or floating)

- DSCR requirements and cash sweep provisions

This step is where you begin to calculate repayment schedules, debt balances, and interest expenses, which feed into the financial statements.

Step 5: Integrate Financial Statements

Link your assumptions to dynamically generate:

- Income Statement (with EBITDA, net income)

- Cash Flow Statement (with operating, investing, financing flows)

- Balance Sheet (assets, liabilities, and equity)

This ensures your model is fully self-balancing and audit-ready, a critical feature for both internal use and investor presentations.

Step 6: Build the Cash Flow Waterfall and KPIs

This is where you model the sequence of payments from project cash flows:

- O&M Expenses

- Debt Service

- Reserves

- Equity Distributions

Finally, calculate key metrics:

- IRR for equity and project level

- NPV

- DSCR (annual and minimum)

- Payback period

Use visual dashboards to summarize results clearly. This adds polish and credibility to your presentation. All of these elements are already structured within Fin-Wiser’s financial modeling templates—so instead of building from zero, you can focus on analysis and insights.

Real-Life Example: Renewable Energy Project Finance Model

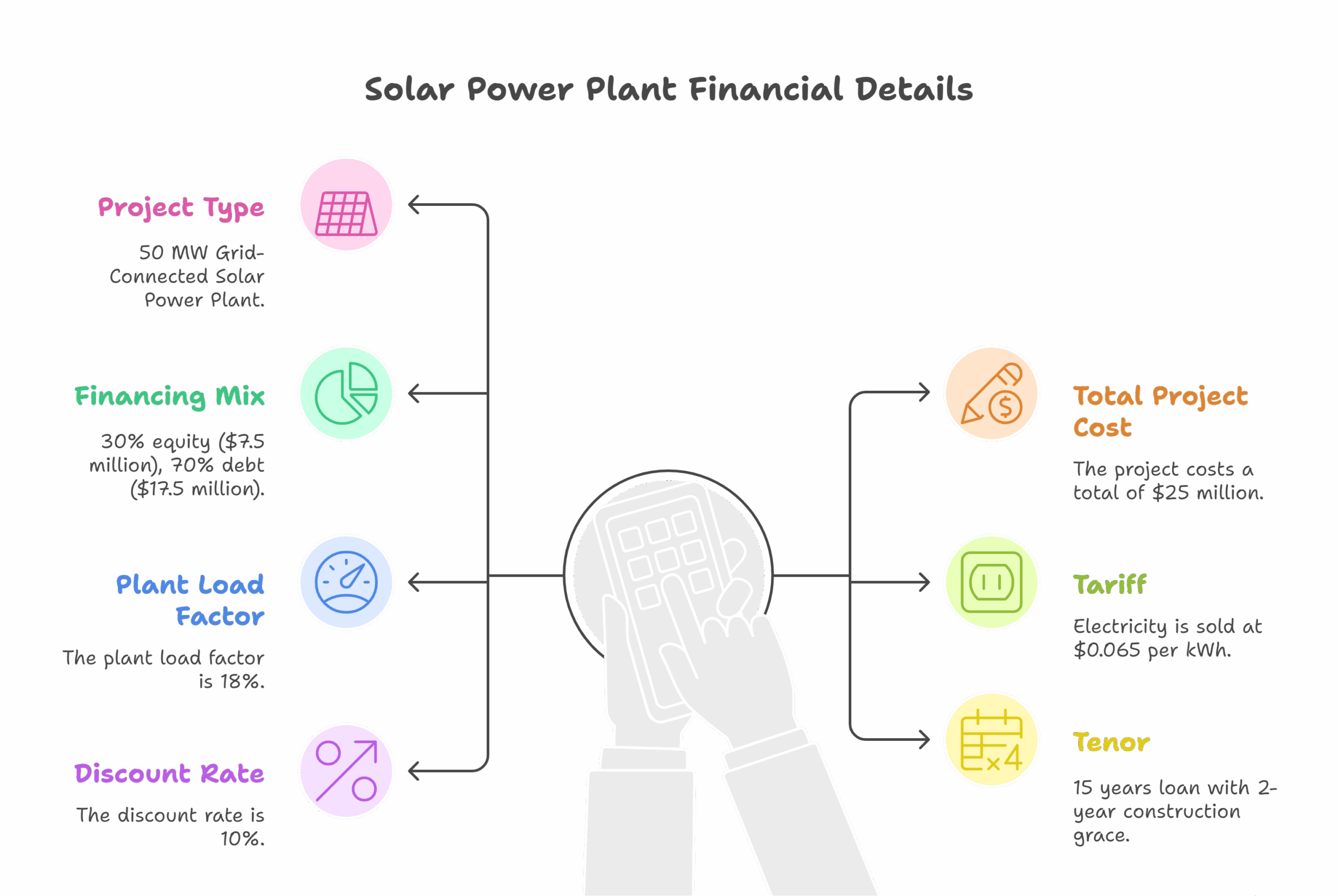

To truly understand how a project finance model functions in practice, let’s walk through a real-world case of a $25 million solar power project. This type of investment is typical in emerging markets where infrastructure is expanding and renewable energy is a high-priority sector for both governments and private equity investors.

At Fin-Wiser, we’ve helped clients structure similar models to secure debt financing and present compelling value to equity partners—fast-tracking their projects from idea to execution.

Project Overview

- Project Type: 50 MW Grid-Connected Solar Power Plant

- Total Project Cost: $25 million

- Financing Mix: 30% equity ($7.5 million), 70% debt ($17.5 million)

- Tariff: $0.065 per kWh (locked in via PPA)

- Plant Load Factor (PLF): 18%

- Tenor: 15 years loan with 2-year construction grace

- Discount Rate: 10%

Key Assumptions Used in the Model

- Annual Energy Output:

50 MW x 18% PLF x 8760 hours = ~78.8 million kWh/year - Annual Revenue:

78.8M kWh x $0.065 = ~$5.12 million/year - O&M Cost:

$450,000 annually, escalating at 3% - CapEx Disbursement:

$10 million in Year 1, $15 million in Year 2 - Debt Repayment:

Quarterly installments starting Year 3

Financial Outputs from the Model

- Net Present Value (NPV):

After applying a 10% discount rate over the project life:

NPV = $4.8 million

This indicates strong value creation above the invested capital. - Internal Rate of Return (IRR):

- Project IRR (pre-financing): 13.4%

- Equity IRR (post-financing): 18.7%

The higher equity IRR reflects the benefit of leverage in project finance.

- DSCR (Debt Service Coverage Ratio):

- Minimum DSCR: 1.24

- Average DSCR: 1.38

These values meet typical lender requirements and reflect solid repayment capacity.

- Payback Period:

- Equity Payback Period: ~6.2 years

Outcome: Investor-Ready Model That Secured Financing

With this model, the project sponsor was able to:

- Secure a long-term loan from a development finance institution

- Present an investor-ready model during fundraising rounds

- Run sensitivity scenarios on PLF, tariff, and cost escalations

- Build confidence with stakeholders using a transparent, logic-driven structure

This example illustrates the power of a well-structured project finance model: it doesn’t just crunch numbers—it builds trust. And with Fin-Wiser’s financial modeling templates, these frameworks are pre-structured for energy, infrastructure, and industrial projects, allowing you to focus on strategic thinking rather than formula mechanics.

How Fin-Wiser Simplifies Project Finance Modeling

Building a project finance model from scratch can be time-consuming, technically challenging, and prone to human error—especially when working under tight investor or lender deadlines. That’s where Fin-Wiser comes in. We simplify the process so you can focus on strategy, stakeholder engagement, and execution, not spreadsheets.

Ready-to-Use, Expert-Built Templates

Fin-Wiser offers a range of professionally developed financial models that are:

- Structured specifically for project finance

- Built with dynamic cash flow waterfalls

- Designed to handle multiple funding tranches and repayment structures

- Integrated with financial statements, KPIs, and dashboards

Whether you’re working on a renewable energy plant, toll road, airport, or real estate venture, our templates are pre-configured to support real-world project structures and assumptions.

Industry-Specific Focus

Each model is tailored to suit unique sector needs:

- Energy (solar, wind, hydro) – pre-built tariff calculators, PLF inputs, degradation models

- Infrastructure (roads, logistics, transport) – milestone-based CapEx, grant modeling, usage assumptions

- Real Estate – phased development, unit sales absorption, lease/rent cash flows

This level of specificity makes it easy for users to plug in their project assumptions and get accurate results fast.

Designed for Decision-Makers

Fin-Wiser’s financial models are built not just for analysts, but also for:

- Project developers preparing investment teasers and pitch decks

- CFOs and finance managers modeling capital structure and IRR thresholds

- Banking teams and lenders evaluating loan repayment capacity (DSCR, LLCR)

- Advisory firms running sensitivity and scenario analyses for clients

With built-in summaries, visual dashboards, and automation features, our models help you communicate complex project dynamics clearly and confidently.

Support, Customization & Scale

Need help customizing your model? Want to add mezzanine financing or restructure debt? Fin-Wiser provides:

- Customization services tailored to project complexity

- Model audits and checks for financial accuracy

- Support for investor and lender presentations

We’re not just a platform—we’re your project finance partner.

Why Choose Fin-Wiser for Project Finance Modeling?

- Save dozens of hours building from scratch

- Gain access to battle-tested structures used in real transactions

- Increase your project’s credibility with banks and investors

- Avoid modeling mistakes that can cost you millions

Visit the Fin-Wiser Online Store to access ready-to-use templates and start modeling with clarity and confidence.

Conclusion

A well-structured Project Finance Model is more than just a spreadsheet—it’s the financial engine that drives clarity, credibility, and capital. From real estate developers and renewable energy firms to infrastructure sponsors and startup founders, anyone seeking to build and fund capital-intensive projects needs a robust modeling framework to make their case compelling and their decisions bulletproof.

In this blog, we walked through the key components of a bankable model, outlined the step-by-step process to build one from scratch, and shared a real-world case study to demonstrate how these principles come to life in the field. Whether you’re forecasting revenues, structuring debt, or calculating IRR and DSCR, every part of the model must speak clearly and confidently to the stakeholders who matter most—investors, lenders, and internal decision-makers.

But you don’t have to start from a blank Excel sheet. At Fin-Wiser, we’ve done the heavy lifting for you. Our ready-to-use, industry-specific financial models help you build with speed, accuracy, and impact—so you can focus on what matters: securing funding, delivering returns, and growing with confidence.

If you’re planning a new project or need to enhance your current financial modeling capabilities, explore the Fin-Wiser Online Store for proven tools trusted by professionals around the world.

The future of your project starts with the right model. Build it right—with Fin-Wiser.