Making strategic investment decisions is critical for businesses, investors, and financial analysts. Every investment carries financial risks, and companies must ensure that capital is allocated efficiently to maximize profitability and minimize losses. This is where Net Present Value (NPV) and Internal Rate of Return (IRR) come into play. These two key financial metrics help businesses evaluate whether an investment will create value over time and determine if it aligns with the company’s financial goals.

At Fin-Wiser, we specialize in financial modeling solutions that incorporate NPV, IRR, and Discounted Cash Flow (DCF) to help businesses make accurate, data-driven investment decisions.

Why Investment Decisions Rely on NPV and IRR

Every business must decide whether to invest in new projects, acquisitions, or capital expenditures. Without proper financial evaluation, companies risk overinvesting in projects that do not generate sufficient returns.

NPV helps determine absolute profitability by calculating whether an investment will add value after considering all future cash flows.

IRR measures return efficiency, ensuring that businesses allocate capital to the most profitable projects.

Both metrics help in risk management, ensuring that investments meet the required return and do not drain company resources.

By applying NPV and IRR calculations, businesses can prioritize investments, identify high-yield opportunities, and avoid financial losses from underperforming projects.

What is Discounted Cash Flow (DCF) and Why It Matters

The foundation of NPV and IRR analysis is Discounted Cash Flow (DCF), a financial valuation method that determines the present value of future cash flows.

DCF ensures that future earnings are adjusted for risk, inflation, and time value of money.

It helps businesses evaluate the true value of an investment, considering the impact of financing costs and expected returns.

DCF is widely used in project valuation, mergers and acquisitions, and corporate financial planning.

By applying DCF analysis, businesses can ensure that they are making well-informed investment decisions rather than relying on arbitrary projections. Many companies use Fin-Wiser’s financial modeling tools to automate DCF calculations, ensuring accuracy and eliminating errors in investment evaluations.

How Businesses Use These Financial Metrics for Capital Allocation

Effective capital allocation is one of the most important responsibilities of financial executives and investors. Companies must ensure that they allocate funds to projects that generate the highest return while minimizing risk.

NPV and IRR help compare multiple investment opportunities, ensuring capital is deployed in the most profitable ventures.

Financial models incorporating DCF provide a structured approach to evaluate long-term profitability.

Businesses use these metrics to attract investors, proving that a project has strong financial viability.

For instance, a company considering an expansion into renewable energy must determine whether the long-term cash flows from the investment justify the initial capital required. By using NPV and IRR calculations, the company can quantify risk-adjusted profitability and decide whether the expansion is financially sound.

Many organizations streamline this process by using Fin-Wiser’s pre-built financial models, which offer automated NPV and IRR calculations, helping businesses make investment decisions faster and more accurately.

Understanding Discounted Cash Flow (DCF)

What is Discounted Cash Flow (DCF) Methodology?

Discounted Cash Flow (DCF) is a financial valuation method used to determine the present value of future cash flows. It is widely used in corporate finance, investment analysis, and project evaluation to assess whether an investment will generate sufficient returns over time.

The DCF methodology involves:

- Forecasting expected future cash flows from an investment.

- Applying a discount rate to adjust for the time value of money.

- Summing the present values of all future cash flows to determine whether the investment is worthwhile.

DCF calculations help businesses compare different investment opportunities, analyze profitability, and mitigate financial risks before committing capital. Companies use Fin-Wiser’s financial modeling tools to automate these calculations, ensuring accuracy and efficiency in decision-making.

Why Future Cash Flows Must Be Adjusted for the Time Value of Money

The time value of money (TVM) is the core principle behind DCF analysis. It states that a dollar received today is worth more than a dollar received in the future due to factors like inflation, opportunity cost, and risk.

- Investors prefer to receive money sooner rather than later because funds can be reinvested to generate more returns.

- Future cash flows lose value over time, meaning they must be discounted to reflect their real worth today.

- DCF applies a discount rate (such as a company’s cost of capital) to adjust for this depreciation in value.

For example, if a company expects to earn $1 million from an investment five years from now, it cannot treat this amount as equal to $1 million today. By discounting the future cash flow at an appropriate rate, DCF converts it into an equivalent present value, making financial comparison possible.

Businesses use Fin-Wiser’s pre-built financial models to quickly apply discount rates and ensure time-adjusted investment valuations.

DCF as the Foundation for Investment Analysis

DCF is the backbone of investment evaluation because it provides a systematic approach to quantifying profitability. Companies rely on DCF analysis to:

- Assess whether an investment will generate long-term value.

- Compare multiple projects by determining their present worth.

- Measure financial viability before committing capital.

- Ensure risk-adjusted investment planning.

By integrating DCF into NPV and IRR calculations, businesses gain a clearer understanding of an investment’s true profitability. Financial analysts, investors, and CFOs use Fin-Wiser’s automated financial models to streamline DCF-based investment analysis and improve decision-making.

Why NPV and IRR Matter in Investment Decisions

How NPV Ensures Absolute Profitability Analysis

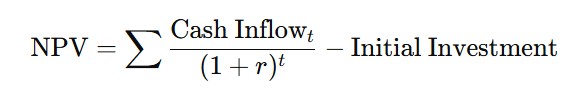

Net Present Value (NPV) is one of the most critical financial metrics for evaluating an investment’s absolute profitability. It determines whether a project or investment will create value by comparing the present value of expected cash inflows to the initial investment cost.

- NPV quantifies actual profit or loss in monetary terms, making it easy to determine if an investment is worthwhile.

- A positive NPV indicates that the investment creates value, while a negative NPV suggests the project will result in financial loss.

- Unlike IRR, NPV provides a concrete dollar amount, which is more reliable for making investment decisions.

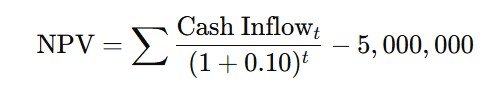

For example, a company investing $5 million in a manufacturing plant expects to generate $1.5 million per year in net cash inflows for five years. Using a discount rate of 10%, the company calculates:

After performing the calculation, the NPV is $1.2 million. Since it is positive, the company should proceed with the investment, as it will generate additional value.

Businesses that want to automate NPV calculations and avoid manual errors use Fin-Wiser’s financial models, which provide pre-built templates for precise NPV analysis.

How IRR Helps Compare Investment Returns Efficiently

Internal Rate of Return (IRR) measures the return percentage of an investment, helping businesses compare multiple opportunities and choose the most profitable option.

- IRR simplifies investment comparisons by expressing profitability as a percentage, making it easy to benchmark against other investments or financing costs.

- A project is considered viable if its IRR is higher than the company’s required rate of return or cost of capital.

- IRR is useful for ranking investment opportunities, especially when companies have limited capital and must select the best-performing projects.

For example, a real estate firm is considering two commercial property investments:

- Project A: Requires a $3 million investment and generates $500,000 annual rental income for 10 years.

- Project B: Requires a $2 million investment and generates $350,000 annual rental income for 10 years.

After performing IRR calculations:

- Project A IRR = 13.5%

- Project B IRR = 15.2%

Since Project B has a higher IRR, it provides a better return efficiency relative to its investment cost. However, IRR alone should not be the sole decision metric—NPV should also be evaluated to ensure total profitability.

To avoid calculation errors and streamline investment comparisons, businesses use Fin-Wiser’s automated IRR models for precise financial forecasting.

How These Metrics Help Businesses Minimize Risk and Maximize Returns

Both NPV and IRR are essential for minimizing financial risk and ensuring optimal capital allocation.

- NPV helps avoid unprofitable investments by providing a clear monetary valuation.

- IRR helps businesses allocate capital efficiently by selecting the most return-generating projects.

- Combining both metrics prevents decision-making errors, ensuring businesses do not rely on just one factor.

For example, in mergers and acquisitions (M&A), companies analyze both NPV and IRR to determine whether an acquisition will generate long-term shareholder value. If an acquisition has a high IRR but negative NPV, it could indicate hidden financial risks that need further evaluation.

Companies that want to reduce risk and improve investment accuracy use Fin-Wiser’s financial modeling tools, which include built-in risk assessments and scenario analysis.

Real-Life Example: NPV and IRR in Business

Case Study: Evaluating a $10 Million Renewable Energy Project

A global renewable energy company is considering investing $10 million in a solar power plant that will generate electricity for the next 15 years. The project is expected to produce annual cash inflows of $1.5 million. The company’s required rate of return (discount rate) is 8%.

The key question: Should the company proceed with this investment? To determine this, the company will calculate Net Present Value (NPV) and Internal Rate of Return (IRR) to evaluate the project’s financial viability.

Step 1: NPV Calculation for the Solar Power Project

Applying the NPV Formula:

.

Where:

- r = 8% (Discount rate)

- t = 1 to 15 years

- Initial Investment = $10 million

- Annual Cash Inflow = $1.5 million

Using the discounted cash flow method, the present value of each cash inflow is calculated:

After performing the calculations, the NPV = $2.75 million.

Decision Based on NPV:

Since NPV is positive ($2.75 million), the project is expected to generate additional value beyond the initial investment. This means the company should proceed as the project is financially viable.

To automate NPV calculations and improve accuracy, businesses use Fin-Wiser’s financial models for faster and error-free investment evaluations.

Step 2: IRR Calculation for the Solar Power Project

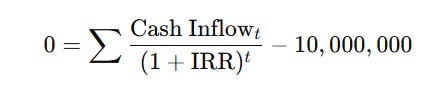

IRR is the rate at which NPV = 0, meaning the project breaks even in terms of profitability.

Since solving for IRR requires trial and error, companies typically use Excel’s IRR function or financial modeling software. After running the calculations:

Decision Based on IRR:

The calculated IRR of 11.5% is higher than the required return of 8%, meaning the project exceeds the company’s cost of capital and is a good investment.

To avoid manual calculation errors, businesses use Fin-Wiser’s automated IRR models, which provide quick and accurate investment analysis.

Final Decision: Approving the Renewable Energy Investment

Based on the NPV and IRR results, the company makes the following conclusions:

- NPV confirms the project will create $2.75 million in additional value.

- IRR shows the project generates an 11.5% return, which exceeds the 8% required rate.

- Both metrics indicate financial viability, making this a strong investment opportunity.

Thus, the company approves the solar power plant project as it aligns with their profitability and sustainability goals.

How Businesses Use NPV and IRR for Real Investment Decisions

This case study illustrates how NPV and IRR help businesses make critical investment decisions.

- NPV ensures total value creation, preventing financial losses from unprofitable projects.

- IRR provides a return percentage, helping businesses compare multiple investment opportunities.

- Both metrics work together to create a risk-adjusted financial strategy.

For organizations seeking to improve investment accuracy, Fin-Wiser’s pre-built financial models offer automated NPV and IRR calculations, ensuring businesses make the right investment choices with confidence.

Common Pitfalls & Misinterpretations of NPV and IRR

While NPV and IRR are essential financial tools for evaluating investments, they can sometimes lead to misleading conclusions if not interpreted correctly. Many businesses make investment mistakes by relying too heavily on one metric or misunderstanding its implications.

This section highlights the common pitfalls of NPV and IRR, how to avoid misinterpretations, and how businesses can use Fin-Wiser’s financial models to ensure more accurate investment decisions.

Multiple IRR Issues in Complex Cash Flow Scenarios

What Causes Multiple IRRs?

In projects where cash flows alternate between positive and negative multiple times, the IRR calculation can produce more than one valid IRR, leading to confusion in decision-making. This often happens in investments that require:

- Large reinvestments at different project stages (e.g., infrastructure and R&D projects).

- Variable cost structures where cash outflows occur later in the project life cycle.

Example of Multiple IRRs

A company invests $5 million in a project and expects cash flows as follows:

- Year 1: $2 million (positive)

- Year 2: -$3 million (negative) (additional investment required)

- Year 3: $5 million (positive)

Using standard IRR calculations, the company finds two possible IRR values: 10% and 22%, creating uncertainty about which one is correct.

How to Avoid This Issue

- Use Modified Internal Rate of Return (MIRR) instead of IRR to adjust for multiple reinvestments.

- Cross-check investment viability with NPV, which always provides a single, clear profitability measure.

- Leverage financial models like those available at Fin-Wiser Online Store to detect multiple IRRs and avoid misinterpretations.

Why High IRR Does Not Always Mean a Better Investment

Understanding IRR’s Limitations

Many investors assume that a higher IRR is always better, but this is not necessarily true. IRR does not account for the absolute size of the investment or the total value generated, which can lead to poor capital allocation.

Example of Misleading IRR Decisions

A company is comparing two investment opportunities:

- Project A: Requires $500,000 investment and generates an IRR of 30% but only creates $150,000 in total NPV.

- Project B: Requires $5 million investment and generates an IRR of 15% but creates $1.2 million in NPV.

If the company chooses Project A solely based on IRR, it might miss out on the significantly higher total profitability of Project B.

How to Avoid This Issue

- Always compare NPV and IRR together—a high IRR on a small investment might not be as valuable as a lower IRR on a larger, high-profit project.

- Consider investment size and scale, as IRR alone cannot indicate the total wealth created.

- Use Fin-Wiser’s financial models to integrate NPV and IRR together for a more accurate financial evaluation.

How Failing to Consider NPV Can Lead to Incorrect Financial Decisions

The Problem with Ignoring NPV

Many businesses focus solely on IRR because it is easier to interpret, but this can lead to investment mistakes. NPV is the only metric that directly measures value creation in absolute terms—without it, companies risk choosing investments that do not maximize financial returns.

Example of Over-Reliance on IRR

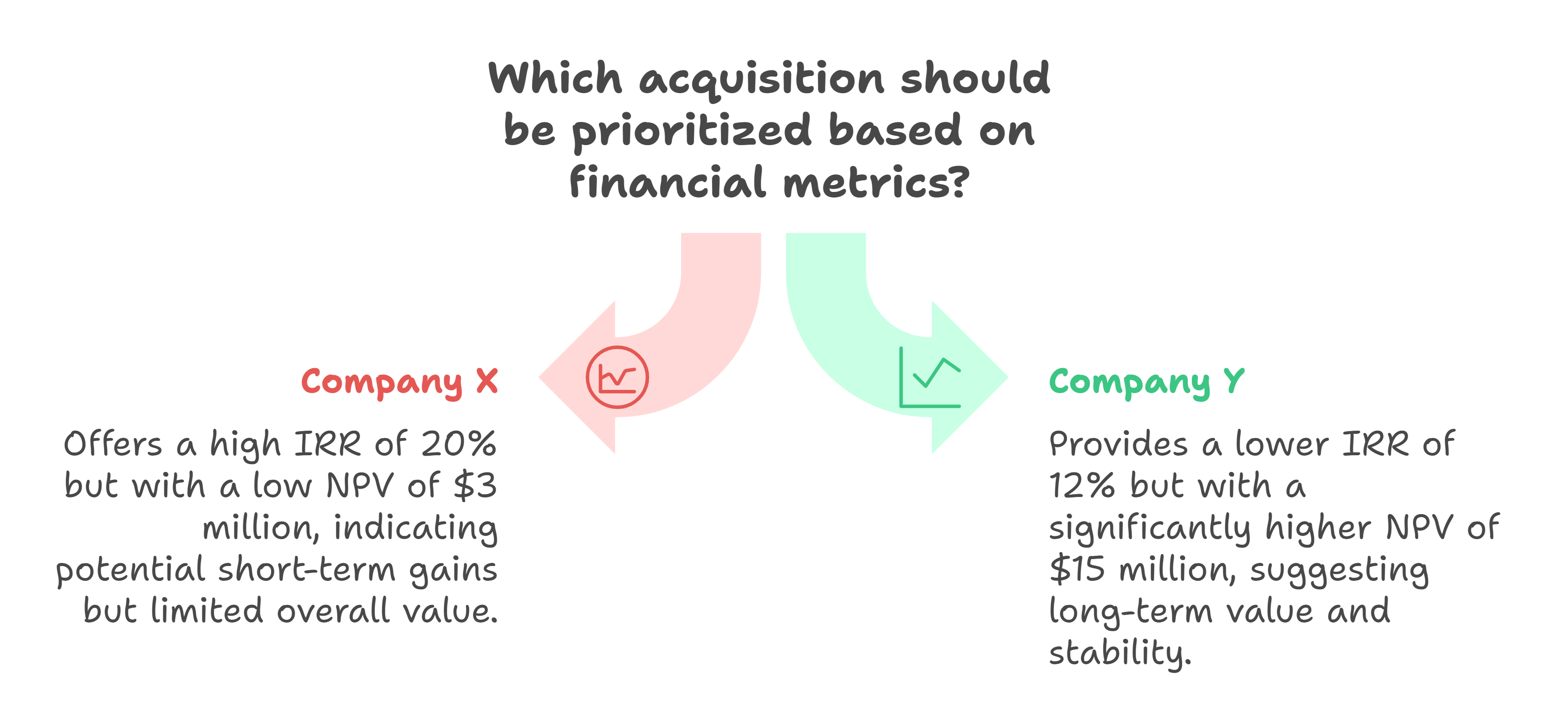

A private equity firm is considering two potential acquisitions:

- Company X: Offers 20% IRR but only generates $3 million in total NPV.

- Company Y: Offers 12% IRR but generates $15 million in NPV.

If the firm only looks at IRR, it may select Company X based on return efficiency, even though Company Y creates far greater total value.

How to Avoid This Issue

- Use NPV as the primary investment metric, as it reflects the real financial benefit.

- IRR should be used as a secondary measure, helping compare projects but not as the sole decision factor.

- Automate NPV and IRR calculations using Fin-Wiser’s pre-built financial models to ensure investment choices align with overall business goals.

Key Takeaways: How to Avoid NPV and IRR Misinterpretations

- NPV should always be the primary metric as it measures actual monetary value creation.

- IRR alone is not sufficient—it must be compared alongside NPV to ensure correct decision-making.

- Multiple IRRs can mislead investors—using Modified IRR (MIRR) or NPV helps prevent confusion.

- Bigger investments with slightly lower IRRs may be more valuable than small, high-IRR projects.

- Financial modeling tools like those from Fin-Wiser help businesses make accurate and well-informed investment decisions.

How Fin-Wiser Helps Businesses Optimize Financial Decisions

Making accurate financial decisions requires precision, advanced modeling techniques, and reliable investment analysis tools. Many businesses struggle with manual calculations, misinterpret financial metrics, or lack the resources to analyze investment opportunities efficiently.

At Fin-Wiser, we provide expert-built financial models that simplify complex investment evaluations, ensuring businesses make data-driven, risk-adjusted decisions with confidence.

Fin-Wiser Solutions for Financial Modeling

Financial modeling is the foundation of strategic investment planning. Without accurate models, businesses may miscalculate project feasibility, leading to poor capital allocation and lost opportunities.

Fin-Wiser provides pre-built and customizable financial models designed to help businesses:

- Analyze investment opportunities efficiently, eliminating the need for manual calculations.

- Assess project profitability using NPV and IRR with built-in discount rate adjustments.

- Perform scenario analysis and stress testing, ensuring robust financial forecasting.

- Identify financial risks early, allowing businesses to mitigate potential losses.

Using Fin-Wiser’s financial modeling tools, businesses can evaluate capital projects, corporate acquisitions, infrastructure investments, and financial planning strategies with higher accuracy and reduced time constraints.

Pre-Built NPV and IRR Calculation Models for Accurate Analysis

Manually calculating Net Present Value (NPV) and Internal Rate of Return (IRR) can be time-consuming, error-prone, and complex—especially for large-scale projects. Fin-Wiser’s pre-built financial models eliminate these challenges by offering automated investment evaluation tools.

Key Features of Fin-Wiser’s NPV and IRR Models

- Instant NPV and IRR calculations with error-free formulas.

- Dynamic discount rate adjustments, allowing businesses to test multiple investment scenarios.

- Cash flow forecasting tools, ensuring accurate projections for long-term investments.

- Customizable templates for different industries, including renewable energy, real estate, private equity, and infrastructure.

For businesses that require fast and precise financial evaluations, our pre-built NPV and IRR models help automate investment decisions, reducing risks and improving capital allocation.

Helping Businesses Make Data-Driven Decisions with Expert Financial Tools

Investment decisions should never be based on assumptions or incomplete data. At Fin-Wiser, we believe in evidence-based financial planning, where companies rely on structured financial models to validate their investment strategies.

Our financial models help businesses:

- Compare multiple investment options to determine the highest-value projects.

- Eliminate errors in financial analysis, reducing the risk of misinterpretation.

- Optimize capital allocation, ensuring funds are invested in projects with the best returns.

- Generate real-time financial reports that support strategic decision-making.

For businesses aiming to enhance their financial planning accuracy, Fin-Wiser’s financial modeling solutions provide the most efficient way to analyze investments, minimize risks, and maximize returns.

Conclusion

Final Thoughts on the Power of Discounted Cash Flow Analysis

Investment decisions require precision, strategic planning, and reliable financial metrics to ensure profitability and risk mitigation. Discounted Cash Flow (DCF) analysis serves as the foundation for evaluating long-term investments, ensuring that future cash flows are accurately assessed for their true present value.

By leveraging DCF-based metrics such as Net Present Value (NPV) and Internal Rate of Return (IRR), businesses can:

- Measure absolute profitability and ensure capital is allocated to high-value projects.

- Compare multiple investment opportunities and choose the most efficient return-generating options.

- Avoid common financial misinterpretations, reducing risks associated with overestimating or miscalculating investment returns.

Companies that rely on manual calculations or incomplete financial analysis may struggle to make informed investment decisions. By using structured financial models, businesses can optimize their investment evaluations and ensure long-term success.

The Right Balance Between NPV and IRR for Strategic Business Planning

Both NPV and IRR are essential tools in capital budgeting and corporate finance. However, businesses must use them together to achieve optimal investment decisions.

- NPV provides a definitive measure of value creation and should always be the primary metric when evaluating investments.

- IRR offers a return percentage, making it useful for comparing projects, but it should never be used in isolation.

- Using both metrics ensures a well-rounded investment evaluation, preventing misjudgments in financial forecasting.

By integrating NPV, IRR, and DCF models, businesses can create a structured financial planning framework that supports growth, profitability, and risk management.

For organizations seeking to enhance their investment analysis, Fin-Wiser’s financial models provide automated, accurate, and efficient tools to simplify capital allocation and business expansion strategies.