Making the right investment decisions is critical for businesses in real estate, startups, and corporate finance. Whether a company is evaluating a property investment, funding a startup, or expanding operations, financial leaders must rely on accurate profitability metrics to guide their decisions. This is where Net Present Value (NPV) and Internal Rate of Return (IRR) play a vital role.

At Fin-Wiser, we specialize in financial modeling solutions that help businesses analyze NPV and IRR calculations with precision, ensuring data-driven investment decisions that maximize returns.

Why NPV and IRR Are Essential for Businesses

Every investment comes with future cash flows, risks, and uncertainties. NPV and IRR help businesses quantify investment value and decide whether a project is financially viable.

- NPV measures the total profitability of an investment by calculating the difference between expected future cash inflows and the initial investment.

- IRR determines the return efficiency of an investment, providing a percentage that helps compare different investment options.

- Using both metrics together ensures accurate investment evaluation, minimizing financial risks and optimizing capital allocation.

How Businesses Use NPV and IRR for Smarter Investment Decisions

Companies across different industries use NPV and IRR to evaluate:

- Real estate investments (e.g., commercial properties, rental projects, land acquisitions).

- Startup funding decisions (e.g., venture capital investments, valuation of early-stage companies).

- Corporate financial planning (e.g., mergers and acquisitions, capital expenditures, business expansion).

For example, a real estate investor analyzing a $5 million commercial property will use NPV to measure long-term value creation and IRR to compare different property investment opportunities. Similarly, a venture capitalist funding a tech startup will assess NPV to determine expected profitability and IRR to evaluate return efficiency over multiple funding rounds.

Many businesses streamline this process by using Fin-Wiser’s pre-built financial models, which automate NPV and IRR calculations, ensuring accurate investment forecasting and risk assessment.

Understanding NPV and IRR in Investment Decisions

What is NPV and How It Measures Absolute Profitability?

Net Present Value (NPV) is a key financial metric used to determine whether an investment will generate more value than it costs. It calculates the present value of expected future cash flows by discounting them using a predetermined rate—usually the cost of capital or required rate of return.

Why NPV is Important for Businesses

- NPV provides a clear measure of profitability by showing the total dollar amount a project will contribute after adjusting for the time value of money.

- A positive NPV means an investment is profitable, while a negative NPV indicates a financial loss.

- It helps compare multiple investment opportunities, allowing businesses to allocate capital efficiently.

Example of NPV Calculation

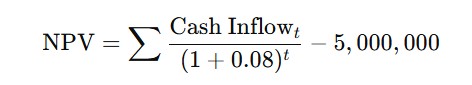

A real estate developer is evaluating a $5 million investment in a commercial property expected to generate $800,000 in annual rental income for 10 years. The company’s required rate of return is 8%.

After discounting the future cash flows, the NPV is calculated as $1.2 million, meaning the investment creates additional value.

Businesses that want to automate NPV calculations and avoid manual errors use Fin-Wiser’s financial models, which provide pre-built templates for precise NPV analysis.

What is IRR and How It Helps Compare Investment Returns?

Internal Rate of Return (IRR) is another crucial metric that calculates the discount rate at which an investment’s NPV equals zero. Unlike NPV, which provides an absolute dollar amount, IRR expresses profitability as a percentage, making it easier to compare different investment options.

Why IRR is Important for Businesses

- IRR helps compare multiple investment opportunities by expressing profitability in percentage terms.

- If IRR is higher than the cost of capital, the investment is financially viable.

- It is particularly useful for ranking investment options when businesses must choose between projects with different sizes and timelines.

Example of IRR Calculation

A venture capital firm is considering investing $2 million in a tech startup that is projected to generate increasing cash flows over the next five years. After applying the IRR formula:

The calculated IRR is 18.5%, which exceeds the investor’s required return of 12%, indicating that the startup investment is a good opportunity.

To streamline IRR calculations and compare investment options efficiently, businesses use Fin-Wiser’s automated IRR models, which provide instant results and scenario analysis.

Why Businesses Must Use Both NPV and IRR Together

While NPV and IRR serve different purposes, they complement each other in investment analysis.

- NPV should always be the primary metric, as it quantifies the total monetary value an investment creates.

- IRR is useful for comparing multiple investment opportunities, especially when businesses need to allocate limited capital.

- Using both metrics ensures a well-rounded investment evaluation, helping businesses avoid misinterpretations.

For example, in corporate finance decisions, a multinational company investing $20 million in a new manufacturing facility would use:

- NPV to determine the absolute financial gain from the project.

- IRR to compare the return rate against other expansion opportunities.

Many businesses eliminate errors and improve financial accuracy by using Fin-Wiser’s financial modeling tools, which integrate NPV and IRR calculations into automated templates.

How Businesses Use NPV and IRR in Different Sectors

NPV and IRR in Real Estate Investments

In the real estate industry, investors and developers use NPV and IRR to evaluate property acquisitions, rental income projects, and large-scale developments. Since real estate investments involve long-term cash flows, risk factors, and financing costs, financial analysis is crucial for ensuring profitability.

How Real Estate Investors Use NPV and IRR

- NPV helps determine the actual financial value of a real estate investment after adjusting for future cash inflows from rental income or property appreciation.

- IRR allows investors to compare multiple real estate opportunities by calculating the annualized return percentage on different properties.

- Using both metrics together ensures smart capital allocation, minimizing risk and maximizing property returns.

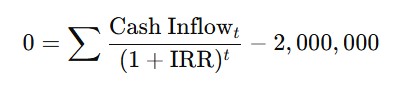

Case Study: Evaluating a $5 Million Commercial Property Investment

A real estate firm is considering acquiring a commercial property for $5 million, expecting to generate $800,000 in annual rental income for 10 years. The firm’s required rate of return is 8%.

- NPV Calculation: After discounting future rental income, the NPV is $1.2 million, confirming that the investment adds value.

- IRR Calculation: The calculated IRR is 11.5%, which is higher than the required return of 8%, making the investment a strong choice.

To streamline NPV and IRR calculations, real estate investors use Fin-Wiser’s financial models for automated profitability analysis.

NPV and IRR in Startup Investments

In the startup ecosystem, venture capitalists (VCs) and angel investors use NPV and IRR to assess early-stage business valuations, funding decisions, and exit strategies. Since startup investments carry high risks and uncertain cash flows, financial modeling is crucial for estimating long-term profitability.

How Investors Use NPV and IRR in Startups

- NPV helps investors determine the present value of a startup’s expected earnings, ensuring that the investment aligns with long-term growth projections.

- IRR allows venture capitalists to measure the annualized return on their investment, helping them prioritize funding opportunities.

- Using both metrics together helps VCs make informed decisions, especially when evaluating multiple startups.

Case Study: Venture Capital Firm Funding a $2 Million Tech Startup

A VC firm is considering investing $2 million in a tech startup, expecting the company to generate $5 million in net profits over five years.

- NPV Calculation: After adjusting for risk and discounting future cash flows, the NPV is $750,000, indicating a strong potential for profit.

- IRR Calculation: The calculated IRR is 22%, making the investment attractive since it exceeds the VC’s required return of 15%.

Investors seeking accurate NPV and IRR projections use Fin-Wiser’s financial modeling tools for automated startup valuation.

NPV and IRR in Corporate Finance

In corporate finance, businesses use NPV and IRR for capital budgeting, expansion projects, and mergers & acquisitions (M&A). These metrics help executives make strategic financial decisions, ensuring that investments contribute to long-term company growth.

How Corporations Use NPV and IRR

- NPV helps corporations evaluate mergers, acquisitions, and capital expenditures, ensuring positive shareholder value.

- IRR provides a return percentage that helps executives compare multiple expansion projects to determine the most profitable one.

- Using both metrics together minimizes investment risk and improves financial forecasting.

Case Study: A Corporation Investing $20 Million in a Manufacturing Expansion

A multinational company plans to invest $20 million in a new manufacturing plant, with expected cash inflows of $5 million per year for six years.

- NPV Calculation: After discounting future cash inflows, the NPV is $3.5 million, confirming long-term value creation.

- IRR Calculation: The IRR is 14%, exceeding the company’s required return of 10%, making it a financially viable project.

For accurate capital budgeting and investment analysis, businesses use Fin-Wiser’s automated financial models to evaluate profitability efficiently.

Common Pitfalls & How to Avoid Them

While NPV and IRR are powerful financial tools, businesses often misinterpret their results or use them incorrectly, leading to poor investment decisions. Understanding these common pitfalls can help businesses make more accurate, risk-adjusted financial evaluations.

1. Misinterpreting IRR in Complex Cash Flow Scenarios

The Problem

IRR is commonly misused when investments involve fluctuating cash flows (e.g., multiple inflows and outflows over time). In such cases, IRR may produce multiple values, leading to confusion.

For example, a real estate investor renovates a commercial property in two phases, requiring additional investments in year 3. If the project generates both positive and negative cash flows, the IRR calculation may return two different results, making it unclear which one to use.

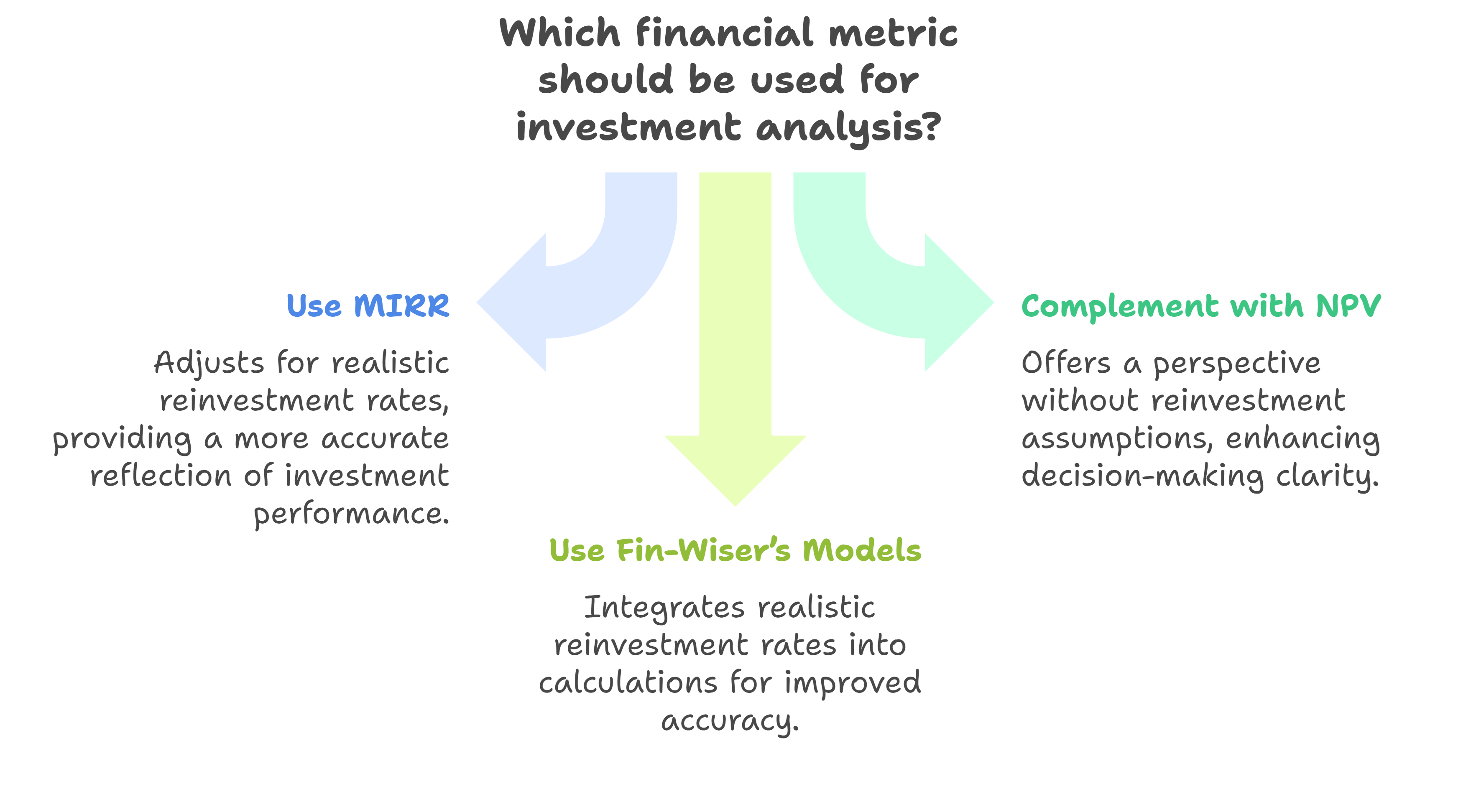

How to Avoid This Issue

- Use NPV as the primary decision-making tool, as it always provides a single, clear value.

- Apply Modified Internal Rate of Return (MIRR) instead of IRR, as it adjusts for reinvestment assumptions.

- Utilize financial modeling tools like Fin-Wiser’s IRR analysis models to detect multiple IRRs and prevent misinterpretation.

2. Assuming a High IRR Means a Better Investment

The Problem

Many investors assume that a higher IRR always indicates a better investment, which is not necessarily true. IRR does not account for investment size or total value created, which can lead to misleading comparisons.

For example, a venture capital firm has two investment opportunities:

- Startup A: Requires $1 million investment and has an IRR of 35%, but generates only $500,000 in net value.

- Startup B: Requires $5 million investment and has an IRR of 18%, but generates $3 million in net value.

If the firm only looks at IRR, it might choose Startup A, despite Startup B generating far greater total value.

How to Avoid This Issue

- Prioritize NPV over IRR, as NPV reflects the total financial benefit of an investment.

- Use IRR as a comparison tool, not as the primary decision metric.

- Rely on structured financial models, such as Fin-Wiser’s automated NPV calculators to ensure investments create maximum value.

3. Ignoring Risk and Discount Rate Adjustments

The Problem

NPV calculations rely on the discount rate, which represents the cost of capital or required return. Many businesses fail to adjust for risks properly, leading to overly optimistic financial projections.

For example, a corporation expanding into an emerging market may assume a discount rate of 10%, but given the economic and political risks, a 12% discount rate would be more appropriate. If the company underestimates risk, it may overvalue the investment and make a costly mistake.

How to Avoid This Issue

- Adjust the discount rate to reflect investment risk, considering factors like inflation, industry trends, and geopolitical risks.

- Run multiple scenarios with different discount rates, testing how sensitive NPV is to changes.

- Use Fin-Wiser’s financial models with built-in risk assessments to apply realistic discount rate assumptions.

4. Using IRR Without Considering Reinvestment Assumptions

The Problem

IRR assumes that all cash inflows are reinvested at the same IRR rate, which is often unrealistic. In reality, businesses may not find equally high-return reinvestment opportunities, leading to an overestimated return.

For example, if a real estate investor sells a property with a 20% IRR, they may struggle to reinvest the proceeds into a project that also generates 20% returns, resulting in lower-than-expected profits.

How to Avoid This Issue

- Use Modified Internal Rate of Return (MIRR) instead of standard IRR, as MIRR adjusts for more realistic reinvestment rates.

- Complement IRR analysis with NPV, which does not require reinvestment assumptions.

- Utilize Fin-Wiser’s IRR models to integrate realistic reinvestment rates into investment calculations.

5. Overlooking NPV in Favor of IRR Alone

The Problem

Many businesses rely solely on IRR because it provides a simple percentage, but IRR alone does not show actual monetary gains. Ignoring NPV can result in companies choosing investments that look attractive on paper but do not create significant value.

For example, a corporate finance team evaluating two expansion projects may see:

- Project A: IRR = 15%, NPV = $2 million.

- Project B: IRR = 12%, NPV = $5 million.

If they only use IRR, they might choose Project A, even though Project B generates more total profit.

How to Avoid This Issue

- Always use NPV as the primary decision-making metric, as it measures actual value creation.

- Use IRR for comparing investment efficiency, but never as the sole basis for decision-making.

- Leverage financial models like Fin-Wiser’s NPV and IRR calculators to ensure both metrics are used correctly.

How Fin-Wiser Helps Businesses Make Smarter Investment Decisions

Investment analysis requires precision, strategic planning, and reliable financial models to ensure businesses allocate capital effectively. Many companies struggle with manual calculations, misinterpret financial metrics, or lack the expertise to build complex investment models.

At Fin-Wiser, we provide expert-built financial models that help businesses make accurate, data-driven investment decisions while minimizing financial risks.

Fin-Wiser’s Advanced Financial Modeling Solutions

Financial modeling is the backbone of effective investment planning. Without structured models, businesses risk making inaccurate profitability projections, misallocating capital, or underestimating financial risks.

Fin-Wiser offers pre-built and customizable financial models designed to help businesses:

- Evaluate investments efficiently, eliminating the risk of calculation errors.

- Analyze NPV and IRR calculations accurately, ensuring profitable decision-making.

- Perform scenario analysis, helping businesses adjust for changing economic conditions.

- Identify financial risks early, allowing proactive investment strategies.

Using Fin-Wiser’s financial modeling tools, businesses can perform detailed investment analysis without the complexity of manual financial forecasting.

Pre-Built NPV and IRR Calculation Models for Accurate Investment Analysis

Manually calculating Net Present Value (NPV) and Internal Rate of Return (IRR) can be time-consuming and prone to errors, especially for large-scale projects or multiple investment comparisons.

Fin-Wiser’s pre-built financial models eliminate these challenges by offering automated investment evaluation tools.

Key Features of Fin-Wiser’s NPV and IRR Models

- Instant NPV and IRR calculations with built-in accuracy checks.

- Dynamic discount rate adjustments, allowing businesses to test multiple financial scenarios.

- Cash flow forecasting templates, ensuring realistic long-term financial planning.

- Customizable models for different industries, including real estate, startups, and corporate finance.

For businesses that require fast and precise financial evaluations, our pre-built NPV and IRR models provide a structured framework to assess investment profitability efficiently.

How Fin-Wiser Helps Businesses Make Data-Driven Decisions

Investment decisions should never rely on assumptions or outdated financial methods. At Fin-Wiser, we emphasize data-driven financial analysis, ensuring businesses can make informed investment choices.

Our financial models help businesses:

- Compare multiple investment options based on real-time financial projections.

- Eliminate errors in financial analysis, ensuring accurate decision-making.

- Optimize capital allocation, prioritizing projects with the highest value generation.

- Generate automated financial reports, providing deep insights for strategic planning.

For businesses aiming to increase investment accuracy, Fin-Wiser’s financial modeling solutions offer the most reliable way to analyze capital investments, reduce financial risks, and maximize returns.

Conclusion

Final Thoughts on the Importance of NPV and IRR in Business Investments

Making strategic investment decisions requires a clear understanding of financial viability, risk, and return potential. Businesses across real estate, startups, and corporate finance rely on Net Present Value (NPV) and Internal Rate of Return (IRR) to evaluate long-term profitability and investment efficiency.

- NPV provides an absolute measure of an investment’s value, helping businesses determine whether a project will generate sufficient returns.

- IRR helps businesses compare multiple investment opportunities, ensuring capital is allocated to projects with the highest return efficiency.

- Using both metrics together prevents misinterpretations and allows for more informed decision-making.

By integrating NPV and IRR calculations into financial planning, businesses can optimize capital allocation, reduce investment risks, and improve long-term profitability.

Why Businesses Should Use NPV and IRR for Smarter Financial Planning

- Real estate investors use NPV and IRR to analyze rental income properties, commercial developments, and land acquisitions.

- Startup investors rely on these metrics to evaluate potential funding rounds and startup growth potential.

- Corporations apply NPV and IRR in mergers, capital budgeting, and expansion projects to maximize shareholder value.

Companies that fail to use structured financial models risk overestimating returns, misinterpreting investment risks, and making inefficient capital allocation decisions.