Making the right investment decision requires a deep understanding of financial metrics that determine project profitability. Among the most commonly used valuation methods, Net Present Value (NPV) and Internal Rate of Return (IRR) stand out as the key indicators for assessing the viability of an investment.

At Fin-Wiser, we specialize in providing financial modeling solutions that simplify complex calculations, ensuring businesses can make data-driven decisions with confidence.

This guide will help you understand:

- How NPV and IRR work and why they are essential for investment analysis.

- How to calculate NPV and IRR step by step using real-world data.

- Which metric to use for different financial scenarios and decision-making.

Why NPV and IRR Matter in Investment Decisions

Every business faces the challenge of evaluating projects to determine their profitability. NPV and IRR help in comparing different projects and deciding where to allocate capital.

- Net Present Value (NPV) measures the total monetary value an investment is expected to generate after adjusting for the time value of money.

- Internal Rate of Return (IRR) calculates the expected percentage return of an investment, helping businesses compare projects of similar scale.

Understanding these two metrics ensures that businesses choose profitable and sustainable investments. A detailed financial model can help businesses automate these calculations, eliminating errors and saving time. Explore pre-built investment analysis templates at Fin-Wiser Online Store to simplify decision-making.

How NPV and IRR Are Used in Real-World Investments

NPV and IRR are applied in capital budgeting, real estate investments, mergers and acquisitions, infrastructure projects, and corporate financial planning. Companies rely on these metrics to assess whether a project will generate sufficient returns to justify the initial investment.

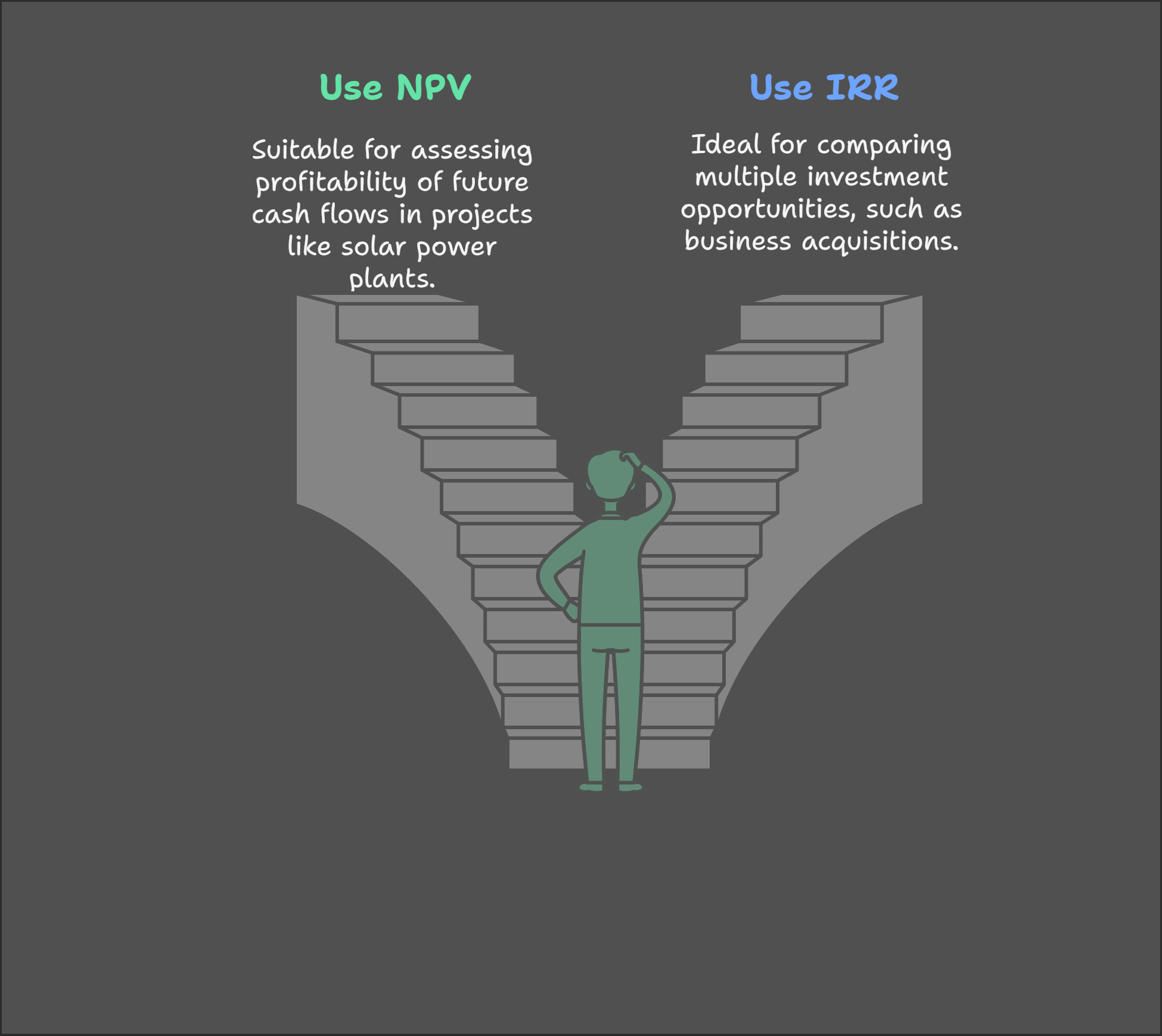

For example:

- A renewable energy firm evaluating a solar power plant uses NPV to calculate future cash flows and determine whether the investment is profitable.

- A private equity firm assessing a potential business acquisition applies IRR to compare multiple investment opportunities.

Using financial models like those available at Fin-Wiser ensures accurate and efficient project evaluation, eliminating manual errors and improving decision-making.

Step-by-Step Guide to Calculating NPV and IRR

Now that we understand NPV and IRR, let’s go through a detailed, step-by-step guide on how to calculate both metrics. We will use real-world numbers and break down each step so you can apply these calculations to your own investment analysis.

Step 1: How to Calculate NPV (Net Present Value)

To calculate NPV, follow these steps:

1. Identify Cash Flows

- Initial Investment: The upfront cost required to start the project.

- Future Cash Inflows: Estimated revenue or savings from the investment.

- Project Timeline: The number of years the project will generate cash flows.

2. Determine the Discount Rate

The discount rate (also called the cost of capital) represents the minimum return required to justify the investment. It is often set based on:

- Company’s cost of borrowing.

- Expected return from alternative investments.

- Industry-standard discount rates.

3. Apply the NPV Formula

![]()

4. Interpret the NPV Result

- NPV > 0: The project is profitable and should be accepted.

- NPV < 0: The project is expected to lose money and should be reconsidered.

- NPV = 0: The project breaks even, meaning it neither gains nor loses value.

Real-Life Example: NPV Calculation

A company is evaluating an investment in a solar power plant, which requires an initial investment of $500,000 and is expected to generate cash inflows of $150,000 per year for 5 years. The company’s cost of capital is 10%.

Given Data:

- Initial Investment: $500,000

- Annual Cash Inflows: $150,000 for 5 years

- Discount Rate: 10%

Step-by-Step NPV Calculation:

![]()

Final NPV Calculation Result:

NPV=568,540−500,000=68,540

Decision:

Since NPV > 0, this project is expected to generate $68,540 in additional value, making it a profitable investment.

To automate NPV calculations, businesses use financial modeling tools like those available at Fin-Wiser Online Store. These models ensure accuracy and efficiency in decision-making.

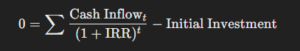

Step 2: How to Calculate IRR (Internal Rate of Return)

The IRR calculation follows a similar process but requires finding the discount rate where NPV = 0.

1. Define Cash Flows

- Use the same initial investment and cash inflows as the NPV calculation.

- The difference is that we solve for IRR instead of using a fixed discount rate.

2. Apply the IRR Formula

Since IRR requires iterative trial and error, it is typically solved using Excel, financial calculators, or modeling software.

Real-Life Example: IRR Calculation

Using the same solar power project data:

- Initial Investment: $500,000

- Annual Cash Inflows: $150,000 for 5 years

To find IRR, we use Excel or a financial calculator:

Excel IRR Formula:

=IRR(−500000,150000,150000,150000,150000,150000)

Final IRR Result:

IRR=14.8%

Decision:

Since the IRR (14.8%) is higher than the discount rate (10%), this project is a good investment.

If you need automated IRR models, check out Fin-Wiser for templates that provide instant IRR calculations.

Key Insight from Fin-Wiser:

- NPV confirms absolute profitability in dollar terms.

- IRR confirms efficiency of returns in percentage form.

- Since both metrics are positive, this project is a strong investment choice.

Real-Life Applications and Common Mistakes in NPV and IRR Calculations

Now that we have covered the step-by-step calculation of NPV and IRR, it’s essential to understand how these metrics are used in real-world investment decisions and the common mistakes businesses make when applying them.

How Businesses Use NPV and IRR for Decision-Making

Companies across various industries rely on NPV and IRR calculations to evaluate capital investments, mergers, infrastructure projects, and financial planning. Below are some practical examples of how businesses use these metrics to ensure their investments generate long-term value.

1. Renewable Energy Projects

A solar energy company is considering the construction of a 100MW solar plant. The project requires an initial investment of $50 million and is expected to generate revenue of $12 million annually for the next 10 years.

Key Financial Decisions:

- NPV Calculation: Helps determine if the project creates long-term value.

- IRR Calculation: Ensures that the return on investment exceeds the financing cost.

- Risk Assessment: Scenario modeling for changes in electricity tariffs and government incentives.

Outcome:

- NPV = $8.2 million (Positive) → The project is profitable.

- IRR = 13.5% (Above the required 10% return) → A strong investment opportunity.

To streamline such investment decisions, renewable energy firms use Fin-Wiser’s financial models, which include NPV and IRR templates for power projects.

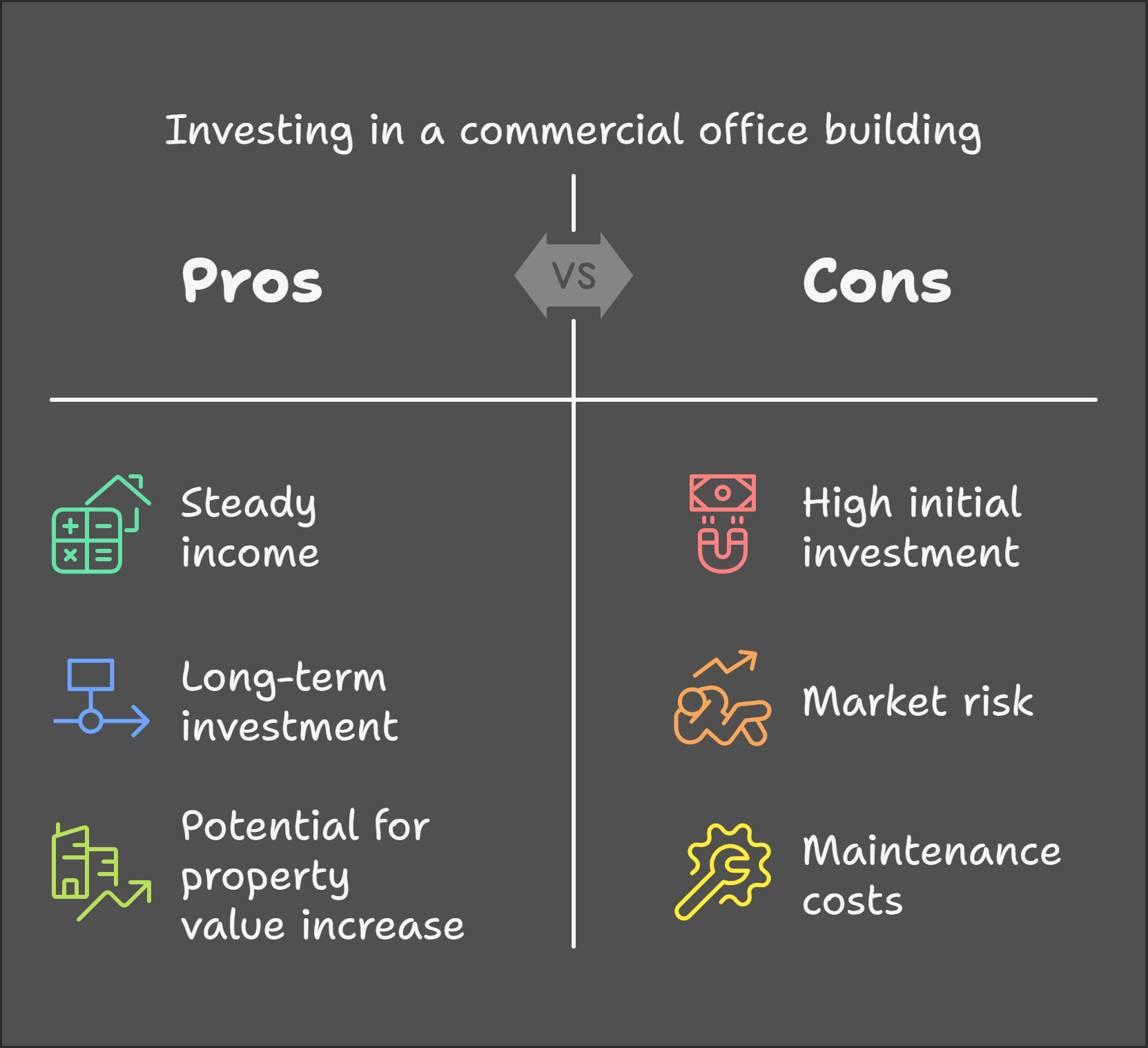

2. Real Estate Investments

A property developer is evaluating whether to invest in a commercial office building that requires an initial investment of $10 million. Rental income projections are $1.5 million annually for the next 10 years.

Key Financial Decisions:

- NPV Analysis: Evaluates the total profit of the project after adjusting for inflation.

- IRR Comparison: Helps compare return rates across different property investments.

- Loan Cost Assessment: Ensures that the IRR is higher than financing costs.

Outcome:

- NPV = $2.1 million (Profitable investment)

- IRR = 11.2% (Above financing cost of 8%)

By using NPV and IRR-based financial models from Fin-Wiser, real estate firms can automate these calculations and improve investment accuracy.

3. Mergers & Acquisitions (M&A)

A private equity firm is considering acquiring a manufacturing company for $200 million. The company’s projected net cash flows are $40 million annually for the next 7 years.

Key Financial Decisions:

- NPV Calculation: Determines the real value of the acquisition.

- IRR Calculation: Evaluates if the acquisition provides higher returns than alternative investments.

- Sensitivity Analysis: Adjusts for variations in market conditions and operational costs.

Outcome:

- NPV = $25 million (Profitable deal)

- IRR = 14.2% (Above industry benchmark of 11%)

Using Fin-Wiser’s financial models, M&A analysts can run multiple scenarios to test investment feasibility and risk.

Common Mistakes to Avoid When Using NPV and IRR

While NPV and IRR are powerful financial tools, misusing them can lead to incorrect investment decisions. Below are the most common mistakes businesses make and how to avoid them.

1. Ignoring the Cost of Capital in IRR Comparisons

Many businesses compare IRR values without considering whether the required return rate (cost of capital) is lower or higher than IRR.

Mistake:

- Choosing a project with high IRR but lower NPV, leading to missed value creation opportunities.

Solution:

- Always compare IRR to the cost of capital before making a decision. If IRR is below the cost of capital, the investment is not viable.

2. Misinterpreting Multiple IRRs in Complex Cash Flows

When a project has irregular cash flows, it can generate multiple IRRs, leading to misleading conclusions.

Mistake:

- Assuming that IRR always provides a single, correct return percentage.

- Using IRR alone for projects with both positive and negative cash flows at different periods.

Solution:

- Use Modified Internal Rate of Return (MIRR) or NPV instead of IRR for such cases.

- Financial models like those at Fin-Wiser help detect IRR inconsistencies.

3. Overlooking the Scale of Investment with IRR

IRR can be misleading when comparing projects of different sizes.

Mistake:

- Choosing a small project with high IRR but lower absolute profit over a larger project with higher total value but lower IRR.

Example:

- Project A: Requires $50,000 investment, generates IRR of 30% but NPV of $20,000.

- Project B: Requires $1 million investment, generates IRR of 15% but NPV of $150,000.

If IRR is the only decision criterion, a company might select Project A and miss out on the higher actual value of Project B.

Solution:

- Prioritize NPV over IRR when evaluating large investments.

- Consider IRR as a secondary metric rather than the sole decision factor.

4. Assuming Reinvestment at IRR Rather Than Cost of Capital

IRR calculations assume that cash inflows are reinvested at the same IRR rate, which is often unrealistic.

Mistake:

- Overestimating profitability due to incorrect reinvestment assumptions.

Solution:

- Use NPV instead of IRR when reinvestment at the IRR rate is unlikely.

- Use Modified IRR (MIRR) to adjust for realistic reinvestment assumptions.

How Fin-Wiser Can Help You Make Smarter Investment Decisions

NPV and IRR calculations require precision, and even small miscalculations can result in major investment mistakes. At Fin-Wiser, we provide expert-built financial models that ensure accuracy and efficiency in investment analysis.

With Fin-Wiser’s financial modeling solutions, you can:

✔ Instantly calculate NPV and IRR for investment projects.

✔ Perform scenario analysis to adjust for market risks.

✔ Compare multiple projects to select the best opportunity.

✔ Use built-in formulas to eliminate manual errors.

For businesses looking to automate their financial evaluations, explore Fin-Wiser Online Store for professional investment templates that improve decision-making speed and accuracy.

Final Conclusion and Key Takeaways

After understanding NPV and IRR, their calculations, real-world applications, and common mistakes, the final step is knowing when to use each metric and how to apply them for smarter investment decisions.

At Fin-Wiser, we help businesses leverage these financial models to ensure accurate, data-driven investment analysis. Whether you’re evaluating infrastructure projects, corporate investments, or capital budgeting decisions, using the right metric can significantly impact profitability.

Key Takeaways: When to Use NPV vs. IRR

Both NPV and IRR are essential investment evaluation tools, but their effectiveness depends on the nature of the project and the financial goals of the company.

When to Use NPV

✔ For large-scale projects where total profitability matters.

✔ For long-term investments with significant upfront capital.

✔ When comparing projects of different sizes to determine value creation.

✔ When reinvestment assumptions need to reflect actual market rates.

✔ For mergers, acquisitions, and corporate financial planning.

When to Use IRR

✔ For quick comparisons between investment alternatives.

✔ When assessing smaller, short-term projects where return efficiency is critical.

✔ When the decision is based on a required rate of return benchmark.

✔ For venture capital investments and high-growth projects.

When to Use Both NPV and IRR Together

✔ When comparing two projects with similar cash flows but different timelines.

✔ To validate IRR decisions by ensuring NPV is positive.

✔ For financial modeling that requires absolute value and percentage-based return.

Using both metrics ensures comprehensive decision-making, preventing errors from over-relying on a single method. For businesses seeking ready-made financial models, explore Fin-Wiser’s Online Store to automate NPV and IRR analysis with precision.

How Fin-Wiser Can Help You Optimize Investment Decisions

Investment analysis requires precision, and manual calculations can lead to costly mistakes. That’s why companies rely on Fin-Wiser to access pre-built financial models that automate:

✔ NPV and IRR calculations with step-by-step accuracy.

✔ Scenario planning to evaluate different discount rates and investment conditions.

✔ Project comparison tools to ensure the best allocation of capital.

✔ Financial dashboards for instant decision-making insights.

To make smarter investment decisions, explore our Fin-Wiser Online Store for tools designed by experts to simplify financial analysis and improve ROI.