The global shift towards renewable energy has brought green hydrogen into the spotlight as a critical solution for decarbonization. With its ability to generate zero-emission fuel using renewable energy sources, green hydrogen holds immense promise for industries such as transportation, energy storage, and heavy manufacturing. Learn more about its applications at Fin-Wiser. However, the question remains: can green hydrogen be financially viable?

This blog takes a deep dive into the financial opportunities of green hydrogen projects, exploring how tools like the Green Hydrogen Project Model can help optimize costs, reduce risks, and maximize ROI.

The Rising Demand for Green Hydrogen

The push for sustainable energy solutions has accelerated the adoption of green hydrogen. Countries across the globe, including those in Europe, the Middle East, and Asia, are making substantial investments to incorporate green hydrogen into their energy mix. Explore the potential of these investments at Fin-Wiser. By 2030, the global green hydrogen market is projected to surpass $60 billion, driven by applications in decarbonizing industrial processes and powering fuel-cell vehicles.

In regions like the UAE, where sunlight and renewable energy are abundant, green hydrogen projects are gaining traction. These large-scale initiatives are paving the way for sustainable development while creating lucrative opportunities for investors and stakeholders. But achieving financial success in green hydrogen requires overcoming significant challenges.

Financial Challenges in Green Hydrogen Projects

Despite its environmental benefits, green hydrogen faces financial barriers that can deter widespread adoption. Key challenges include:

High CAPEX (Capital Expenditure): The cost of electrolyzers, renewable energy infrastructure, and water systems is substantial.

Fluctuating OPEX (Operational Expenditure): Ongoing costs of renewable energy and water supply can impact profitability.

Market Uncertainty: Policy changes and price volatility create risks for long-term investments.

Addressing these challenges requires robust financial planning, where tools like the Green Hydrogen Project Model come into play. Explore a variety of tools and solutions for green hydrogen projects at Fin-Wiser.

Role of Financial Models in Green Hydrogen Projects

A well-structured financial model is essential for evaluating the feasibility and profitability of green hydrogen projects. These models provide a detailed analysis of costs, revenues, and risks, allowing stakeholders to make informed decisions. Here are the key elements of a robust financial model:

CAPEX and OPEX Analysis: Breakdown of upfront and recurring costs to assess project viability.

NPV (Net Present Value) and IRR (Internal Rate of Return): Metrics that quantify the financial returns of the project.

Cash Flow Projections: Insights into the project’s liquidity and ability to meet operational needs.

Scenario Planning: Preparation for uncertainties, such as changes in energy prices or regulatory policies.

The Green Hydrogen Project Model is designed to incorporate these components, helping businesses optimize costs and maximize ROI. Discover how this model supports comprehensive planning at Fin-Wiser. By using this model, stakeholders can confidently navigate the complexities of green hydrogen investments.

Benefits of Using Financial Models for Green Hydrogen

Implementing a robust financial model offers several benefits:

Optimized Cost Structures: Reduce unnecessary expenses and allocate resources efficiently.

Enhanced Risk Management: Identify potential risks early and develop mitigation strategies.

Improved Investment Decisions: Use data-driven insights to attract funding and partnerships.

Increased ROI: Ensure long-term profitability through precise financial planning.

Projects using advanced financial models not only improve their financial viability but also enhance their attractiveness to investors. Unlock your project’s potential with the Green Hydrogen Project Model available at Fin-Wiser. With green hydrogen positioned as a key player in the future of energy, using the right tools can make all the difference.

Case Study: Unlocking Green Hydrogen’s Financial Potential

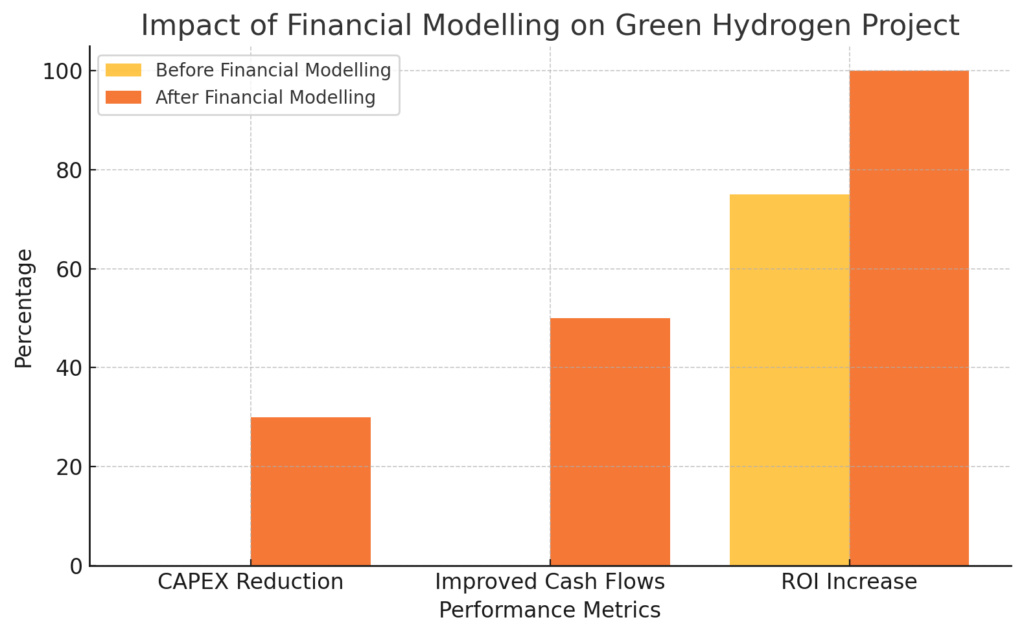

In 2023, a renewable energy company in Europe launched a green hydrogen project powered by onsite solar plants. By employing a detailed financial model, the company achieved the following:

30% Reduction in CAPEX: Optimized the design and procurement of electrolyzers and solar panels.

Improved Cash Flows: Scenario planning helped address fluctuations in energy costs, ensuring stable liquidity.

25% Higher ROI: Precise cost estimations and profitability analysis attracted top-tier investors.

This success underscores the importance of financial modelling in ensuring the economic feasibility of green hydrogen projects. To explore tailored models for your green hydrogen projects, visit the Green Hydrogen Project Model.

Conclusion: Paving the Way for a Sustainable Future

Green hydrogen holds the promise of a sustainable energy future, but its financial success depends on thorough planning and execution. By leveraging tools like the Green Hydrogen Project Model, businesses can navigate challenges, optimize costs, and maximize their ROI.

As the global energy landscape evolves, adopting green hydrogen isn’t just an environmental decision—it’s a strategic financial move. Start building a financially sustainable green hydrogen project today with the right tools and insights.