The rapid transition to renewable energy has made solar and wind projects essential pillars of sustainable development. However, creating financial models for these projects requires careful planning and a deep understanding of various financial and operational factors. This blog provides a practical guide to developing robust financial models for solar and wind energy projects, highlighting key considerations such as cost breakdowns, revenue forecasting, and risk management.

Understanding the Basics of Renewable Energy Financial Models

Financial models for renewable energy projects act as decision-making tools, helping stakeholders assess a project’s feasibility and profitability. These models incorporate factors like initial investments, operational costs, energy output, and revenue potential. By using advanced tools such as the Renewable Energy Template Bundle, businesses can streamline the process of creating reliable financial projections.

Key Considerations for Solar and Wind Financial Models

1. Comprehensive Cost Breakdown

Accurately estimating costs is crucial for building effective financial models. Key cost components include:

Capital Expenditure (CAPEX):

Solar: Panels, inverters, mounting systems, and installation.

Wind: Turbines, towers, foundations, and grid connections.

Operational Expenditure (OPEX): Maintenance, repairs, insurance, and administrative costs.

Land and Permitting Costs: Acquiring land and securing necessary permits.

A detailed breakdown of these costs ensures accurate financial planning. For automated calculations and insights, explore tools like the Wind Farm Model.

2. Revenue Forecasting

Revenue forecasting is a critical component of any renewable energy financial model. For solar and wind projects, revenue depends on:

Energy Production: The capacity factor, location, and weather conditions determine energy output.

Tariff Rates: The price per unit of energy sold under power purchase agreements (PPAs) or feed-in tariffs.

Incentives and Subsidies: Government programs that reduce costs or increase revenues.

Using reliable templates like the Renewable Energy Template Bundle can simplify revenue projections and ensure precision.

3. Risk Management

Risk management plays a vital role in creating resilient financial models. Common risks in solar and wind projects include:

Weather Variability: Changes in sunlight or wind speed affecting energy output.

Regulatory Risks: Changes in government policies or tax incentives.

Financial Risks: Currency fluctuations, interest rate changes, or unexpected cost overruns.

By incorporating sensitivity analyses and scenario planning, financial models can address these uncertainties. Advanced tools like the Wind Farm Model help quantify and mitigate these risks effectively.

Leveraging Technology for Renewable Energy Financial Models

Modern financial modeling tools have made it easier than ever to build accurate and dynamic renewable energy financial models. These technologies enable:

Automated Tariff Calculations: Precise estimation of energy tariffs and revenue streams.

Integrated Financial Statements: Seamless analysis of cash flow, profit and loss, and balance sheets.

Scenario Planning: Simulation of different project conditions to test financial resilience.

Explore the latest financial modeling tools at Fin-Wiser to create efficient and reliable projections.

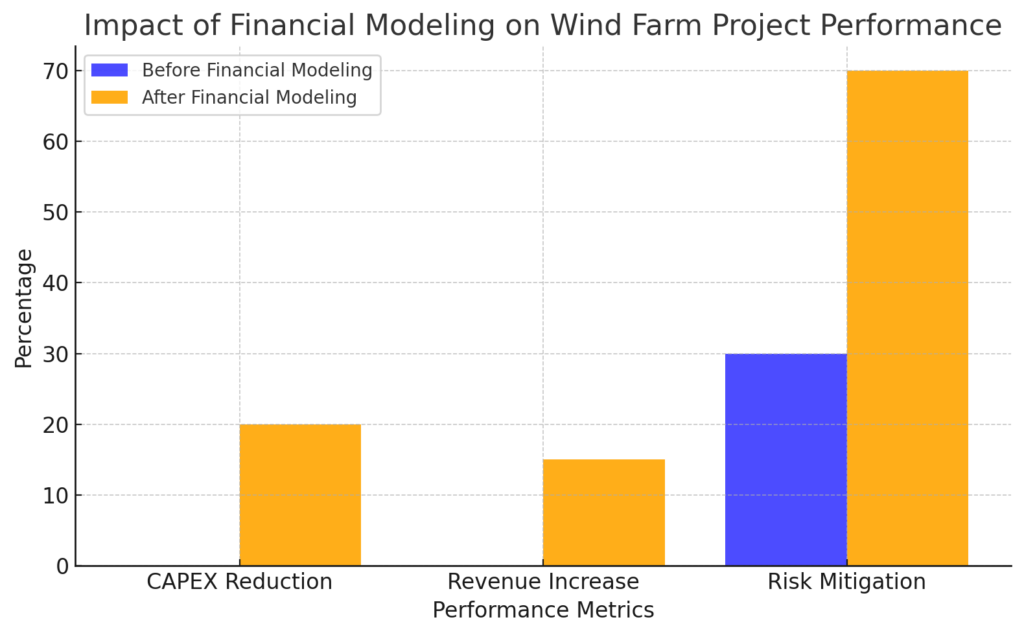

Real-World Example: Financial Modeling for a Wind Farm Project

A recent wind farm project in Southeast Asia provides a perfect example of how effective financial modeling drives success. By leveraging advanced tools, the project team was able to:

Reduce CAPEX by 20%: Optimized turbine selection and grid connection strategies.

Increase Revenue by 15%: Improved energy yield estimates and secured competitive tariff rates.

Mitigate Risks: Conducted detailed sensitivity analyses to address weather and regulatory uncertainties.

This success story highlights the importance of using professional tools like the Renewable Energy Template Bundle to enhance project outcomes.

Conclusion

Developing robust financial models for solar and wind projects is critical to their success. By focusing on key considerations such as cost breakdowns, revenue forecasting, and risk management, businesses can make informed decisions and optimize project performance.

Whether you’re planning a solar park or a wind farm, leveraging advanced tools like the Wind Farm Model ensures precision and efficiency. Visit Fin-Wiser to explore solutions tailored to your renewable energy projects.