Introduction

Running an SME isn’t easy. From handling tight budgets to juggling multiple priorities, small businesses face unique financial challenges. That’s why having the right financial advisory can make all the difference. At Fin-Wiser, we understand how critical it is to get expert support at the right time.

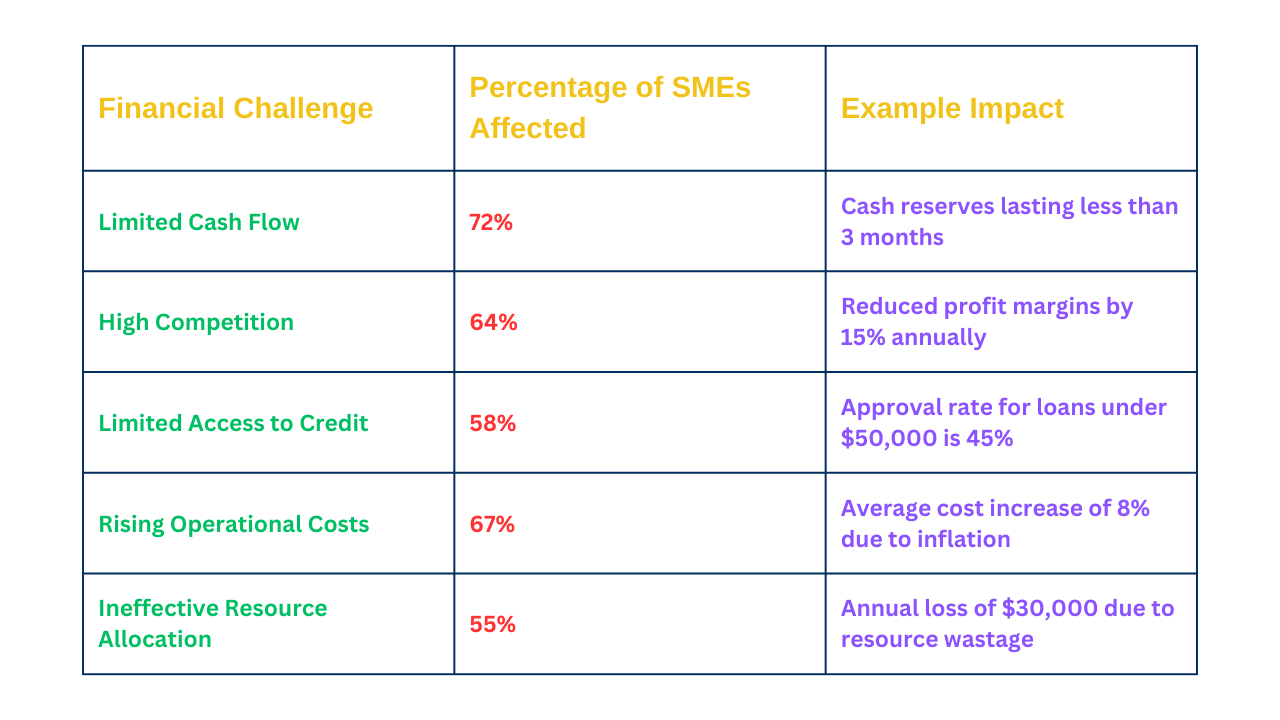

The Financial Challenges Facing SMEs

SMEs often deal with limited resources, fluctuating cash flow, and high competition. Without proper guidance, these issues can quickly escalate, impacting growth and stability. This is where financial advisory for SMEs comes in—helping businesses navigate uncertainties and seize growth opportunities.

Why Timely Financial Advisory Matters

Delaying expert advice can be risky. A well-timed financial advisory can improve cash flow management, optimize spending, and guide strategic decisions. At Fin-Wiser Online Store, we specialize in providing tailored financial strategies for SMEs to drive business success when it matters most.

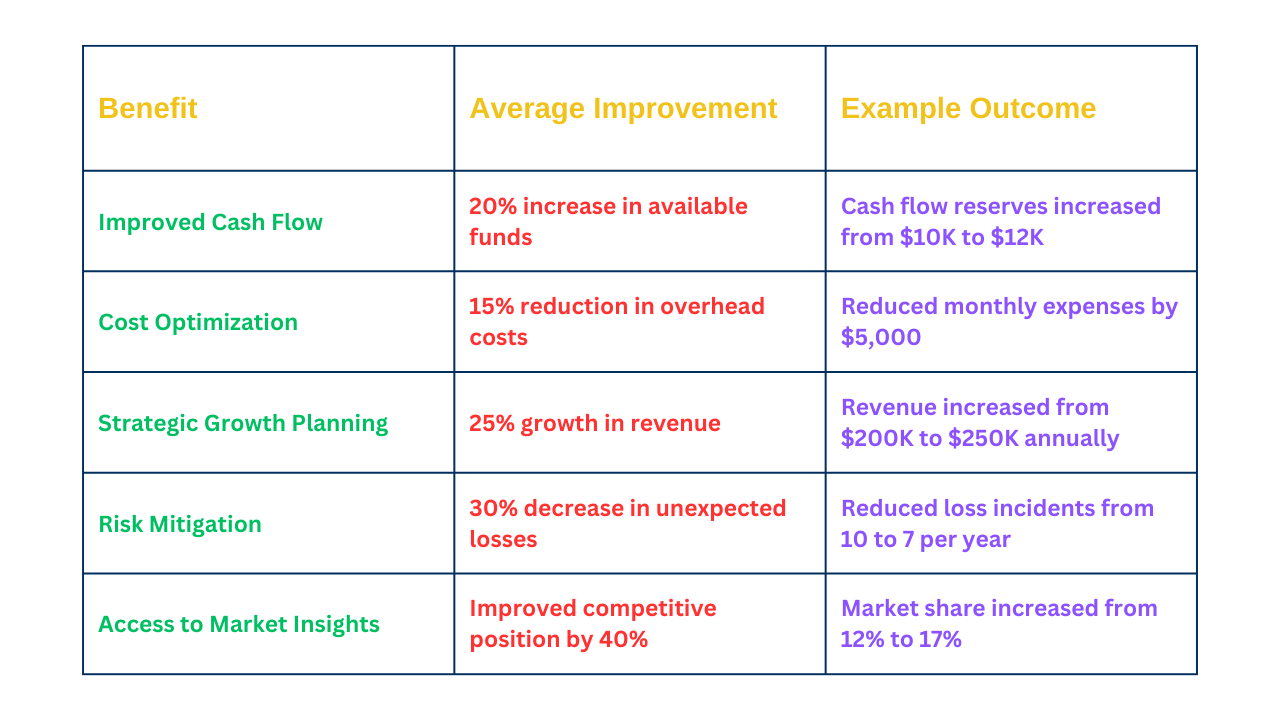

Key Benefits of Financial Advisory for SMEs

Engaging in expert financial advisory can transform how SMEs operate and grow. At Fin-Wiser, we emphasize key benefits that can help businesses thrive.

Strategic Planning and Growth Management

Effective financial advisory enables SMEs to plan for growth strategically. From setting clear goals to creating actionable roadmaps, expert advisors help businesses stay on track and achieve sustainable growth. At Fin-Wiser Online Store, we offer personalized financial strategies for SMEs that focus on growth management and long-term planning.

Effective Cash Flow Management

Managing cash flow is a common challenge for SMEs. A tailored financial advisory helps businesses track cash flow, optimize expenditures, and ensure that funds are available when needed. This approach not only reduces financial stress but also boosts operational efficiency. Fin-Wiser specializes in guiding SMEs through effective cash flow management to maintain financial stability.

Risk Assessment and Mitigation

Navigating risks is crucial for the success of any SME. With the right financial advisory, businesses can identify potential risks early and develop strategies to mitigate them. This proactive approach enhances resilience and minimizes unexpected disruptions. At Fin-Wiser Online Store, we provide comprehensive risk assessment and mitigation services to protect your business’s future.

How Financial Advisory Drives Business Success

Partnering with a trusted financial advisory service can be a game-changer for SMEs. At Fin-Wiser, we believe in empowering businesses with expert support to unlock their full potential.

Access to Expertise and Market Insights

One of the biggest advantages of engaging in financial advisory is gaining access to industry expertise and valuable market insights. This enables SMEs to make informed decisions, anticipate trends, and stay ahead of the competition. At Fin-Wiser Online Store, we provide businesses with expert advice and market-driven strategies tailored to their industry.

Tailored Financial Strategies for SMEs

Every SME is unique, which is why one-size-fits-all solutions don’t work. With tailored financial strategies for SMEs, advisors focus on understanding your specific needs and challenges, creating personalized plans to drive success. Fin-Wiser specializes in crafting flexible and effective strategies that align with your business goals.

Navigating Compliance and Regulations

Keeping up with ever-changing compliance and regulations can be overwhelming. A professional financial advisory can guide SMEs through complex regulatory requirements, ensuring that your business stays compliant and avoids costly penalties. At Fin-Wiser Online Store, we help businesses navigate regulations with confidence and clarity.

Common Pitfalls for SMEs Without Financial Advisory

Skipping out on financial advisory can lead to significant challenges for SMEs. At Fin-Wiser, we’ve seen how these pitfalls can hinder business growth and stability.

Overlooking Growth Opportunities

Without expert guidance, SMEs may miss out on key growth opportunities. A lack of strategic planning can prevent businesses from seizing market trends, expanding their reach, or scaling effectively. Engaging in a comprehensive financial advisory helps identify and capitalize on opportunities at the right time.

Inefficient Use of Resources

Efficient resource management is critical for small businesses. However, without proper financial guidance, SMEs often struggle with ineffective allocation of resources, leading to wasted time and money. At Fin-Wiser Online Store, we provide tailored strategies that help optimize the use of limited resources and enhance operational efficiency.

Financial Uncertainty and Cash Flow Problems

Financial uncertainty and unstable cash flow management are common issues for SMEs lacking proper advisory. Poor cash flow can disrupt operations, delay payments, and create unnecessary stress. Engaging in the right financial advisory for SMEs helps businesses maintain healthy cash flow and reduce financial risks. At Fin-Wiser, we focus on resolving financial challenges to keep your business on track.

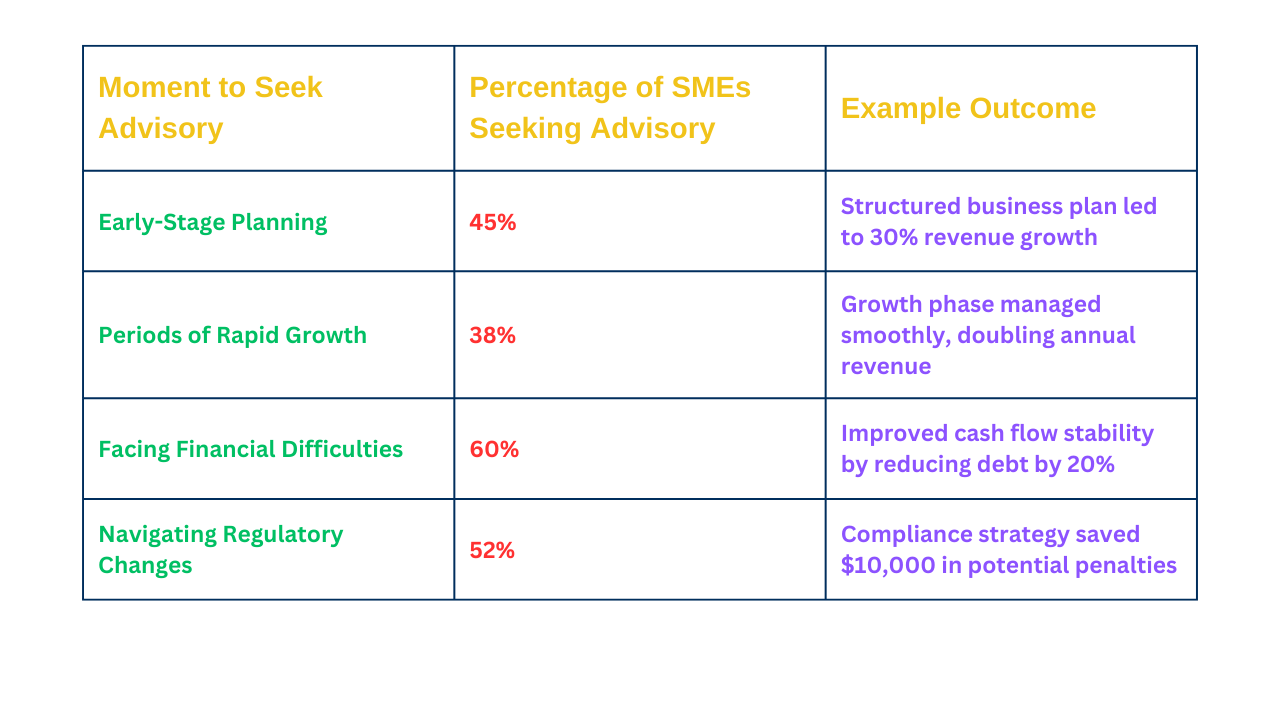

When to Seek Financial Advisory Services

Knowing the right time to engage in financial advisory is crucial for SMEs looking to grow and stay resilient. At Fin-Wiser, we recommend seeking professional support at these critical stages.

Early-Stage Planning and Business Setup

Getting a strong start is essential. During the early stages of business setup, having a solid financial foundation can set your SME up for long-term success. A professional financial advisory helps with budgeting, forecasting, and creating an actionable business plan. At Fin-Wiser Online Store, we offer expert guidance to help you lay the groundwork for a thriving business.

During Periods of Rapid Growth or Market Changes

Periods of rapid growth or market fluctuations can be both exciting and challenging for SMEs. Having a trusted financial advisory ensures that your business can handle expansion smoothly and adapt to market shifts effectively. At Fin-Wiser, we specialize in providing strategic advice during high-growth phases to keep your business on track.

When Facing Financial Difficulties or Uncertainty

Financial challenges and uncertainty can create significant stress for small businesses. Seeking expert financial advisory during tough times helps identify the root causes of financial struggles and develop recovery strategies. At Fin-Wiser Online Store, we provide solutions that guide SMEs through difficult periods with confidence and clarity.

Choosing the Right Financial Advisory Partner

Selecting the right financial advisory partner is essential for SMEs aiming for sustainable growth. At Fin-Wiser, we believe in delivering expert-driven solutions tailored to your unique needs.

Identifying Expertise and Industry Experience

The first step is to find an advisor with the right expertise and experience in your industry. A knowledgeable financial advisory partner understands the challenges and opportunities specific to your business. They can offer more relevant insights and create strategies that align with your goals. At Fin-Wiser Online Store, we provide industry-focused advisory services to help SMEs make informed decisions.

Evaluating a Proven Track Record

An advisor’s proven track record speaks volumes about their credibility and effectiveness. Look for a financial advisory partner with a history of delivering successful outcomes for businesses similar to yours. Evaluating case studies and testimonials can give you confidence in their ability to support your growth. At Fin-Wiser, we take pride in our strong track record of helping SMEs achieve financial stability and growth.

Why Fin-Wiser is the Right Choice for SMEs

Choosing Fin-Wiser means partnering with a team dedicated to your success. We combine our expertise with personalized strategies to help SMEs navigate financial challenges, seize opportunities, and drive growth. Our commitment to providing tailored solutions, backed by industry experience and a strong track record, makes us the ideal choice for businesses looking for comprehensive financial advisory.

Conclusion

In today’s competitive landscape, SMEs can’t afford to overlook the importance of expert financial advisory. With the right guidance, small businesses can overcome financial challenges, seize growth opportunities, and ensure long-term success. At Fin-Wiser, we believe that proactive financial planning is key to building a resilient and thriving business.

Embrace Financial Advisory for Long-Term Success

Investing in professional financial advisory isn’t just a short-term fix—it’s a long-term strategy for sustainable growth. By partnering with experienced advisors, SMEs can gain valuable insights, improve cash flow management, and develop strategies that drive their business forward. At Fin-Wiser Online Store, we provide comprehensive support to help your business reach its full potential.

Take Action Before It’s Too Late

Don’t wait until financial challenges spiral out of control. Taking timely action with expert financial advisory can be the difference between growth and stagnation. At Fin-Wiser, we’re here to help you make the right financial moves and achieve lasting success.