Introduction

Creating effective financial models is crucial for businesses aiming to forecast performance, evaluate risks, and make informed decisions. At Fin-Wiser, we believe that mastering the basics of financial modeling doesn’t have to be daunting. With the right tips and tricks, you can create clear and accurate models that support your business goals.

What Are Financial Models?

Financial models are tools used to represent a company’s financial performance over time. These models often include key elements such as financial statements, ratios, and projections to provide a detailed overview of the business. At Fin-Wiser Online Store, we offer resources to help businesses build reliable financial models that aid in planning and analysis.

Why Financial Modeling Matters for Businesses

Financial modeling is essential for businesses because it supports critical decisions such as budgeting, investments, and strategic planning. A well-structured financial model helps businesses understand their current financial health, forecast future outcomes, and identify potential opportunities or risks. At Fin-Wiser, we emphasize the importance of building accurate and flexible models to drive business financial success.

Essential Components of a Financial Model

Creating effective financial models requires understanding their core elements. At Fin-Wiser, we guide businesses to focus on the right components for clear and accurate modeling.

Key Financial Statements to Include

The foundation of any financial model is built on three primary financial statements:

- Income Statement: Provides a snapshot of a company’s profitability by tracking revenue, expenses, and net income.

- Balance Sheet: Offers a view of the company’s assets, liabilities, and equity at a given point in time.

- Cash Flow Statement: Shows how cash moves through the business, indicating liquidity and financial health.

Including these key financial statements ensures that your financial model is comprehensive and accurate. At Fin-Wiser Online Store, we offer templates to help businesses build these financial statements effectively.

Important Metrics and Ratios to Track

When building financial models, it’s crucial to track key financial ratios and metrics. These help analyze the company’s performance and highlight areas needing attention. Some essential financial metrics include:

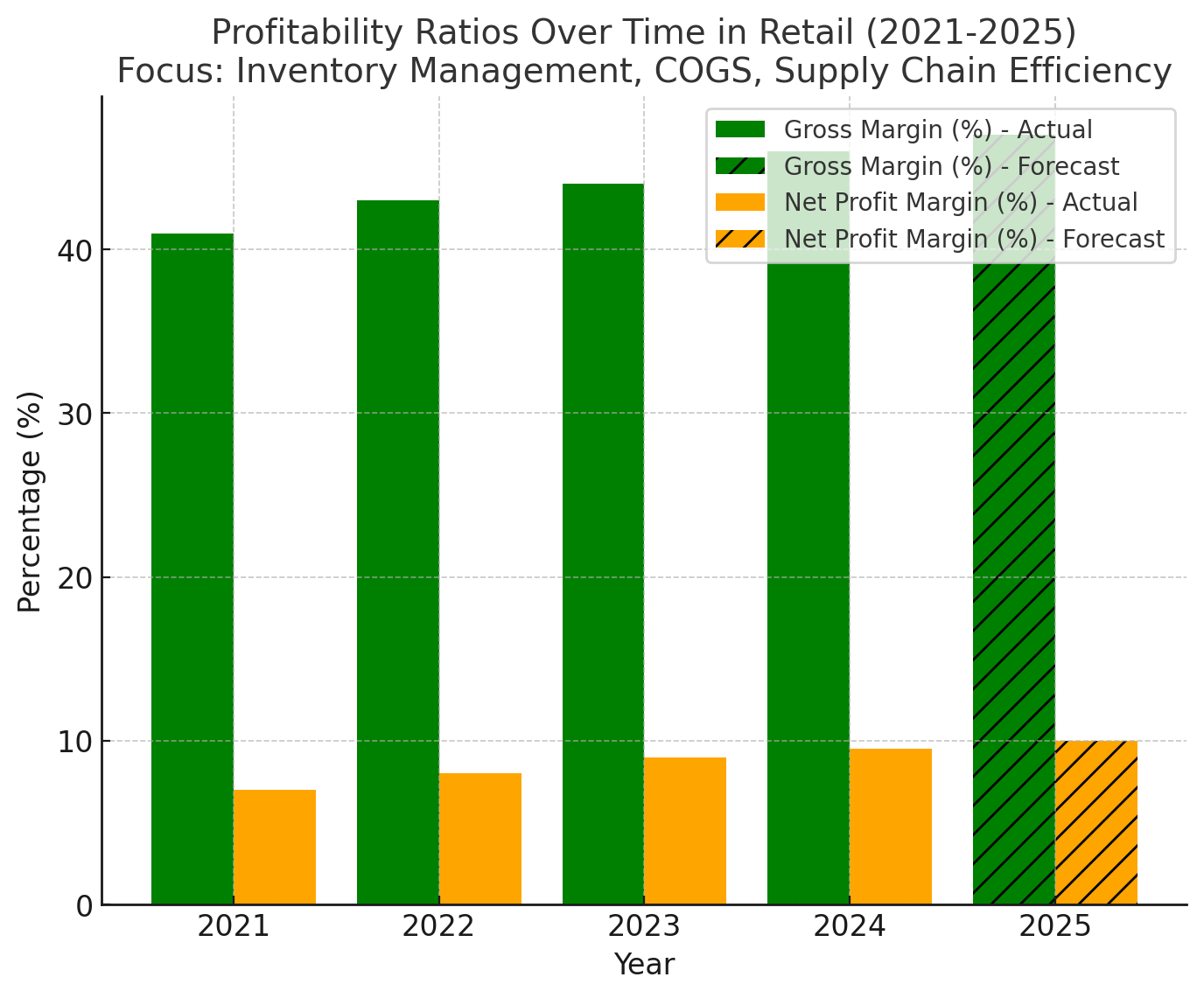

- Profitability Ratios: Such as Gross Margin and Net Profit Margin.

- Liquidity Ratios: Like Current Ratio and Quick Ratio to measure short-term financial stability.

- Efficiency Ratios: Including Asset Turnover and Inventory Turnover to assess operational efficiency.

By focusing on these financial ratios and metrics, businesses can gain valuable insights and make data-driven decisions. At Fin-Wiser, we provide resources to help track these metrics accurately within your financial models.

Tips for Building Effective Financial Models

Building clear and reliable financial models can make a huge difference in decision-making and strategic planning. At Fin-Wiser, we recommend a few key tips to keep your models accurate and easy to use.

Simplify Your Assumptions

When creating financial models, it’s essential to keep your assumptions straightforward and realistic. Overcomplicating financial assumptions can lead to confusion and inaccuracies. Simplify wherever possible and clearly label all assumptions so they’re easy to understand and adjust. At Fin-Wiser Online Store, we provide tools to help you structure your models with simple, transparent assumptions.

Use Consistent Formatting and Layouts

Maintaining a consistent format and layout ensures that your financial model remains clear and professional. Use standardized cell colors, fonts, and labeling conventions to make your model easy to follow. This consistency helps prevent errors and makes it easier for others to review and interpret the financial model. At Fin-Wiser, we offer customizable templates with standard formatting best practices.

Focus on Accuracy and Clarity

Above all, your financial model must be accurate and easy to read. Double-check calculations, validate formulas, and keep the structure clear. An accurate and well-organized model builds trust and credibility. At Fin-Wiser Online Store, we emphasize the importance of clarity and precision in all our financial modeling resources.

Tricks to Enhance Financial Models

To take your financial models to the next level, it’s crucial to implement advanced techniques that save time and provide clearer insights. At Fin-Wiser, we recommend some effective tricks to enhance your modeling approach.

Automate Calculations with Formulas

Automating calculations using built-in formulas not only saves time but also reduces the risk of manual errors. Excel and other financial modeling tools offer a variety of functions to streamline calculations, such as SUMIF, VLOOKUP, and IFERROR. By automating these calculations, you can maintain accuracy and update your financial model quickly when new data is available. At Fin-Wiser Online Store, we provide resources to help you leverage these formulas efficiently.

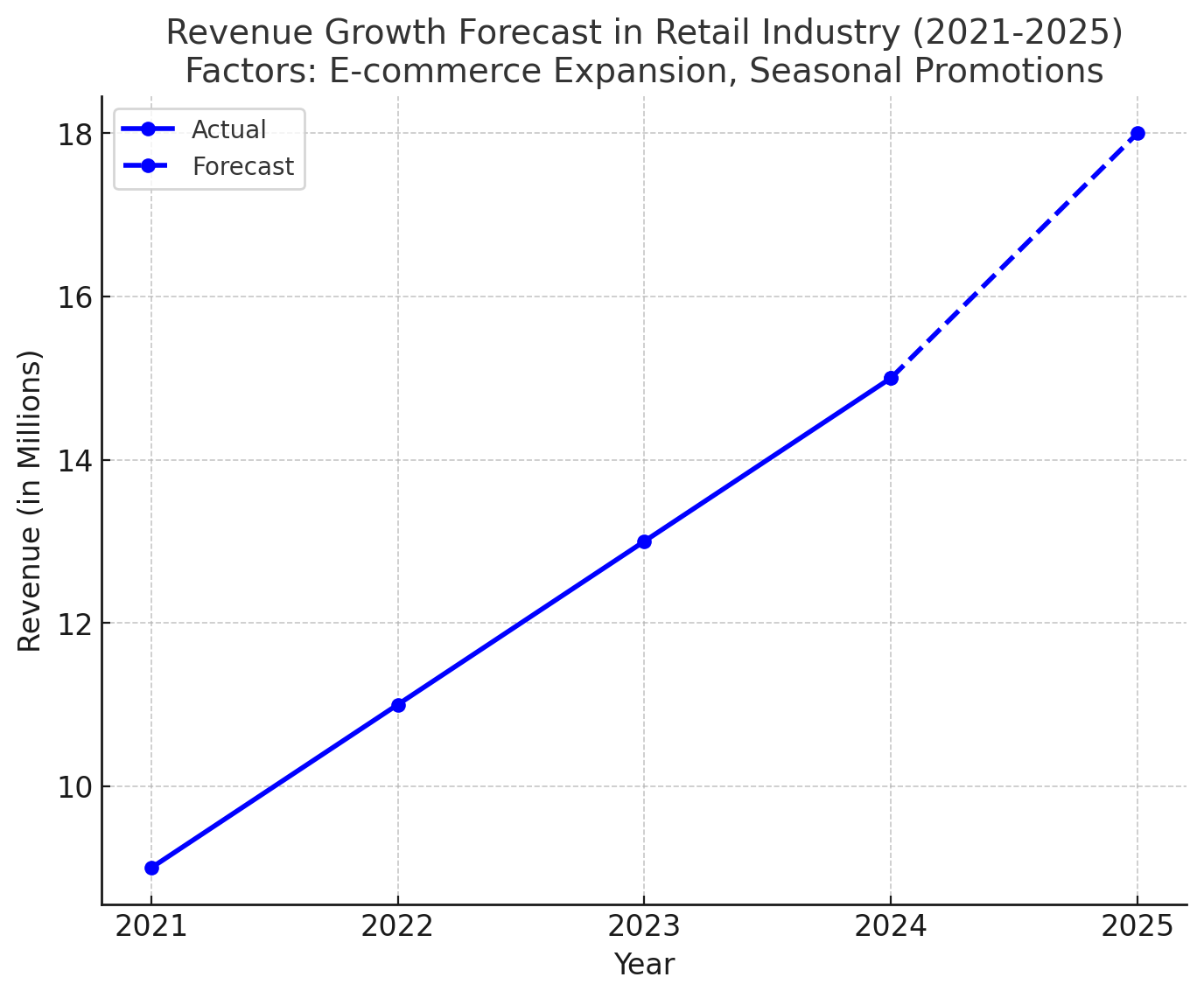

Use Visual Aids to Simplify Complex Data

Incorporating visual aids like charts, graphs, and dashboards helps to simplify complex data and highlight key trends. Data visualization allows stakeholders to grasp important insights at a glance, making your financial model more intuitive and engaging. At Fin-Wiser, we emphasize the importance of clear visual aids in enhancing decision-making and communication.

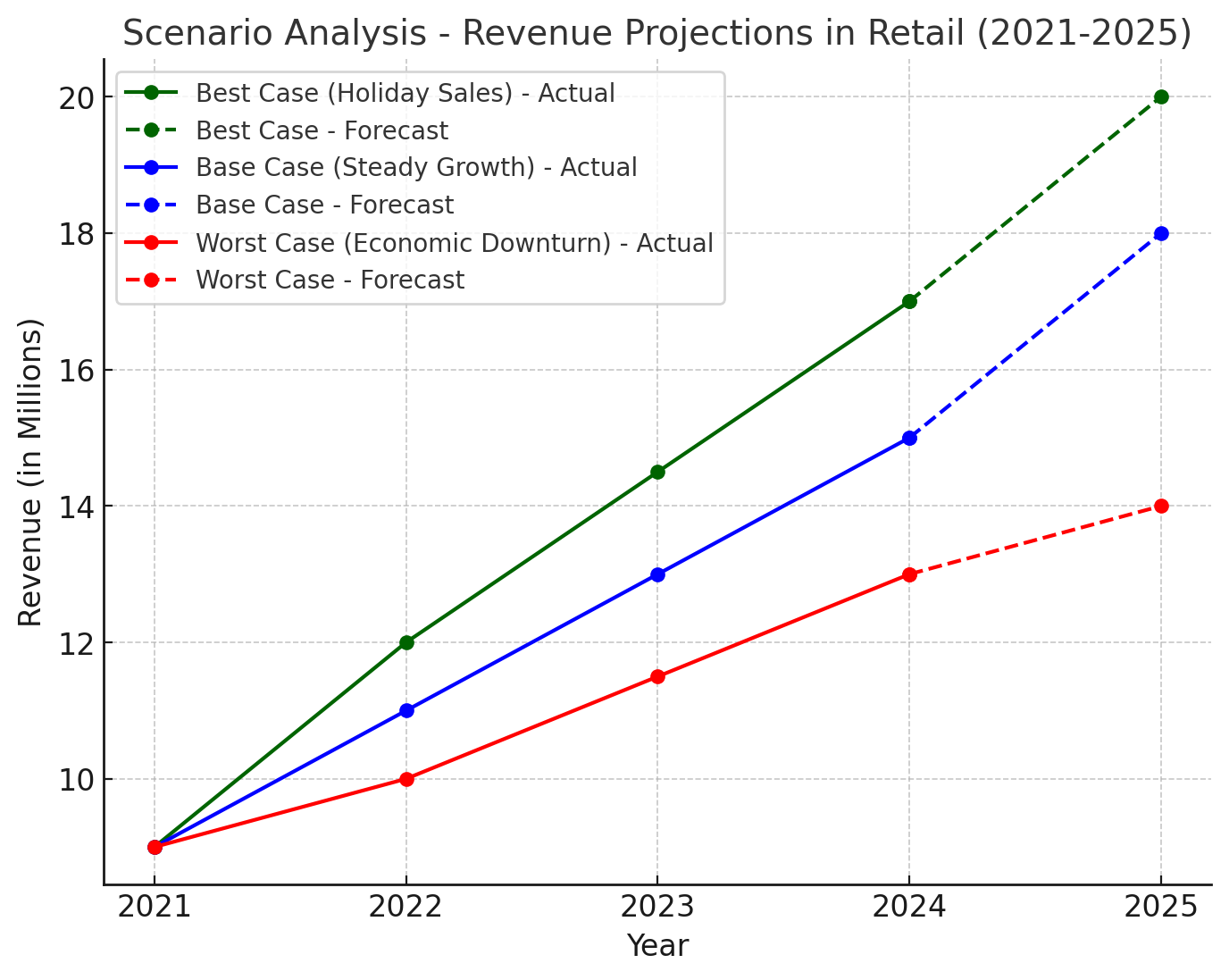

Integrate Scenario Analysis for Better Decision-Making

Adding scenario analysis enables businesses to anticipate various outcomes based on changing assumptions or market conditions. This involves creating multiple scenarios—such as best-case, worst-case, and most likely case—and analyzing their impact on financial performance. Scenario analysis helps businesses make proactive decisions and manage risks effectively. At Fin-Wiser Online Store, we provide templates and tools to help integrate scenario analysis seamlessly into your financial models.

Common Mistakes to Avoid in Financial Modeling

Creating effective financial models requires careful attention to detail. At Fin-Wiser, we help businesses avoid common pitfalls that can undermine the accuracy and reliability of their models.

Ignoring Data Quality and Consistency

Using inaccurate or inconsistent data is one of the biggest mistakes in financial modeling. Poor data quality can lead to faulty conclusions and misguided decisions. Always double-check your data sources and verify that your calculations align with the latest information. At Fin-Wiser Online Store, we offer solutions to maintain data quality and consistency within your financial models.

Overcomplicating the Model

While it may be tempting to include every possible detail, overcomplicating your financial model can create confusion and increase the risk of errors. Keep the structure simple and focus on the most critical metrics and assumptions. A clear and concise model is easier to interpret and manage. At Fin-Wiser, we advocate for simplicity and clarity in all financial modeling projects.

Failing to Validate and Test Assumptions

Assumptions are the backbone of any financial model, so it’s essential to validate and test them. Failing to do so can result in inaccurate projections and misguided strategies. Conduct sensitivity analyses and scenario testing to ensure that your assumptions hold up under different conditions. At Fin-Wiser Online Store, we provide templates and resources for validating and testing financial assumptions.

Best Practices for Financial Modeling

Adopting best practices in financial modeling helps ensure that your models are accurate, efficient, and user-friendly. At Fin-Wiser, we recommend these essential practices to streamline your modeling process.

Maintain Version Control and Documentation

Keeping track of changes and updates in your financial models is crucial. Implementing version control helps you monitor adjustments and revert to previous versions if needed. Additionally, maintaining proper documentation allows others to understand your model’s logic and calculations. At Fin-Wiser Online Store, we offer resources to help businesses manage version control effectively and maintain clear documentation.

Use Standardized Templates

Using standardized financial modeling templates not only saves time but also ensures consistency across all your models. These templates provide a structured format for organizing data, calculations, and assumptions. At Fin-Wiser, we provide customizable templates that incorporate best practices for formatting and layout.

Keep the End-User in Mind

When building a financial model, always consider the end-user’s perspective. Your model should be intuitive and easy to navigate, especially for stakeholders who might not be familiar with complex financial concepts. Focus on clarity, simplicity, and user-friendliness to make the model accessible. At Fin-Wiser Online Store, we emphasize designing models with the end-user in mind, ensuring effective communication of insights.

How Financial Models Drive Business Success

Effective financial models are more than just numbers; they are strategic tools that empower businesses to make informed decisions and achieve their goals. At Fin-Wiser, we emphasize the value of financial modeling in supporting growth and sustainability.

Supporting Decision-Making with Data

A well-structured financial model provides a solid foundation for data-driven decision-making. By analyzing key financial statements, metrics, and scenarios, businesses can assess their current position and forecast future performance. This enables leaders to make informed choices based on accurate data. At Fin-Wiser Online Store, we offer solutions that enhance decision-making through comprehensive financial models.

Identifying Risks and Opportunities

One of the key benefits of financial modeling is its ability to highlight potential risks and opportunities. By integrating scenario analysis and sensitivity testing, businesses can anticipate market changes and proactively plan for different outcomes. This approach helps companies minimize risks and capitalize on emerging opportunities. At Fin-Wiser, we guide businesses in identifying and managing risks through robust financial models.

Conclusion

Mastering financial models doesn’t have to be complex. By embracing simplicity and focusing on accuracy, businesses can create powerful tools that drive informed decisions and long-term growth. At Fin-Wiser, we believe in building financial models that are clear, concise, and effective in supporting your business goals.

Embrace Simplicity and Accuracy in Financial Models

The key to successful financial modeling is finding the right balance between detail and simplicity. Overcomplicated models can be difficult to interpret and prone to errors. Instead, focus on creating straightforward, accurate models that are easy to update and understand. This approach builds trust and enables better decision-making. At Fin-Wiser Online Store, we offer tools and resources to help businesses achieve this balance in their financial models.

Next Steps for Mastering Financial Modeling

If you’re ready to take your financial modeling skills to the next level, start by refining your techniques and leveraging the right resources. Continue learning new tips and tricks, avoid common mistakes, and follow best practices to build models that truly support your business. At Fin-Wiser, we’re here to guide you every step of the way as you master the art of financial modeling.