Introduction

When businesses take on large projects like clean energy plants or low-carbon products, they need a reliable financial strategy—this is where project finance becomes crucial. But what exactly is project finance, and why should businesses care? At Fin-Wiser, we help companies choose the right funding approach, whether it’s through financial modeling, balancing debt and equity, or providing corporate finance advisory services.

The goal is to reduce risk, raise capital, and ensure the project is set up for long-term success. This guide will give you a clear understanding of project finance, its importance, and how your business can approach it. Whether you’re new to the concept or want to sharpen your financial strategies, we’ll break it down in simple terms. And remember, for personalized support, Fin-Wiser is here to help you navigate the complexities of sustainability finance and project planning.

What is Project Finance?

Project finance is a long-term financing approach, mainly used for large-scale projects such as infrastructure development, clean energy initiatives, or low-carbon product manufacturing. It’s structured around the project’s cash flows instead of the overall balance sheet of the parent company. This means the project’s revenue generation determines whether investors and lenders get paid back.

At Fin-Wiser, we assist businesses in structuring project finance deals using advanced financial modeling techniques to predict cash flow, manage risks, and ensure successful financing. This method isolates the risks from the parent company, making it appealing for businesses in high-risk sectors like clean energy.

Key Characteristics of Project Finance

- Special Purpose Vehicle (SPV): A separate legal entity is created solely for the project, ensuring the project’s risks don’t impact the parent company.

- Non-recourse Financing: Lenders rely on the project’s revenue to recover their loans, without seeking recourse from the parent company.

- Long-Term Debt Financing: Financing is typically over 10–30 years, matching the lifespan of projects like infrastructure or clean energy.

- Risk Allocation: Risks are distributed among lenders, investors, and contractors.

At Fin-Wiser, we guide businesses in setting up SPVs and structuring deals that reduce risk and enhance financing opportunities.

Difference Between Project Finance and Traditional Corporate Finance

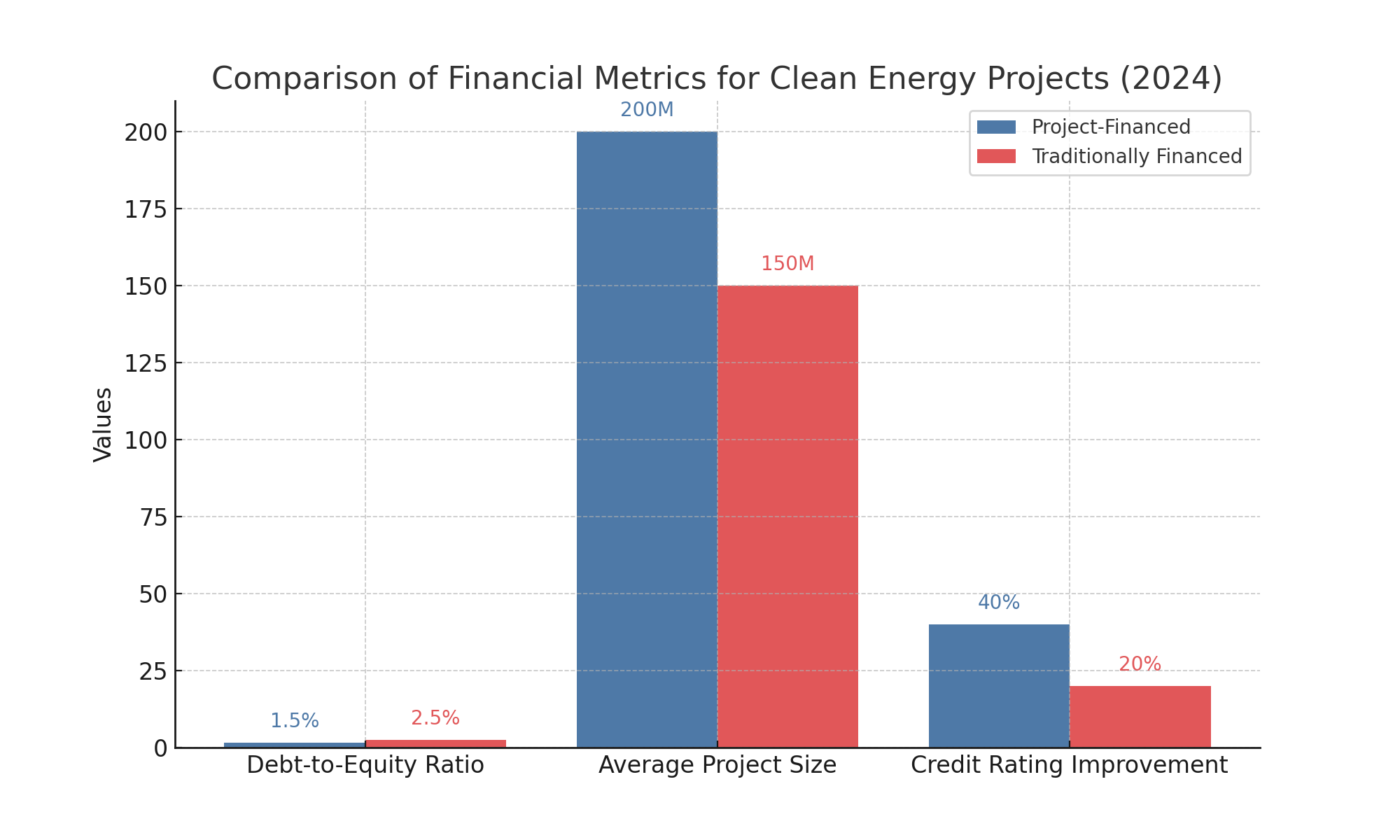

In traditional corporate finance, businesses secure loans based on their overall financial health, making them fully liable for repayment even if the project fails. Project finance, on the other hand, isolates the project from the parent company. The cash flow generated by the project determines repayment, reducing the financial burden on the parent company.

For instance, in corporate finance, a company building a factory secures funding based on its balance sheet. In project finance, a company developing a low-carbon product can set up an SPV, with financing based solely on the product’s revenue. Fin-Wiser offers tailored solutions depending on the project’s scale and risk profile.

Industries Using Project Finance

Project finance is commonly used in industries that require large-scale, capital-intensive projects, such as:

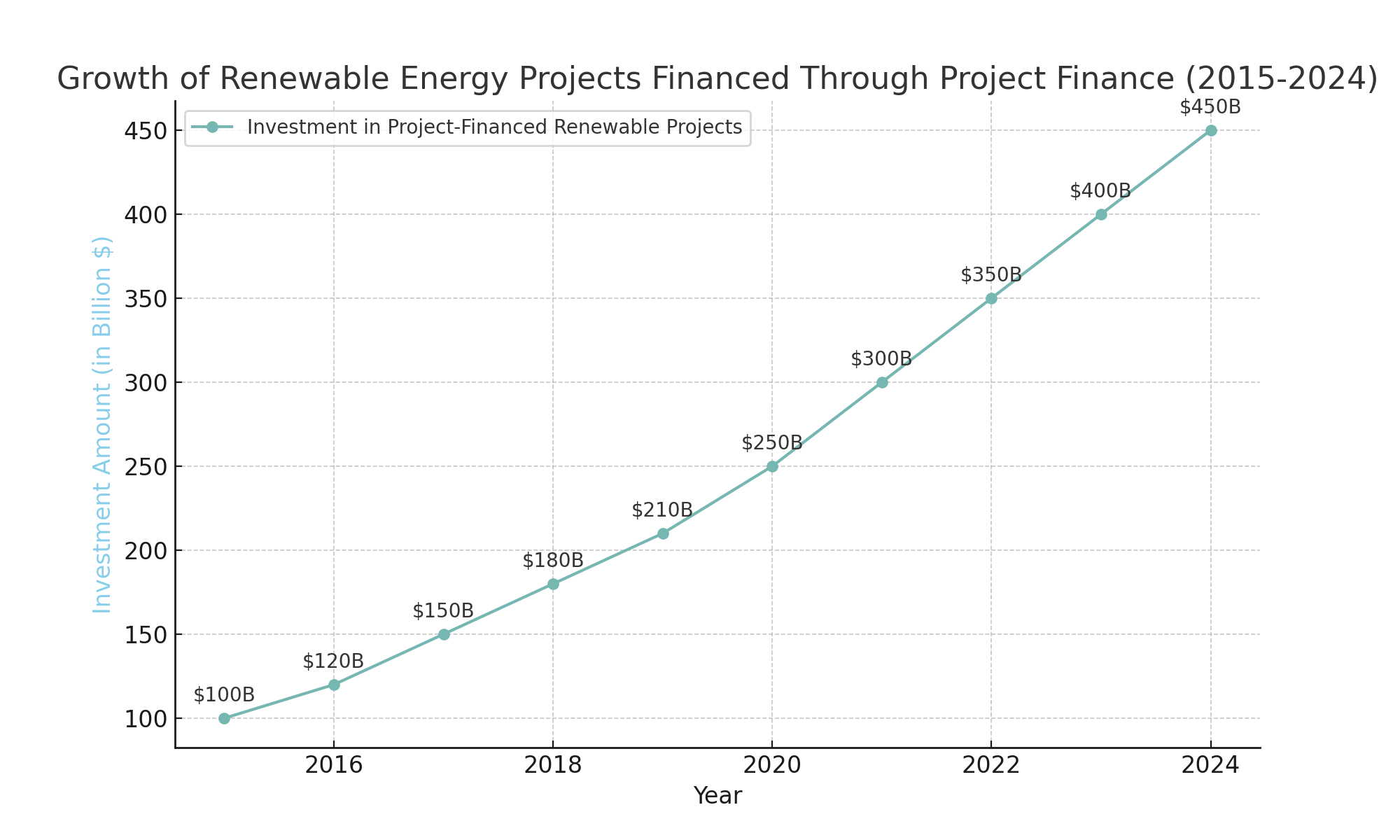

- Clean Energy Projects: Solar, wind, and hydropower projects are typical examples. The revenue from selling energy repays investors and lenders.

- Infrastructure Development: Projects like roads, bridges, airports, and public transportation often rely on project finance due to high upfront costs.

- Low-Carbon Products: With growing demand for sustainable goods, project finance helps businesses manage the risks of high initial investments.

For businesses in these sectors, Fin-Wiser provides expert support, offering financial modeling, risk management, and advisory services to ensure project success.

Why is Project Finance Important for Businesses?

For businesses tackling large projects like developing clean energy plants or launching low-carbon products, project finance is essential. It allows companies to fund ambitious projects without overburdening their balance sheets or exposing the entire company to risk. With Fin-Wiser as your trusted partner, businesses can leverage project finance to access capital, distribute risks, and grow sustainably.

Benefits of Project Finance

Risk Allocation: Project finance distributes risks to the parties best suited to manage them—such as contractors or operators—minimizing the parent company’s exposure.

Example: In a $100 million solar project, if construction costs overrun by 10%, the additional $10 million may be covered by the contractor, reducing the risk for the parent company.

Access to Large-Scale Funding: Project finance allows businesses to secure large amounts of capital based on future cash flows, rather than their current balance sheet.

Example: A hydropower project requiring $500 million can access funds based on the projected revenue from selling electricity.

Off-Balance-Sheet Financing: The debt incurred in project finance doesn’t appear on the parent company’s balance sheet, allowing businesses to maintain healthy financial ratios.

Example: A company with a 1:1 debt-to-equity ratio can undertake a $200 million wind project without reporting the debt on its balance sheet.

With Fin-Wiser, businesses can capitalize on these advantages, ensuring both financial health and growth potential.

How Project Finance Supports Growth

By minimizing risks and securing large-scale funding, project finance helps businesses focus on long-term growth. It allows companies to pursue ventures they might otherwise avoid due to potential liabilities. Whether it’s a clean energy facility, a new manufacturing plant, or low-carbon product development, project finance can support growth without stretching financial resources.

Fin-Wiser provides expert corporate finance advisory services to help businesses align their projects with long-term goals.

Conclusion

Project finance is an essential tool for businesses looking to fund large-scale projects like clean energy or infrastructure development. From structuring deals to mitigating risks, Fin-Wiser helps companies secure funding, manage risks, and ensure long-term project success. Whether you’re new to project finance or looking to improve your financial strategies, Fin-Wiser is here to help.