Understanding Levelized Cost of Energy (LCOE): What It Is, Why It Matters, and How to Compare Projects

If you’re exploring the world of energy economics or renewable energy projects, you’ve probably encountered the term “Levelized Cost of Energy” (LCOE). While it might sound like complex jargon, it’s a straightforward and handy concept. Let’s break down what LCOE is, how it’s used, and its benefits, and then walk through a practical example comparing two energy projects.

What is the Levelized Cost of Energy (LCOE)?

In simple terms, the Levelized Cost of Energy measures the average cost of producing one unit of electricity (usually expressed in dollars per megawatt-hour, or $/MWh) over the lifetime of a power plant. It’s a comprehensive metric that includes all costs: initial construction, operation and maintenance, fuel (if applicable), and decommissioning. By accounting for these costs, LCOE provides a way to compare the cost-effectiveness of different energy sources on a level playing field.

Why is LCOE Important?

LCOE is a critical tool for a few key reasons:

- Comparing Technologies: It allows us to compare the cost-effectiveness of different types of energy generation, such as solar, wind, natural gas, and coal.

- Investment Decisions: Investors use LCOE to determine which projects offer the best return on investment.

- Policy Making: Governments and regulators rely on LCOE to shape energy policies and incentives, ensuring support goes to the most efficient technologies.

- Economic Feasibility: It helps to assess whether a specific energy project is viable over its expected lifespan.

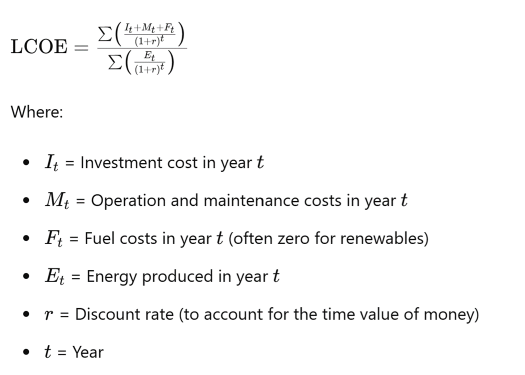

How is LCOE Calculated?

Calculating LCOE involves summing up all the costs over the life of a project and dividing by the total energy produced. Here’s the basic formula:

Benefits of LCOE

- Comprehensive Cost Analysis: It includes all costs associated with a project, providing a complete picture.

- Investment Insight: Helps investors identify the most cost-effective and potentially profitable projects.

- Policy and Planning: Assists policymakers in designing effective subsidies and support mechanisms for renewable energy.

Example: Comparing Two Solar Projects

Let’s look at an example comparing two hypothetical solar projects, Solar Project A and Solar Project B, using LCOE.

Project Details:

Parameters | Solar Project A | Solar Project B |

Initial Investment (CapEx) | $1,000,000 | $1,200,000 |

Annual O&M Costs (OpEx) | $20,000 | $15,000 |

Expected Lifespan | 25 years | 25 years |

Annual Energy Production | 1,500 MWh | 1,800 MWh |

Discount Rate | 5% | 5% |

Steps to Calculate LCOE in Excel

- Set Up Your Spreadsheet: Open Excel and label your columns: Year, Investment Cost, O&M Cost, Fuel Cost, Total Cost, Energy Produced, Discount Factor, PV of Total Cost, PV of Energy Produced.

- Input Data:

- Enter the years from 1 to 25.

- In the first year, the initial investment for each project is entered.

- For each year, enter the annual O&M costs.

- Since these are solar projects, enter $0 for fuel costs.

- Calculate the total cost for each year.

- Enter the annual energy production for each project.

- Calculate the discount factor using 1/(1 + r)^t

- Calculate Present Value (PV):

- Calculate the PV of total costs and energy produced using the discount factor.

- Sum these PV values for the total costs and total energy produced over 25 years.

- Compute LCOE:

- Divide the total PV of costs by the total PV of energy produced.

Example Calculation in Excel:

Year | Investment Cost (A) | O&M Cost (A) | Fuel Cost (A) | Total Cost (A) | Energy Produced (A) | Discount Factor | PV of Total Cost (A) | PV of Energy Produced (A) |

1 | $1,000,000 | $20,000 | $0 | $1,020,000 | 1,500 | 0.9524 | $971,429 | 1,428.57 |

2 | $0 | $20,000 | $0 | $20,000 | 1,500 | 0.9070 | $18,140 | 1,360.50 |

3 | $0 | $20,000 | $0 | $20,000 | 1,500 | 0.8638 | $17,276 | 1,295.70 |

… | … | … | … | … | … | … | … | … |

25 | $0 | $20,000 | $0 | $20,000 | 1,500 | 0.2953 | $5,906 | 442.95 |

Repeat the calculations for Solar Project B.

Summarize Results

Parameter | Solar Project A | Solar Project B |

Total PV of Costs | $1,312,440 | $1,434,330 |

Total PV of Energy Produced | 23,433 MWh | 28,120 MWh |

LCOE | $56.00 / MWh | $51.00 / MWh |

Selecting the Project

From the calculations, Solar Project B has a lower LCOE ($51.00/MWh) compared to Solar Project A ($56.00/MWh). This means Project B is more cost-effective and would be the preferable choice from an economic standpoint.

Conclusion

Understanding the Levelized Cost of Energy (LCOE) is essential for making informed decisions in the energy sector. It provides a consistent method to compare different energy projects, helping to identify the most cost-effective solutions. Whether you’re an investor, policymaker, or just curious about energy economics, LCOE offers a valuable lens through which to view the costs and benefits of various energy technologies. By following the steps outlined in this guide, you can calculate LCOE yourself and gain deeper insights into the financial viability of energy projects.